pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

Other real estate obligations in the amount of €20 million<br />

(previous year: €34 million) stem essentially from maintenance<br />

obligations.<br />

Significant components of the obligations from merchandise<br />

trading are provisions for rebates from the Payback<br />

programme in the amount of €78 million (previous year: €85<br />

million) as well as provisions for guarantee services in the<br />

amount of €53 million (previous year: €54 million).<br />

The other provisions item contains mainly litigation costs/risks<br />

in the amount of €35 million (previous year: €40 million), gratuity<br />

commitments of €18 million (previous year: €9 million) as<br />

well as surety and guarantee risks of €12 million (previous<br />

year: €4 million). Provisions for share-based remuneration<br />

amount to €60 million (previous year: €13 million). Supplementary<br />

explanations on share-based remuneration are provided<br />

in no. 49 “Share-based compensation for executives”.<br />

In the context of the decision to dispose of the french consumer<br />

electronics stores, provisions of €53 million were<br />

reclassified to the item “liabilities related to assets held for<br />

sale”. The reclassification is shown as a transfer.<br />

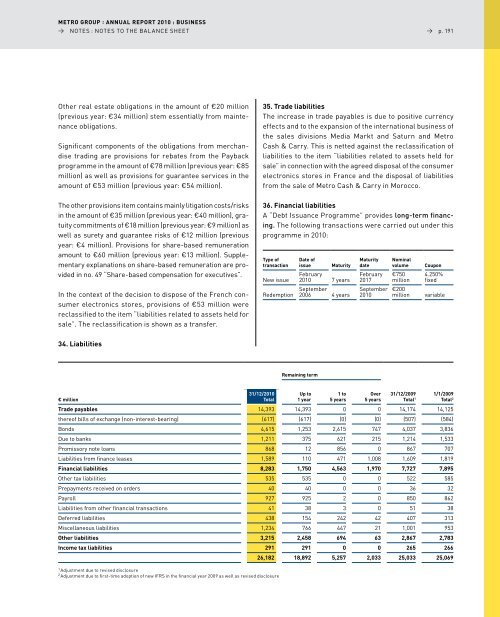

34. Liabilities<br />

€ million<br />

→ p. 191<br />

35. Trade liabilities<br />

The increase in trade payables is due to positive currency<br />

effects and to the expansion of the international business of<br />

the sales divisions Media Markt and Saturn and Metro<br />

Cash & Carry. This is netted against the reclassification of<br />

liabilities to the item “liabilities related to assets held for<br />

sale” in connection with the agreed disposal of the consumer<br />

electronics stores in france and the disposal of liabilities<br />

from the sale of Metro Cash & Carry in Morocco.<br />

36. Financial liabilities<br />

A “debt Issuance Programme” provides long-term financing.<br />

The following transactions were carried out under this<br />

programme in 2010:<br />

Type of<br />

transaction<br />

New issue<br />

31/12/2010<br />

Total<br />

Remaining term<br />

Up to<br />

1 year<br />

1 to<br />

5 years<br />

Over<br />

5 years<br />

31/12/2009<br />

Total 1<br />

1/1/2009<br />

Total 2<br />

Trade payables 14,393 14,393 0 0 14,174 14,125<br />

thereof bills of exchange (non-interest-bearing) (617) (617) (0) (0) (507) (584)<br />

Bonds 4,615 1,253 2,615 747 4,037 3,836<br />

due to banks 1,211 375 621 215 1,214 1,533<br />

Promissory note loans 868 12 856 0 867 707<br />

liabilities from finance leases 1,589 110 471 1,008 1,609 1,819<br />

Financial liabilities 8,283 1,750 4,563 1,970 7,727 7,895<br />

Other tax liabilities 535 535 0 0 522 585<br />

Prepayments received on orders 40 40 0 0 36 32<br />

Payroll 927 925 2 0 850 862<br />

liabilities from other financial transactions 41 38 3 0 51 38<br />

deferred liabilities 438 154 242 42 407 313<br />

Miscellaneous liabilities 1,234 766 447 21 1,001 953<br />

Other liabilities 3,215 2,458 694 63 2,867 2,783<br />

Income tax liabilities 291 291 0 0 265 266<br />

1 Adjustment due to revised disclosure<br />

2 Adjustment due to first-time adoption of new IfRS in the financial year 2009 as well as revised disclosure<br />

Date of<br />

issue Maturity<br />

february<br />

2010 7 years<br />

Redemption September<br />

2006 4 years<br />

Maturity<br />

date<br />

february<br />

2017<br />

September<br />

2010<br />

Nominal<br />

volume Coupon<br />

€750<br />

million<br />

4.250%<br />

fixed<br />

€200<br />

million variable<br />

26,182 18,892 5,257 2,033 25,033 25,069