pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 4. FINANCIAL ANd ASSET POSITION<br />

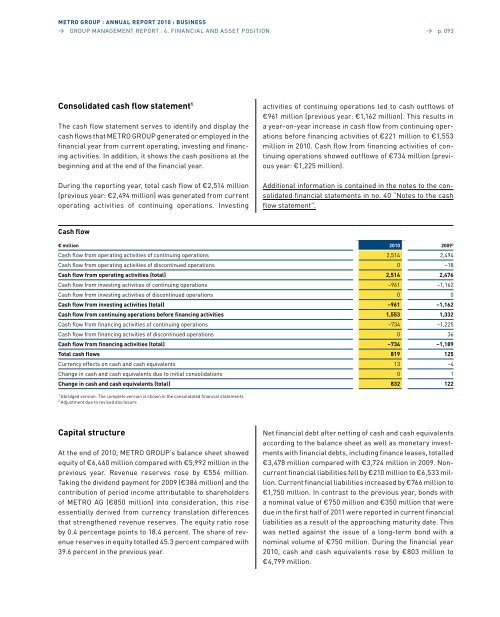

Consolidated cash flow statement 1<br />

The cash flow statement serves to identify and display the<br />

cash flows that <strong>METRO</strong> GROUP generated or employed in the<br />

financial year from current operating, investing and financing<br />

activities. In addition, it shows the cash positions at the<br />

beginning and at the end of the financial year.<br />

during the reporting year, total cash flow of €2,514 million<br />

(previous year: €2,494 million) was generated from current<br />

operating activities of continuing operations. Investing<br />

Cash flow<br />

Capital structure<br />

At the end of 2010, <strong>METRO</strong> GROUP’s balance sheet showed<br />

equity of €6,460 million compared with €5,992 million in the<br />

previous year. Revenue reserves rose by €554 million.<br />

Taking the dividend payment for 2009 (€386 million) and the<br />

contribution of period income attributable to shareholders<br />

of <strong>METRO</strong> AG (€850 million) into consideration, this rise<br />

essentially derived from currency translation differences<br />

that strengthened revenue reserves. The equity ratio rose<br />

by 0.4 percentage points to 18.4 percent. The share of revenue<br />

reserves in equity totalled 45.3 percent compared with<br />

39.6 percent in the previous year.<br />

→ p. 093<br />

activities of continuing operations led to cash outflows of<br />

€961 million (previous year: €1,162 million). This results in<br />

a year-on-year increase in cash flow from continuing operations<br />

before financing activities of €221 million to €1,553<br />

million in 2010. Cash flow from financing activities of continuing<br />

operations showed outflows of €734 million (previous<br />

year: €1,225 million).<br />

Additional information is contained in the notes to the consolidated<br />

financial statements in no. 40 “Notes to the cash<br />

flow statement”.<br />

€ million 2010 20092 Cash flow from operating activities of continuing operations 2,514 2,494<br />

Cash flow from operating activities of discontinued operations 0 –18<br />

Cash flow from operating activities (total) 2,514 2,476<br />

Cash flow from investing activities of continuing operations –961 –1,162<br />

Cash flow from investing activities of discontinued operations 0 0<br />

Cash flow from investing activities (total) –961 –1,162<br />

Cash flow from continuing operations before financing activities 1,553 1,332<br />

Cash flow from financing activities of continuing operations –734 –1,225<br />

Cash flow from financing activities of discontinued operations 0 36<br />

Cash flow from financing activities (total) –734 –1,189<br />

Total cash flows 819 125<br />

Currency effects on cash and cash equivalents 13 –4<br />

Change in cash and cash equivalents due to initial consolidations 0 1<br />

Change in cash and cash equivalents (total) 832 122<br />

1 Abridged version. The complete version is shown in the consolidated financial statements<br />

2 Adjustment due to revised disclosure<br />

Net financial debt after netting of cash and cash equivalents<br />

according to the balance sheet as well as monetary investments<br />

with financial debts, including finance leases, totalled<br />

€3,478 million compared with €3,724 million in 2009. Noncurrent<br />

financial liabilities fell by €210 million to €6,533 million.<br />

Current financial liabilities increased by €766 million to<br />

€1,750 million. In contrast to the previous year, bonds with<br />

a nominal value of €750 million and €350 million that were<br />

due in the first half of 2011 were reported in current financial<br />

liabilities as a result of the approaching maturity date. This<br />

was netted against the issue of a long-term bond with a<br />

nominal volume of €750 million. during the financial year<br />

2010, cash and cash equivalents rose by €803 million to<br />

€4,799 million.