pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 9. NOTES PURSUANT TO § 315 SECTION 4 OF ThE GERMAN COMMERCIAL COdE<br />

ANd EXPL ANATORy REPORT OF ThE MANAGEMENT BOARd<br />

9. Notes pursuant to § 315<br />

Section 4 of the German<br />

Commercial Code and<br />

explanatory report of the<br />

Management Board<br />

Composition of capital (§ 315 Section 4 No. 1 of<br />

the German Commercial Code)<br />

On 31 december 2010, the share capital of <strong>METRO</strong> AG<br />

totalled €835,419,052.27. It is divided into a total of<br />

326,787,529 no-par value bearer shares. The proportional<br />

value per share amounted to about €<strong>2.5</strong>6.<br />

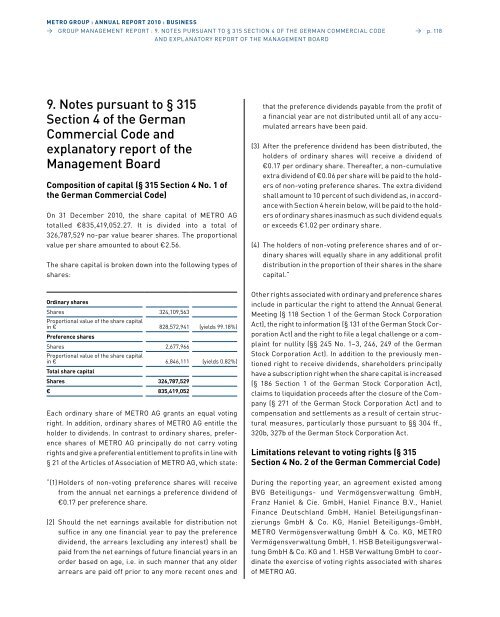

The share capital is broken down into the following types of<br />

shares:<br />

Ordinary shares<br />

Shares<br />

Proportional value of the share capital<br />

324,109,563<br />

in €<br />

Preference shares<br />

828,572,941 (yields 99.18%)<br />

Shares<br />

Proportional value of the share capital<br />

2,677,966<br />

in €<br />

Total share capital<br />

6,846,111 (yields 0.82%)<br />

Shares 326,787,529<br />

€ 835,419,052<br />

Each ordinary share of <strong>METRO</strong> AG grants an equal voting<br />

right. In addition, ordinary shares of <strong>METRO</strong> AG entitle the<br />

holder to dividends. In contrast to ordinary shares, preference<br />

shares of <strong>METRO</strong> AG principally do not carry voting<br />

rights and give a preferential entitlement to profits in line with<br />

§ 21 of the Articles of Association of <strong>METRO</strong> AG, which state:<br />

“(1) holders of non-voting preference shares will receive<br />

from the annual net earnings a preference dividend of<br />

€0.17 per preference share.<br />

(2) Should the net earnings available for distribution not<br />

suffice in any one financial year to pay the preference<br />

dividend, the arrears (excluding any interest) shall be<br />

paid from the net earnings of future financial years in an<br />

order based on age, i.e. in such manner that any older<br />

arrears are paid off prior to any more recent ones and<br />

→ p. 118<br />

that the preference dividends payable from the profit of<br />

a financial year are not distributed until all of any accumulated<br />

arrears have been paid.<br />

(3) After the preference dividend has been distributed, the<br />

holders of ordinary shares will receive a dividend of<br />

€0.17 per ordinary share. Thereafter, a non-cumulative<br />

extra dividend of €0.06 per share will be paid to the holders<br />

of non-voting preference shares. The extra dividend<br />

shall amount to 10 percent of such dividend as, in accordance<br />

with Section 4 herein below, will be paid to the holders<br />

of ordinary shares inasmuch as such dividend equals<br />

or exceeds €1.02 per ordinary share.<br />

(4) The holders of non-voting preference shares and of ordinary<br />

shares will equally share in any additional profit<br />

distribution in the proportion of their shares in the share<br />

capital.”<br />

Other rights associated with ordinary and preference shares<br />

include in particular the right to attend the Annual General<br />

Meeting (§ 118 Section 1 of the German Stock Corporation<br />

Act), the right to information (§ 131 of the German Stock Corporation<br />

Act) and the right to file a legal challenge or a complaint<br />

for nullity (§§ 245 No. 1–3, 246, 249 of the German<br />

Stock Corporation Act). In addition to the previously mentioned<br />

right to receive dividends, shareholders principally<br />

have a subscription right when the share capital is increased<br />

(§ 186 Section 1 of the German Stock Corporation Act),<br />

claims to liquidation proceeds after the closure of the Company<br />

(§ 271 of the German Stock Corporation Act) and to<br />

compensation and settlements as a result of certain structural<br />

measures, particularly those pursuant to §§ 304 ff.,<br />

320b, 327b of the German Stock Corporation Act.<br />

Limitations relevant to voting rights (§ 315<br />

Section 4 No. 2 of the German Commercial Code)<br />

during the reporting year, an agreement existed among<br />

BvG Beteiligungs- und vermögensverwaltung Gmbh,<br />

Franz haniel & Cie. Gmbh, haniel Finance B.v., haniel<br />

Finance deutschland Gmbh, haniel Beteiligungsfinanzierungs<br />

Gmbh & Co. KG, haniel Beteiligungs-Gmbh,<br />

<strong>METRO</strong> vermögensverwaltung Gmbh & Co. KG, <strong>METRO</strong><br />

vermögensverwaltung Gmbh, 1. hSB Beteiligungsverwaltung<br />

Gmbh & Co. KG and 1. hSB verwaltung Gmbh to coordinate<br />

the exercise of voting rights associated with shares<br />

of <strong>METRO</strong> AG.