pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : OThER NOTES<br />

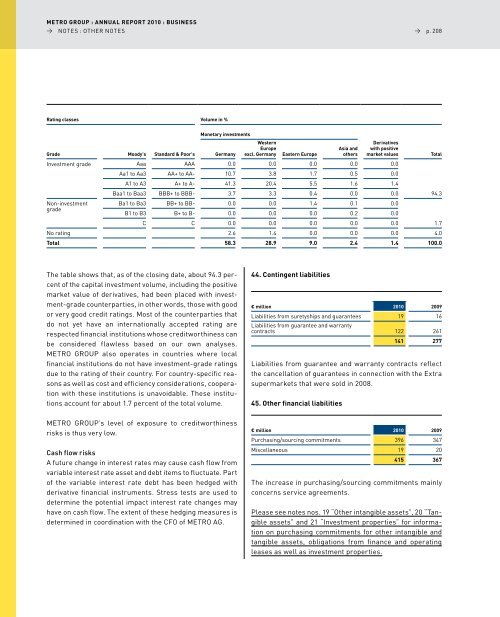

Rating classes Volume in %<br />

Monetary investments<br />

Grade Moody's Standard & Poor's Germany<br />

Western<br />

Europe<br />

excl. Germany Eastern Europe<br />

The table shows that, as of the closing date, about 94.3 percent<br />

of the capital investment volume, including the positive<br />

market value of derivatives, had been placed with investment-grade<br />

counterparties, in other words, those with good<br />

or very good credit ratings. Most of the counterparties that<br />

do not yet have an internationally accepted rating are<br />

respected financial institutions whose creditworthiness can<br />

be considered flawless based on our own analyses.<br />

<strong>METRO</strong> GROuP also operates in countries where local<br />

financial institutions do not have investment-grade ratings<br />

due to the rating of their country. for country-specific reasons<br />

as well as cost and efficiency considerations, cooperation<br />

with these institutions is unavoidable. These institutions<br />

account for about 1.7 percent of the total volume.<br />

<strong>METRO</strong> GROuP’s level of exposure to creditworthiness<br />

risks is thus very low.<br />

Cash flow risks<br />

A future change in interest rates may cause cash flow from<br />

variable interest rate asset and debt items to fluctuate. Part<br />

of the variable interest rate debt has been hedged with<br />

derivative financial instruments. Stress tests are used to<br />

determine the potential impact interest rate changes may<br />

have on cash flow. The extent of these hedging measures is<br />

determined in coordination with the CfO of <strong>METRO</strong> AG.<br />

44. Contingent liabilities<br />

→ p. 208<br />

€ million 2010 2009<br />

liabilities from suretyships and guarantees<br />

liabilities from guarantee and warranty<br />

19 16<br />

contracts 122 261<br />

141 277<br />

liabilities from guarantee and warranty contracts reflect<br />

the cancellation of guarantees in connection with the Extra<br />

supermarkets that were sold in 2008.<br />

45. Other financial liabilities<br />

Asia and<br />

others<br />

Derivatives<br />

with positive<br />

market values Total<br />

Investment grade Aaa AAA 0.0 0.0 0.0 0.0 0.0<br />

Aa1 to Aa3 AA+ to AA- 10.7 3.8 1.7 0.5 0.0<br />

A1 to A3 A+ to A- 41.3 20.4 5.5 1.6 1.4<br />

Baa1 to Baa3 BBB+ to BBB- 3.7 3.3 0.4 0.0 0.0<br />

94.3<br />

Non-investment<br />

Ba1 to Ba3 BB+ to BB- 0.0 0.0 1.4 0.1 0.0<br />

grade<br />

B1 to B3 B+ to B- 0.0 0.0 0.0 0.2 0.0<br />

C C 0.0 0.0 0.0 0.0 0.0<br />

1.7<br />

No rating 2.6 1.4 0.0 0.0 0.0 4.0<br />

Total 58.3 28.9 9.0 2.4 1.4 100.0<br />

€ million 2010 2009<br />

Purchasing/sourcing commitments 396 347<br />

Miscellaneous 19 20<br />

415 367<br />

The increase in purchasing/sourcing commitments mainly<br />

concerns service agreements.<br />

Please see notes nos. 19 “Other intangible assets”, 20 “Tangible<br />

assets” and 21 “Investment properties” for information<br />

on purchasing commitments for other intangible and<br />

tangible assets, obligations from finance and operating<br />

leases as well as investment properties.