pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

due to their mostly short terms, the fair values of receivables<br />

due from suppliers, trade receivables and cash and<br />

cash equivalents essentially correspond to their book<br />

values.<br />

The measurement of the fair value of bonds, promissory<br />

note loans and bank loans is based on the market interest<br />

rate curve following the zero coupon method without consideration<br />

of credit spreads. The amounts comprise the<br />

interest prorated to the closing date.<br />

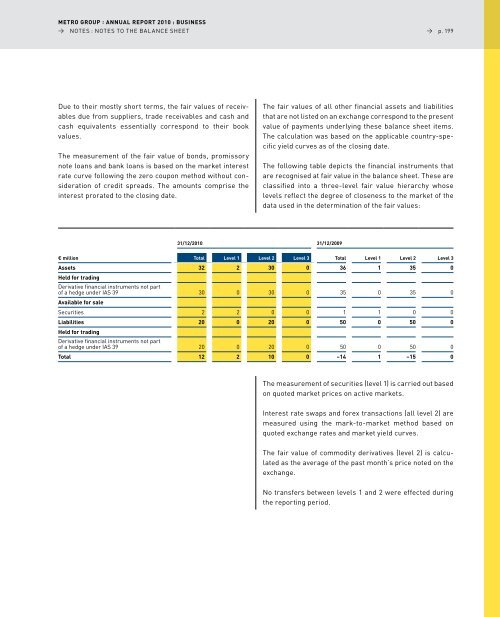

€ million<br />

31/12/2010 31/12/2009<br />

→ p. 199<br />

Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3<br />

Assets 32 2 30 0 36 1 35 0<br />

Held for trading<br />

The fair values of all other financial assets and liabilities<br />

that are not listed on an exchange correspond to the present<br />

value of payments underlying these balance sheet items.<br />

The calculation was based on the applicable country-specific<br />

yield curves as of the closing date.<br />

The following table depicts the financial instruments that<br />

are recognised at fair value in the balance sheet. These are<br />

classified into a three-level fair value hierarchy whose<br />

levels reflect the degree of closeness to the market of the<br />

data used in the determination of the fair values:<br />

derivative financial instruments not part<br />

of a hedge under IAS 39<br />

Available for sale<br />

30 0 30 0 35 0 35 0<br />

Securities 2 2 0 0 1 1 0 0<br />

Liabilities<br />

Held for trading<br />

derivative financial instruments not part<br />

20 0 20 0 50 0 50 0<br />

of a hedge under IAS 39 20 0 20 0 50 0 50 0<br />

Total 12 2 10 0 –14 1 –15 0<br />

The measurement of securities (level 1) is carried out based<br />

on quoted market prices on active markets.<br />

Interest rate swaps and forex transactions (all level 2) are<br />

measured using the mark-to-market method based on<br />

quoted exchange rates and market yield curves.<br />

The fair value of commodity derivatives (level 2) is calculated<br />

as the average of the past month’s price noted on the<br />

exchange.<br />

No transfers between levels 1 and 2 were effected during<br />

the reporting period.