pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ CONSOlIdATEd fINANCIAl STATEMENTS : BAl ANCE ShEET / STATEMENT Of ChANGES IN EquIT y<br />

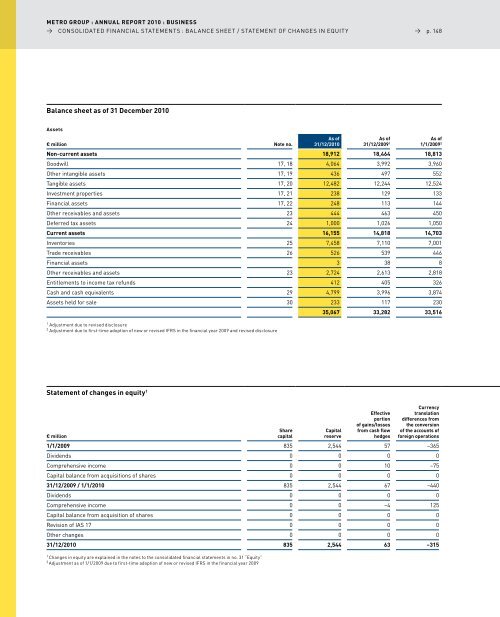

Balance sheet as of 31 December 2010<br />

Assets<br />

€ million Note no.<br />

As of<br />

31/12/2010<br />

As of<br />

31/12/2009 1<br />

→ p. 148<br />

As of<br />

1/1/2009 2<br />

Non-current assets 18,912 18,464 18,813<br />

Goodwill 17, 18 4,064 3,992 3,960<br />

Other intangible assets 17, 19 436 497 552<br />

Tangible assets 17, 20 12,482 12,244 12,524<br />

Investment properties 17, 21 238 129 133<br />

financial assets 17, 22 248 113 144<br />

Other receivables and assets 23 444 463 450<br />

deferred tax assets 24 1,000 1,026 1,050<br />

Current assets 16,155 14,818 14,703<br />

Inventories 25 7,458 7,110 7,001<br />

Trade receivables 26 526 539 446<br />

financial assets 3 38 8<br />

Other receivables and assets 23 2,724 2,613 2,818<br />

Entitlements to income tax refunds 412 405 326<br />

Cash and cash equivalents 29 4,799 3,996 3,874<br />

Assets held for sale 30 233 117 230<br />

1 Adjustment due to revised disclosure<br />

2 Adjustment due to first-time adoption of new or revised IfRS in the financial year 2009 and revised disclosure<br />

Statement of changes in equity 1<br />

€ million<br />

Share<br />

capital<br />

35,067 33,282 33,516<br />

Capital<br />

reserve<br />

Effective<br />

portion<br />

of gains/losses<br />

from cash flow<br />

hedges<br />

Currency<br />

translation<br />

differences from<br />

the conversion<br />

of the accounts of<br />

foreign operations<br />

1/1/2009 835 2,544 57 –365<br />

dividends 0 0 0 0<br />

Comprehensive income 0 0 10 –75<br />

Capital balance from acquisitions of shares 0 0 0 0<br />

31/12/2009 / 1/1/2010 835 2,544 67 –440<br />

dividends 0 0 0 0<br />

Comprehensive income 0 0 –4 125<br />

Capital balance from acquisition of shares 0 0 0 0<br />

Revision of IAS 17 0 0 0 0<br />

Other changes 0 0 0 0<br />

31/12/2010 835 2,544 63 –315<br />

1 Changes in equity are explained in the notes to the consolidated financial statements in no. 31 “Equity”<br />

2 Adjustment as of 1/1/2009 due to first-time adoption of new or revised IfRS in the financial year 2009