Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

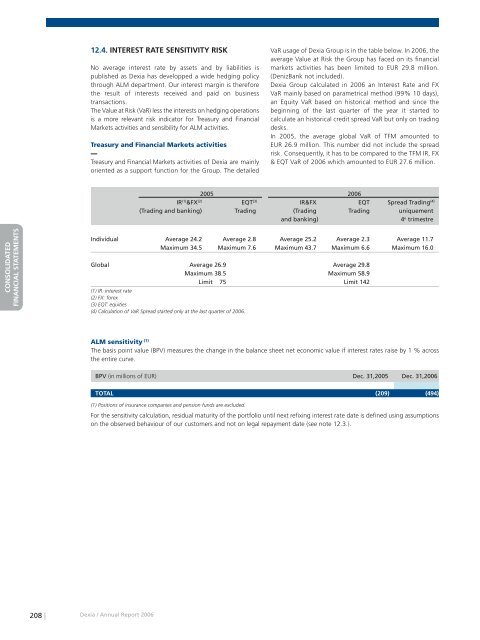

12.4. INTEREST RATE SENSITIVITY RISK<br />

No average interest rate by assets and by liabilities is<br />

published as <strong>Dexia</strong> has developped a wide hedging policy<br />

through ALM department. Our interest margin is therefore<br />

the result of interests received and paid on business<br />

transactions.<br />

The Value at Risk (VaR) less the interests on hedging operations<br />

is a more relevant risk indicator for Treasury and Financial<br />

Markets activities and sensibility for ALM activities.<br />

Treasury and Financial Markets activities<br />

Treasury and Financial Markets activities of <strong>Dexia</strong> are mainly<br />

oriented as a support function for the Group. The detailed<br />

VaR usage of <strong>Dexia</strong> Group is in the table below. In <strong>2006</strong>, the<br />

average Value at Risk the Group has faced on its financial<br />

markets activities has been limited to EUR 29.8 million.<br />

(DenizBank not included).<br />

<strong>Dexia</strong> Group calculated in <strong>2006</strong> an Interest Rate and FX<br />

VaR mainly based on parametrical method (99% 10 days),<br />

an Equity VaR based on historical method and since the<br />

beginning of the last quarter of the year it started to<br />

calculate an historical credit spread VaR but only on trading<br />

desks.<br />

In 2005, the average global VaR of TFM amounted to<br />

EUR 26.9 million. This number did not include the spread<br />

risk. Consequently, it has to be <strong>com</strong>pared to the TFM IR, FX<br />

& EQT VaR of <strong>2006</strong> which amounted to EUR 27.6 million.<br />

2005 <strong>2006</strong><br />

IR (1) &FX (2) EQT (3) IR&FX EQT Spread Trading (4)<br />

(Trading and banking) Trading (Trading Trading uniquement<br />

and banking)<br />

4 e trimestre<br />

Individual Average 24.2 Average 2.8 Average 25.2 Average 2.3 Average 11.7<br />

Maximum 34.5 Maximum 7.6 Maximum 43.7 Maximum 6.6 Maximum 16.0<br />

Global Average 26.9 Average 29.8<br />

Maximum 38.5 Maximum 58.9<br />

Limit 75 Limit 142<br />

(1) IR: interest rate<br />

(2) FX: forex<br />

(3) EQT: equities<br />

(4) Calculation of VaR Spread started only at the last quarter of <strong>2006</strong>.<br />

COMPTES SOCIAUX<br />

ALM sensitivity (1)<br />

The basis point value (BPV) measures the change in the balance sheet net economic value if interest rates raise by 1 % across<br />

the entire curve.<br />

BPV (in millions of EUR) Dec. 31,2005 Dec. 31,<strong>2006</strong><br />

TOTAL (209) (494)<br />

(1) Positions of insurance <strong>com</strong>panies and pension funds are excluded.<br />

For the sensitivity calculation, residual maturity of the portfolio until next refixing interest rate date is defined using assumptions<br />

on the observed behaviour of our customers and not on legal repayment date (see note 12.3.).<br />

208 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>