pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE INCOME STATEMENT<br />

The increase in personnel expenses is essentially due to<br />

expansion, particularly at Media Markt and Saturn. This<br />

increase, however, is weakened by the decline in newly initiated<br />

Shape measures, which resulted in a reduction of<br />

related personnel expenses. In addition, savings from<br />

already implemented Shape measures dampened the cost<br />

increase.<br />

In addition, in the cost of materials, impairments and provisions<br />

related to the decision to dispose of the french consumer<br />

electronics stores resulted in one-time expenses of<br />

€119 million.<br />

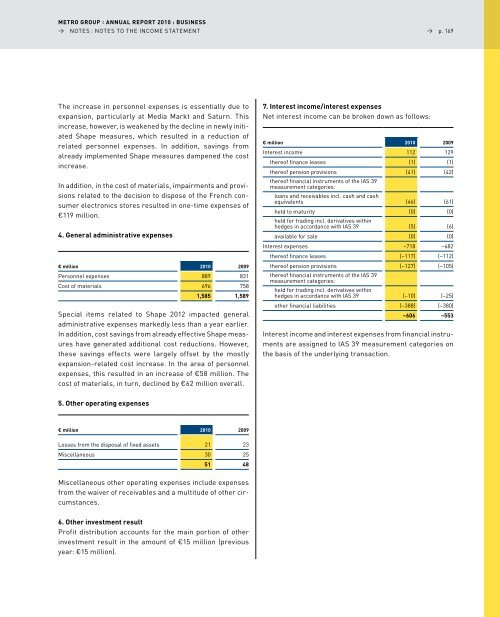

4. General administrative expenses<br />

€ million 2010 2009<br />

Personnel expenses 889 831<br />

Cost of materials 696 758<br />

1,585 1,589<br />

Special items related to Shape 2012 impacted general<br />

administrative expenses markedly less than a year earlier.<br />

In addition, cost savings from already effective Shape measures<br />

have generated additional cost reductions. however,<br />

these savings effects were largely offset by the mostly<br />

expansion-related cost increase. In the area of personnel<br />

expenses, this resulted in an increase of €58 million. The<br />

cost of materials, in turn, declined by €62 million overall.<br />

5. Other operating expenses<br />

€ million 2010 2009<br />

losses from the disposal of fixed assets 21 23<br />

Miscellaneous 30 25<br />

51 48<br />

Miscellaneous other operating expenses include expenses<br />

from the waiver of receivables and a multitude of other circumstances.<br />

6. Other investment result<br />

Profit distribution accounts for the main portion of other<br />

investment result in the amount of €15 million (previous<br />

year: €15 million).<br />

7. Interest income/interest expenses<br />

Net interest income can be broken down as follows:<br />

→ p. 169<br />

€ million 2010 2009<br />

Interest income 112 129<br />

thereof finance leases (1) (1)<br />

thereof pension provisions (41) (42)<br />

thereof financial instruments of the IAS 39<br />

measurement categories:<br />

loans and receivables incl. cash and cash<br />

equivalents (46) (61)<br />

held to maturity (0) (0)<br />

held for trading incl. derivatives within<br />

hedges in accordance with IAS 39 (5) (6)<br />

available for sale (0) (0)<br />

Interest expenses –718 –682<br />

thereof finance leases (–117) (–112)<br />

thereof pension provisions (–127) (–105)<br />

thereof financial instruments of the IAS 39<br />

measurement categories:<br />

held for trading incl. derivatives within<br />

hedges in accordance with IAS 39 (–10) (–25)<br />

other financial liabilities (–388) (–380)<br />

–606 –553<br />

Interest income and interest expenses from financial instruments<br />

are assigned to IAS 39 measurement categories on<br />

the basis of the underlying transaction.