pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

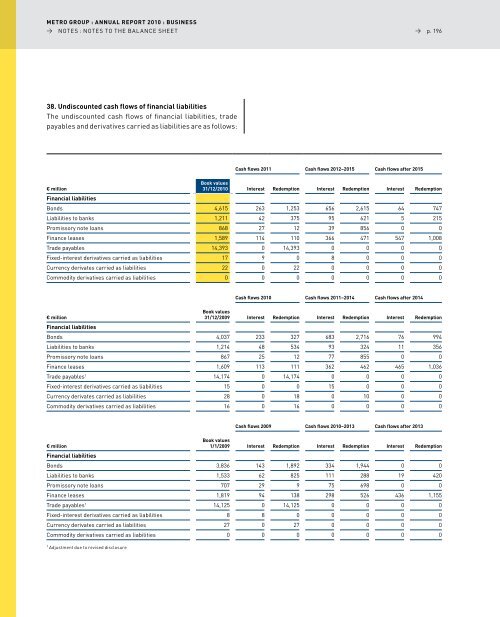

38. Undiscounted cash flows of financial liabilities<br />

The undiscounted cash flows of financial liabilities, trade<br />

payables and derivatives carried as liabilities are as follows:<br />

Cash flows 2011 Cash flows 2012–2015 Cash flows after 2015<br />

→ p. 196<br />

€ million<br />

Financial liabilities<br />

Book values<br />

31/12/2010 Interest Redemption Interest Redemption Interest Redemption<br />

Bonds 4,615 263 1,253 656 2,615 64 747<br />

liabilities to banks 1,211 42 375 95 621 5 215<br />

Promissory note loans 868 27 12 39 856 0 0<br />

finance leases 1,589 114 110 366 471 547 1,008<br />

Trade payables 14,393 0 14,393 0 0 0 0<br />

fixed-interest derivatives carried as liabilities 17 9 0 8 0 0 0<br />

Currency derivates carried as liabilities 22 0 22 0 0 0 0<br />

Commodity derivatives carried as liabilities 0 0 0 0 0 0 0<br />

Cash flows 2010 Cash flows 2011–2014 Cash flows after 2014<br />

€ million<br />

Financial liabilities<br />

Book values<br />

31/12/2009 Interest Redemption Interest Redemption Interest Redemption<br />

Bonds 4,037 233 327 683 2,716 76 994<br />

liabilities to banks 1,214 48 534 93 324 11 356<br />

Promissory note loans 867 25 12 77 855 0 0<br />

finance leases 1,609 113 111 362 462 465 1,036<br />

Trade payables1 14,174 0 14,174 0 0 0 0<br />

fixed-interest derivatives carried as liabilities 15 0 0 15 0 0 0<br />

Currency derivates carried as liabilities 28 0 18 0 10 0 0<br />

Commodity derivatives carried as liabilities 16 0 16 0 0 0 0<br />

Cash flows 2009 Cash flows 2010–2013 Cash flows after 2013<br />

€ million<br />

Financial liabilities<br />

Book values<br />

1/1/2009 Interest Redemption Interest Redemption Interest Redemption<br />

Bonds 3,836 143 1,892 334 1,944 0 0<br />

liabilities to banks 1,533 62 825 111 288 19 420<br />

Promissory note loans 707 29 9 75 698 0 0<br />

finance leases 1,819 94 138 298 526 436 1,155<br />

Trade payables1 14,125 0 14,125 0 0 0 0<br />

fixed-interest derivatives carried as liabilities 8 8 0 0 0 0 0<br />

Currency derivates carried as liabilities 27 0 27 0 0 0 0<br />

Commodity derivatives carried as liabilities 0 0 0 0 0 0 0<br />

1 Adjustment due to revised disclosure