pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 3. EARNINGS POSITION<br />

2010, sales of the “others” segment declined by 26.0 percent<br />

to €286 million. This drop was due mostly to the sale of the<br />

operating business of AXXE Reisegastronomie, the divestment<br />

of Grillpfanne locations and a decline in third-party<br />

procurement volumes.<br />

EBIT amounted to €–323 million compared with €–336 million<br />

in 2009. EBIT before special items was €52 million below<br />

the previous year’s level at €–282 million. The decline in<br />

EBIT was largely due to higher expenses for governance<br />

functions as well as one-time expenses in connection with<br />

the departure of members of the Management Board of<br />

<strong>METRO</strong> AG.<br />

Financial result and taxes<br />

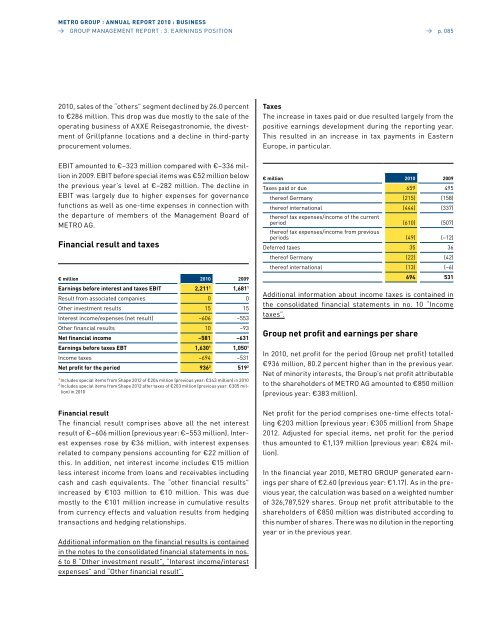

€ million 2010 2009<br />

Earnings before interest and taxes EBIT 2,2111 1,6811 Result from associated companies 0 0<br />

Other investment results 15 15<br />

Interest income/expenses (net result) –606 –553<br />

Other financial results 10 –93<br />

Net financial income –581 –631<br />

Earnings before taxes EBT 1,6301 1,0501 Income taxes –694 –531<br />

Net profit for the period 9362 5192 1 Includes special items from Shape 2012 of €204 million (previous year: €343 million) in 2010<br />

2 Includes special items from Shape 2012 after taxes of €203 million (previous year: €305 million)<br />

in 2010<br />

Financial result<br />

The financial result comprises above all the net interest<br />

result of €–606 million (previous year: €–553 million). Interest<br />

expenses rose by €36 million, with interest expenses<br />

related to company pensions accounting for €22 million of<br />

this. In addition, net interest income includes €15 million<br />

less interest income from loans and receivables including<br />

cash and cash equivalents. The “other financial results”<br />

increased by €103 million to €10 million. This was due<br />

mostly to the €101 million increase in cumulative results<br />

from currency effects and valuation results from hedging<br />

transactions and hedging relationships.<br />

Additional information on the financial results is contained<br />

in the notes to the consolidated financial statements in nos.<br />

6 to 8 “Other investment result”, “Interest income/interest<br />

expenses” and “Other financial result”.<br />

→ p. 085<br />

Taxes<br />

The increase in taxes paid or due resulted largely from the<br />

positive earnings development during the reporting year.<br />

This resulted in an increase in tax payments in Eastern<br />

Europe, in particular.<br />

€ million 2010 2009<br />

Taxes paid or due 659 495<br />

thereof Germany (215) (158)<br />

thereof international (444) (337)<br />

thereof tax expenses/income of the current<br />

period (610) (507)<br />

thereof tax expenses/income from previous<br />

periods (49) (–12)<br />

deferred taxes 35 36<br />

thereof Germany (22) (42)<br />

thereof international (13) (–6)<br />

694 531<br />

Additional information about income taxes is contained in<br />

the consolidated financial statements in no. 10 “Income<br />

taxes”.<br />

<strong>Group</strong> net profit and earnings per share<br />

In 2010, net profit for the period (<strong>Group</strong> net profit) totalled<br />

€936 million, 80.2 percent higher than in the previous year.<br />

Net of minority interests, the <strong>Group</strong>’s net profit attributable<br />

to the shareholders of <strong>METRO</strong> AG amounted to €850 million<br />

(previous year: €383 million).<br />

Net profit for the period comprises one-time effects totalling<br />

€203 million (previous year: €305 million) from Shape<br />

2012. Adjusted for special items, net profit for the period<br />

thus amounted to €1,139 million (previous year: €824 million).<br />

In the financial year 2010, <strong>METRO</strong> GROUP generated earnings<br />

per share of €2.60 (previous year: €1.17). As in the previous<br />

year, the calculation was based on a weighted number<br />

of 326,787,529 shares. <strong>Group</strong> net profit attributable to the<br />

shareholders of €850 million was distributed according to<br />

this number of shares. There was no dilution in the reporting<br />

year or in the previous year.