pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 8. REMUNERATION REPORT<br />

ditions of the performance share plan, entitlements cannot<br />

be described with a particular fixed number at the time of<br />

granting. The value of the performance shares distributed in<br />

2010 was calculated by external experts using recognised<br />

financial-mathematical methods (Monte Carlo simulation).<br />

Messrs Mierdorf and Unger received no performance shares<br />

distributed in the tranche for 2010. There were no rights<br />

from previous tranches of the performance share plan and<br />

the share bonus programme.<br />

In addition to the tranche from the performance share plan<br />

distributed in the financial year 2010, dr Cordes, Mr Muller<br />

and Mr Saveuse possess rights from the tranche from 2009.<br />

Mr Koch, a member of the Management Board since September<br />

2009, did not receive any performance shares from the<br />

tranche distributed from the performance share plan in 2009.<br />

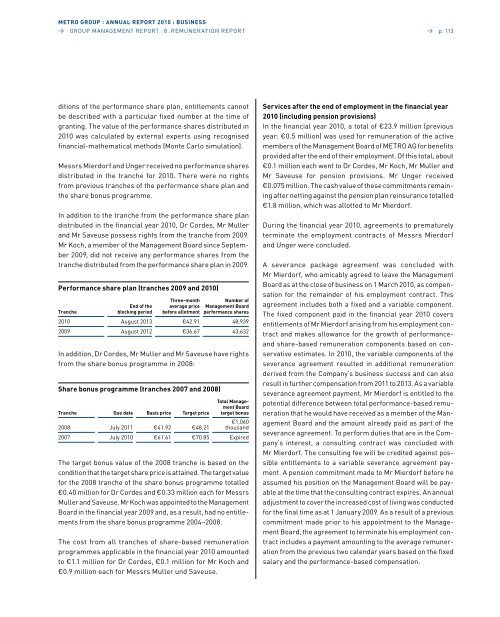

Performance share plan (tranches 2009 and 2010)<br />

Tranche<br />

End of the<br />

blocking period<br />

Three-month<br />

average price<br />

before allotment<br />

Number of<br />

Management Board<br />

performance shares<br />

2010 August 2013 €42.91 48,939<br />

2009 August 2012 €36.67 43,632<br />

In addition, dr Cordes, Mr Muller and Mr Saveuse have rights<br />

from the share bonus programme in 2008:<br />

Share bonus programme (tranches 2007 and 2008)<br />

Tranche Due date Basis price Target price<br />

2008 July 2011 €41.92 €48.21<br />

Total Management<br />

Board<br />

target bonus<br />

€1,060<br />

thousand<br />

2007 July 2010 €61.61 €70.85 Expired<br />

The target bonus value of the 2008 tranche is based on the<br />

condition that the target share price is attained. The target value<br />

for the 2008 tranche of the share bonus programme totalled<br />

€0.40 million for dr Cordes and €0.33 million each for Messrs<br />

Muller and Saveuse. Mr Koch was appointed to the Management<br />

Board in the financial year 2009 and, as a result, had no entitlements<br />

from the share bonus programme 2004–2008.<br />

The cost from all tranches of share-based remuneration<br />

programmes applicable in the financial year 2010 amounted<br />

to €1.1 million for dr Cordes, €0.1 million for Mr Koch and<br />

€0.9 million each for Messrs Muller und Saveuse.<br />

→ p. 113<br />

Services after the end of employment in the financial year<br />

2010 (including pension provisions)<br />

In the financial year 2010, a total of €23.9 million (previous<br />

year: €0.5 million) was used for remuneration of the active<br />

members of the Management Board of <strong>METRO</strong> AG for benefits<br />

provided after the end of their employment. Of this total, about<br />

€0.1 million each went to dr Cordes, Mr Koch, Mr Muller and<br />

Mr Saveuse for pension provisions. Mr Unger received<br />

€0.075 million. The cash value of these commitments remaining<br />

after netting against the pension plan reinsurance totalled<br />

€1.8 million, which was allotted to Mr Mierdorf.<br />

during the financial year 2010, agreements to prematurely<br />

terminate the employment contracts of Messrs Mierdorf<br />

and Unger were concluded.<br />

A severance package agreement was concluded with<br />

Mr Mierdorf, who amicably agreed to leave the Management<br />

Board as at the close of business on 1 March 2010, as compensation<br />

for the remainder of his employment contract. This<br />

agreement includes both a fixed and a variable component.<br />

The fixed component paid in the financial year 2010 covers<br />

entitlements of Mr Mierdorf arising from his employment contract<br />

and makes allowance for the growth of performanceand<br />

share-based remuneration components based on conservative<br />

estimates. In 2010, the variable components of the<br />

severance agreement resulted in additional remuneration<br />

derived from the Company’s business success and can also<br />

result in further compensation from 2011 to 2013. As a variable<br />

severance agreement payment, Mr Mierdorf is entitled to the<br />

potential difference between total performance-based remuneration<br />

that he would have received as a member of the Management<br />

Board and the amount already paid as part of the<br />

severance agreement. To perform duties that are in the Company’s<br />

interest, a consulting contract was concluded with<br />

Mr Mierdorf. The consulting fee will be credited against possible<br />

entitlements to a variable severance agreement payment.<br />

A pension commitment made to Mr Mierdorf before he<br />

assumed his position on the Management Board will be payable<br />

at the time that the consulting contract expires. An annual<br />

adjustment to cover the increased cost of living was conducted<br />

for the final time as at 1 January 2009. As a result of a previous<br />

commitment made prior to his appointment to the Management<br />

Board, the agreement to terminate his employment contract<br />

includes a payment amounting to the average remuneration<br />

from the previous two calendar years based on the fixed<br />

salary and the performance-based compensation.