pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

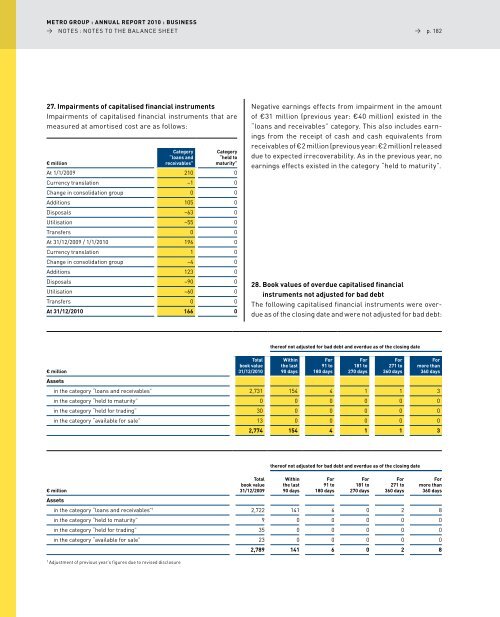

27. Impairments of capitalised financial instruments<br />

Impairments of capitalised financial instruments that are<br />

measured at amortised cost are as follows:<br />

€ million<br />

Category<br />

“loans and<br />

receivables”<br />

Category<br />

“held to<br />

maturity”<br />

At 1/1/2009 210 0<br />

Currency translation –1 0<br />

Change in consolidation group 0 0<br />

Additions 105 0<br />

disposals –63 0<br />

utilisation –55 0<br />

Transfers 0 0<br />

At 31/12/2009 / 1/1/2010 196 0<br />

Currency translation 1 0<br />

Change in consolidation group –4 0<br />

Additions 123 0<br />

disposals –90 0<br />

utilisation –60 0<br />

Transfers 0 0<br />

At 31/12/2010 166 0<br />

€ million<br />

→ p. 182<br />

Negative earnings effects from impairment in the amount<br />

of €31 million (previous year: €40 million) existed in the<br />

“loans and receivables” category. This also includes earnings<br />

from the receipt of cash and cash equivalents from<br />

receivables of €2 million (previous year: €2 million) released<br />

due to expected irrecoverability. As in the previous year, no<br />

earnings effects existed in the category “held to maturity”.<br />

28. Book values of overdue capitalised financial<br />

instruments not adjusted for bad debt<br />

The following capitalised financial instruments were overdue<br />

as of the closing date and were not adjusted for bad debt:<br />

Total<br />

book value<br />

31/12/2010<br />

thereof not adjusted for bad debt and overdue as of the closing date<br />

Within<br />

the last<br />

90 days<br />

For<br />

91 to<br />

180 days<br />

For<br />

181 to<br />

270 days<br />

For<br />

271 to<br />

360 days<br />

For<br />

more than<br />

360 days<br />

Assets<br />

in the category “loans and receivables” 2,731 154 4 1 1 3<br />

in the category “held to maturity” 0 0 0 0 0 0<br />

in the category “held for trading” 30 0 0 0 0 0<br />

in the category “available for sale” 13 0 0 0 0 0<br />

2,774 154 4 1 1 3<br />

thereof not adjusted for bad debt and overdue as of the closing date<br />

Total Within<br />

For<br />

For<br />

For<br />

For<br />

book value the last 91 to 181 to 271 to more than<br />

€ million<br />

Assets<br />

31/12/2009 90 days 180 days 270 days 360 days 360 days<br />

in the category “loans and receivables” 1 2,722 141 6 0 2 8<br />

in the category “held to maturity” 9 0 0 0 0 0<br />

in the category “held for trading” 35 0 0 0 0 0<br />

in the category “available for sale” 23 0 0 0 0 0<br />

2,789 141 6 0 2 8<br />

1 Adjustment of previous year’s figures due to revised disclosure