pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

loans and receivables due within the last 90 days largely<br />

result from standard business payment transactions without<br />

or with short-term payment targets. for non-adjusted<br />

loans and receivables over 90 days overdue, there is no indication<br />

as of the closing date that debtors will not fulfil their<br />

payment obligations. This is also the case for all capitalised<br />

financial instruments that are not overdue and not adjusted<br />

for bad debt.<br />

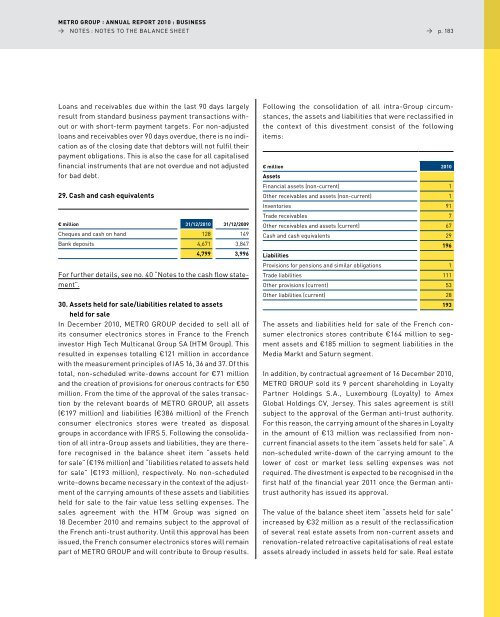

29. Cash and cash equivalents<br />

€ million 31/12/2010 31/12/2009<br />

Cheques and cash on hand 128 149<br />

Bank deposits 4,671 3,847<br />

4,799 3,996<br />

for further details, see no. 40 “Notes to the cash flow statement”.<br />

30. Assets held for sale/liabilities related to assets<br />

held for sale<br />

In december 2010, <strong>METRO</strong> GROuP decided to sell all of<br />

its consumer electronics stores in france to the french<br />

investor high Tech Multicanal <strong>Group</strong> SA (hTM <strong>Group</strong>). This<br />

resulted in expenses totalling €121 million in accordance<br />

with the measurement principles of IAS 16, 36 and 37. Of this<br />

total, non-scheduled write-downs account for €71 million<br />

and the creation of provisions for onerous contracts for €50<br />

million. from the time of the approval of the sales transaction<br />

by the relevant boards of <strong>METRO</strong> GROuP, all assets<br />

(€197 million) and liabilities (€386 million) of the french<br />

consumer electronics stores were treated as disposal<br />

groups in accordance with IfRS 5. following the consolidation<br />

of all intra-<strong>Group</strong> assets and liabilities, they are therefore<br />

recognised in the balance sheet item “assets held<br />

for sale” (€196 million) and “liabilities related to assets held<br />

for sale” (€193 million), respectively. No non-scheduled<br />

write-downs became necessary in the context of the adjustment<br />

of the carrying amounts of these assets and liabilities<br />

held for sale to the fair value less selling expenses. The<br />

sales agreement with the hTM <strong>Group</strong> was signed on<br />

18 december 2010 and remains subject to the approval of<br />

the french anti-trust authority. until this approval has been<br />

issued, the french consumer electronics stores will remain<br />

part of <strong>METRO</strong> GROuP and will contribute to <strong>Group</strong> results.<br />

→ p. 183<br />

following the consolidation of all intra-<strong>Group</strong> circumstances,<br />

the assets and liabilities that were reclassified in<br />

the context of this divestment consist of the following<br />

items:<br />

€ million 2010<br />

Assets<br />

financial assets (non-current) 1<br />

Other receivables and assets (non-current) 1<br />

Inventories 91<br />

Trade receivables 7<br />

Other receivables and assets (current) 67<br />

Cash and cash equivalents<br />

Liabilities<br />

29<br />

196<br />

Provisions for pensions and similar obligations 1<br />

Trade liabilities 111<br />

Other provisions (current) 53<br />

Other liabilities (current) 28<br />

193<br />

The assets and liabilities held for sale of the french consumer<br />

electronics stores contribute €164 million to segment<br />

assets and €185 million to segment liabilities in the<br />

Media Markt and Saturn segment.<br />

In addition, by contractual agreement of 16 december 2010,<br />

<strong>METRO</strong> GROuP sold its 9 percent shareholding in loyalty<br />

Partner holdings S.A., luxembourg (loyalty) to Amex<br />

Global holdings CV, Jersey. This sales agreement is still<br />

subject to the approval of the German anti-trust authority.<br />

for this reason, the carrying amount of the shares in loyalty<br />

in the amount of €13 million was reclassified from noncurrent<br />

financial assets to the item “assets held for sale”. A<br />

non-scheduled write-down of the carrying amount to the<br />

lower of cost or market less selling expenses was not<br />

required. The divestment is expected to be recognised in the<br />

first half of the financial year 2011 once the German antitrust<br />

authority has issued its approval.<br />

The value of the balance sheet item “assets held for sale”<br />

increased by €32 million as a result of the reclassification<br />

of several real estate assets from non-current assets and<br />

renovation-related retroactive capitalisations of real estate<br />

assets already included in assets held for sale. Real estate