pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : CAPITAl MANAGEMENT<br />

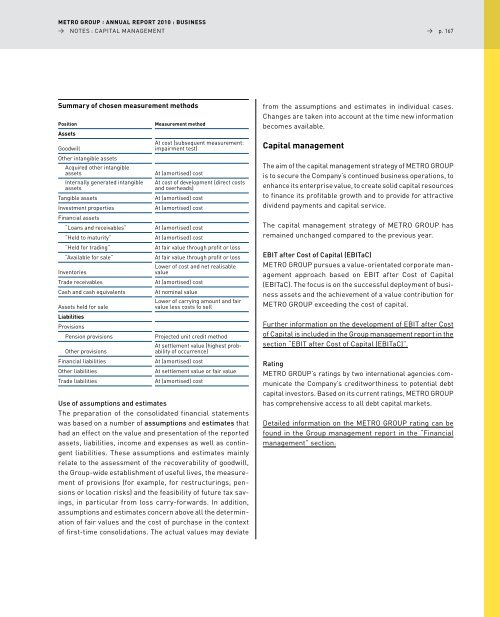

Summary of chosen measurement methods<br />

Position Measurement method<br />

Assets<br />

Goodwill<br />

Other intangible assets<br />

At cost (subsequent measurement:<br />

impairment test)<br />

Acquired other intangible<br />

assets At (amortised) cost<br />

Internally generated intangible<br />

assets<br />

At cost of development (direct costs<br />

and overheads)<br />

Tangible assets At (amortised) cost<br />

Investment properties<br />

financial assets<br />

At (amortised) cost<br />

“loans and receivables” At (amortised) cost<br />

“held to maturity” At (amortised) cost<br />

“held for trading” At fair value through profit or loss<br />

“Available for sale” At fair value through profit or loss<br />

lower of cost and net realisable<br />

Inventories<br />

value<br />

Trade receivables At (amortised) cost<br />

Cash and cash equivalents At nominal value<br />

lower of carrying amount and fair<br />

Assets held for sale<br />

value less costs to sell<br />

Liabilities<br />

Provisions<br />

Pension provisions Projected unit credit method<br />

Other provisions<br />

At settlement value (highest probability<br />

of occurrence)<br />

financial liabilities At (amortised) cost<br />

Other liabilities At settlement value or fair value<br />

Trade liabilities At (amortised) cost<br />

Use of assumptions and estimates<br />

The preparation of the consolidated financial statements<br />

was based on a number of assumptions and estimates that<br />

had an effect on the value and presentation of the reported<br />

assets, liabilities, income and expenses as well as contingent<br />

liabilities. These assumptions and estimates mainly<br />

relate to the assessment of the recoverability of goodwill,<br />

the <strong>Group</strong>-wide establishment of useful lives, the measurement<br />

of provisions (for example, for restructurings, pensions<br />

or location risks) and the feasibility of future tax savings,<br />

in particular from loss carry-forwards. In addition,<br />

assumptions and estimates concern above all the determination<br />

of fair values and the cost of purchase in the context<br />

of first-time consolidations. The actual values may deviate<br />

→ p. 167<br />

from the assumptions and estimates in individual cases.<br />

Changes are taken into account at the time new information<br />

becomes available.<br />

Capital management<br />

The aim of the capital management strategy of <strong>METRO</strong> GROuP<br />

is to secure the Company’s continued business operations, to<br />

enhance its enterprise value, to create solid capital resources<br />

to finance its profitable growth and to provide for attractive<br />

dividend payments and capital service.<br />

The capital management strategy of <strong>METRO</strong> GROuP has<br />

remained unchanged compared to the previous year.<br />

EBIT after Cost of Capital (EBITaC)<br />

<strong>METRO</strong> GROuP pursues a value-orientated corporate management<br />

approach based on EBIT after Cost of Capital<br />

(EBITaC). The focus is on the successful deployment of business<br />

assets and the achievement of a value contribution for<br />

<strong>METRO</strong> GROuP exceeding the cost of capital.<br />

further information on the development of EBIT after Cost<br />

of Capital is included in the <strong>Group</strong> management report in the<br />

section “EBIT after Cost of Capital (EBITaC)”.<br />

Rating<br />

<strong>METRO</strong> GROuP’s ratings by two international agencies communicate<br />

the Company’s creditworthiness to potential debt<br />

capital investors. Based on its current ratings, <strong>METRO</strong> GROuP<br />

has comprehensive access to all debt capital markets.<br />

detailed information on the <strong>METRO</strong> GROuP rating can be<br />

found in the <strong>Group</strong> management report in the “financial<br />

management” section.