Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

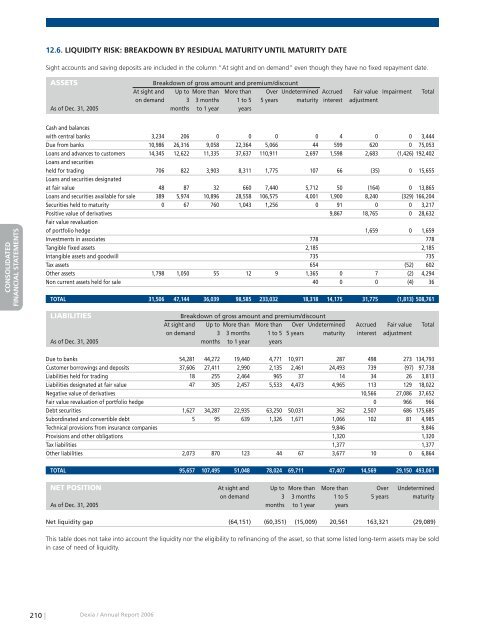

12.6. LIQUIDITY RISK: BREAKDOWN BY RESIDUAL MATURITY UNTIL MATURITY DATE<br />

Sight accounts and saving deposits are included in the column “At sight and on demand” even though they have no fixed repayment date.<br />

ASSETS<br />

Breakdown of gross amount and premium/discount<br />

At sight and Up to More than More than Over Undetermined Accrued Fair value Impairment Total<br />

on demand 3 3 months 1 to 5 5 years maturity interest adjustment<br />

As of Dec. 31, 2005 months to 1 year years<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

Cash and balances<br />

with central banks 3,234 206 0 0 0 0 4 0 0 3,444<br />

Due from banks 10,986 26,316 9,058 22,364 5,066 44 599 620 0 75,053<br />

Loans and advances to customers 14,345 12,622 11,335 37,637 110,911 2,697 1,598 2,683 (1,426) 192,402<br />

Loans and securities<br />

held for trading 706 822 3,903 8,311 1,775 107 66 (35) 0 15,655<br />

Loans and securities designated<br />

at fair value 48 87 32 660 7,440 5,712 50 (164) 0 13,865<br />

Loans and securities available for sale 389 5,974 10,896 28,558 106,575 4,001 1,900 8,240 (329) 166,204<br />

Securities held to maturity 0 67 760 1,043 1,256 0 91 0 0 3,217<br />

Positive value of derivatives 9,867 18,765 0 28,632<br />

Fair value revaluation<br />

of portfolio hedge 1,659 0 1,659<br />

Investments in associates 778 778<br />

Tangible fixed assets 2,185 2,185<br />

Intangible assets and goodwill 735 735<br />

Tax assets 654 (52) 602<br />

Other assets 1,798 1,050 55 12 9 1,365 0 7 (2) 4,294<br />

Non current assets held for sale 40 0 0 (4) 36<br />

TOTAL 31,506 47,144 36,039 98,585 233,032 18,318 14,175 31,775 (1,813) 508,761<br />

LIABILITIES<br />

Breakdown of gross amount and premium/discount<br />

At sight and Up to More than More than Over Undetermined Accrued Fair value Total<br />

on demand 3 3 months 1 to 5 5 years maturity interest adjustment<br />

As of Dec. 31, 2005 months to 1 year years<br />

Due to banks 54,281 44,272 19,440 4,771 10,971 287 498 273 134,793<br />

Customer borrowings and deposits 37,606 27,411 2,990 2,135 2,461 24,493 739 (97) 97,738<br />

Liabilities held for trading 18 255 2,464 965 37 14 34 26 3,813<br />

Liabilities designated at fair value 47 305 2,457 5,533 4,473 4,965 113 129 18,022<br />

Negative value of derivatives 10,566 27,086 37,652<br />

Fair value revaluation of portfolio hedge 0 966 966<br />

Debt securities 1,627 34,287 22,935 63,250 50,031 362 2,507 686 175,685<br />

Subordinated and convertible debt 5 95 639 1,326 1,671 1,066 102 81 4,985<br />

Technical provisions from insurance <strong>com</strong>panies 9,846 9,846<br />

Provisions and other obligations 1,320 1,320<br />

Tax liabilities 1,377 1,377<br />

Other liabilities 2,073 870 123 44 67 3,677 10 0 6,864<br />

TOTAL 95,657 107,495 51,048 78,024 69,711 47,407 14,569 29,150 493,061<br />

NET POSITION At sight and Up to More than More than Over Undetermined<br />

on demand 3 3 months 1 to 5 5 years maturity<br />

As of Dec. 31, 2005 months to 1 year years<br />

Net liquidity gap (64,151) (60,351) (15,009) 20,561 163,321 (29,089)<br />

This table does not take into account the liquidity nor the eligibility to refinancing of the asset, so that some listed long-term assets may be sold<br />

in case of need of liquidity.<br />

210 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>