pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 3. EARNINGS POSITION<br />

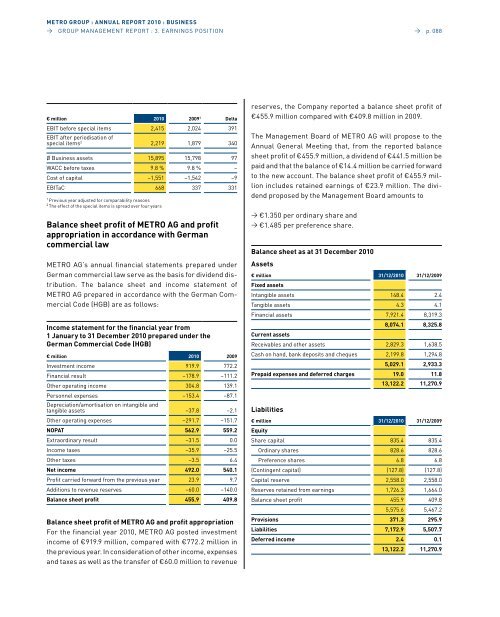

€ million 2010 2009 1 Delta<br />

EBIT before special items 2,415 2,024 391<br />

EBIT after periodisation of<br />

special items 2 2,219 1,879 340<br />

Ø Business assets 15,895 15,798 97<br />

wACC before taxes 9.8 % 9.8 % –<br />

Cost of capital –1,551 –1,542 –9<br />

EBITaC 668 337 331<br />

1 Previous year adjusted for comparability reasons<br />

2 The effect of the special items is spread over four years<br />

Balance sheet profit of <strong>METRO</strong> AG and profit<br />

appropriation in accordance with German<br />

commercial law<br />

<strong>METRO</strong> AG’s annual financial statements prepared under<br />

German commercial law serve as the basis for dividend distribution.<br />

The balance sheet and income statement of<br />

<strong>METRO</strong> AG prepared in accordance with the German Commercial<br />

Code (hGB) are as follows:<br />

Income statement for the financial year from<br />

1 January to 31 December 2010 prepared under the<br />

German Commercial Code (HGB)<br />

€ million 2010 2009<br />

Investment income 919.9 772.2<br />

Financial result –178.9 –111.2<br />

Other operating income 304.8 139.1<br />

Personnel expenses<br />

depreciation/amortisation on intangible and<br />

–153.4 –87.1<br />

tangible assets –37.8 –2.1<br />

Other operating expenses –291.7 –151.7<br />

NOPAT 562.9 559.2<br />

Extraordinary result –31.5 0.0<br />

Income taxes –35.9 –25.5<br />

Other taxes –3.5 6.4<br />

Net income 492.0 540.1<br />

Profit carried forward from the previous year 23.9 9.7<br />

Additions to revenue reserves –60.0 –140.0<br />

Balance sheet profit 455.9 409.8<br />

Balance sheet profit of <strong>METRO</strong> AG and profit appropriation<br />

For the financial year 2010, <strong>METRO</strong> AG posted investment<br />

income of €919.9 million, compared with €772.2 million in<br />

the previous year. In consideration of other income, expenses<br />

and taxes as well as the transfer of €60.0 million to revenue<br />

Balance sheet as at 31 December 2010<br />

Assets<br />

Liabilities<br />

→ p. 088<br />

reserves, the Company reported a balance sheet profit of<br />

€455.9 million compared with €409.8 million in 2009.<br />

The Management Board of <strong>METRO</strong> AG will propose to the<br />

Annual General Meeting that, from the reported balance<br />

sheet profit of €455.9 million, a dividend of €441.5 million be<br />

paid and that the balance of €14.4 million be carried forward<br />

to the new account. The balance sheet profit of €455.9 million<br />

includes retained earnings of €23.9 million. The dividend<br />

proposed by the Management Board amounts to<br />

→ €1.350 per ordinary share and<br />

→ €1.485 per preference share.<br />

€ million<br />

Fixed assets<br />

31/12/2010 31/12/2009<br />

Intangible assets 148.4 2.4<br />

Tangible assets 4.3 4.1<br />

Financial assets 7,921.4 8,319.3<br />

Current assets<br />

8,074.1 8,325.8<br />

Receivables and other assets 2,829.3 1,638.5<br />

Cash on hand, bank deposits and cheques 2,199.8 1,294.8<br />

5,029.1 2,933.3<br />

Prepaid expenses and deferred charges 19.0 11.8<br />

13,122.2 11,270.9<br />

€ million<br />

Equity<br />

31/12/2010 31/12/2009<br />

Share capital 835.4 835.4<br />

Ordinary shares 828.6 828.6<br />

Preference shares 6.8 6.8<br />

(Contingent capital) (127.8) (127.8)<br />

Capital reserve 2,558.0 2,558.0<br />

Reserves retained from earnings 1,726.3 1,664.0<br />

Balance sheet profit 455.9 409.8<br />

5,575.6 5,467.2<br />

Provisions 371.3 295.9<br />

Liabilities 7,172.9 5,507.7<br />

Deferred income 2.4 0.1<br />

13,122.2 11,270.9