Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RISK MANAGEMENT<br />

IRBA approach for regulatory capital calculation from January<br />

1, 2008. As part of our application file, an impact study has<br />

been carried out, estimating the capital requirement with the<br />

new methods at different levels of consolidation. This study has<br />

been carried out using our final IT method and infrastructure,<br />

proving that <strong>Dexia</strong>’s Basel II organization is up and running for<br />

future regulatory calculations. The result of this study confirmed<br />

the magnitude of regulatory capital saving estimated in previous<br />

quantitative impact studies.<br />

2007 will see intense relations with the different regulatory<br />

authorities as our application is examined. Two official exercises<br />

will be performed for the purpose, consisting of calculating<br />

capital requirements under Basel I and Basel II regulations<br />

(double runs). Additional projects linked to Basel II will also<br />

be <strong>com</strong>missioned, such as the new integrated tool for limit<br />

monitoring or the <strong>com</strong>mon <strong>report</strong>ing platform.<br />

MARKET RISKS<br />

Market risk <strong>com</strong>prises the Group’s exposure to adverse movements<br />

in market prices (general and specific interest rates,<br />

exchange rates, share prices, spreads) stemming from its<br />

Treasury and Financial Market activities. As a general rule, the<br />

market risks generated by the other businesses are hedged.<br />

The market exposure evaluation rules are explained in point 4.1.<br />

of note 1 “Accounting principles and rules of the consolidated<br />

financial statements” on page 133.<br />

<strong>Dexia</strong>’s exposure to market risk arises mainly from European<br />

interest rates. Its market risk exposure generated by equity,<br />

foreign exchange and spread (trading only) positions remains<br />

much lower.<br />

<strong>Dexia</strong> Group has adopted the Value at Risk (VaR) measurement<br />

methodology as one of the leading risk indicators.<br />

The VaR calculated by <strong>Dexia</strong> is a measure of the potential<br />

loss that can be experienced with a 99% confidence level<br />

and for a holding period of 10 days. <strong>Dexia</strong> has developed<br />

and employs multiple VaR-approaches which are based on<br />

their ability to accurately measure the market risk inherent<br />

in the different portfolios. General interest rate & forex risks<br />

are measured through a parametric VaR-approach. Specific<br />

interest rate risk in trading books and equity risk are<br />

moreover measured by means of an historical VaR approach.<br />

Nonlinear and particular risks are measured through specific<br />

and historical VaR methodologies, with a view to a better<br />

apprehension and measurement of the sensitivity of those<br />

positions to market volatilities.<br />

As a <strong>com</strong>plement to VaR risk measures, market risk exposure<br />

is captured by nominal volume limits, limits on basis point<br />

interest rate sensitivity and spread sensitivity and limits on<br />

option sensitivities (delta, gamma, vega, thêta, rhô).<br />

<strong>Dexia</strong> Group uses its internal VaR model for the capital requirement<br />

calculus on general interest rate risk and foreign exchange<br />

risk exposure within the <strong>Dexia</strong> Bank Belgium and <strong>Dexia</strong> Banque<br />

Internationale à Luxembourg trading scope.<br />

MANAGEMENT REPORT<br />

COMPTES CONSOLIDÉS<br />

C<br />

D<br />

E<br />

A<br />

B<br />

C<br />

D<br />

E A<br />

B<br />

C<br />

B<br />

D<br />

E<br />

A<br />

COMPTES SOCIAUX<br />

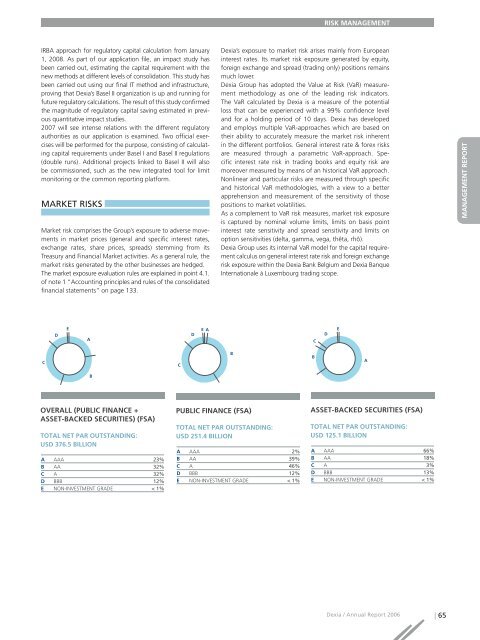

OVERALL (PUBLIC FINANCE +<br />

ASSET-BACKED SECURITIES) (FSA)<br />

TOTAL NET PAR OUTSTANDING:<br />

USD 376.5 BILLION<br />

A AAA 23%<br />

B AA 32%<br />

C A 32%<br />

D BBB 12%<br />

E NON-INVESTMENT GRADE < 1%<br />

PUBLIC FINANCE (FSA)<br />

TOTAL NET PAR OUTSTANDING:<br />

USD 251.4 BILLION<br />

A AAA 2%<br />

B AA 39%<br />

C A 46%<br />

D BBB 12%<br />

E NON-INVESTMENT GRADE < 1%<br />

ASSET-BACKED SECURITIES (FSA)<br />

TOTAL NET PAR OUTSTANDING:<br />

USD 125.1 BILLION<br />

A AAA 66%<br />

B AA 18%<br />

C A 3%<br />

D BBB 13%<br />

E NON-INVESTMENT GRADE < 1%<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 65