pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

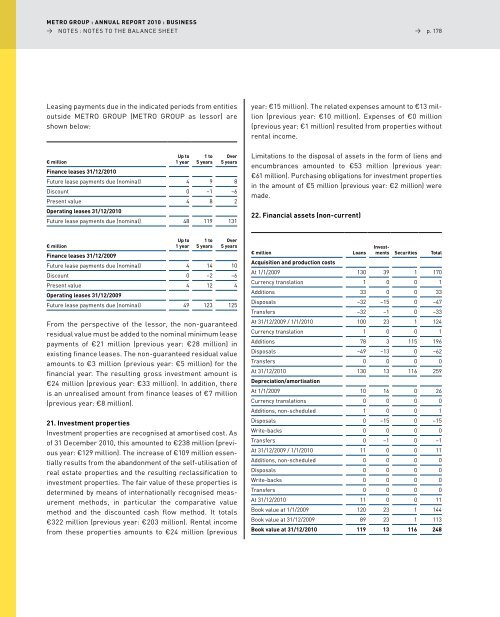

leasing payments due in the indicated periods from entities<br />

outside <strong>METRO</strong> GROuP (<strong>METRO</strong> GROuP as lessor) are<br />

shown below:<br />

Up to 1 to Over<br />

€ million<br />

Finance leases 31/12/2010<br />

1 year 5 years 5 years<br />

future lease payments due (nominal) 4 9 8<br />

discount 0 –1 –6<br />

Present value<br />

Operating leases 31/12/2010<br />

4 8 2<br />

future lease payments due (nominal) 48 119 131<br />

Up to 1 to Over<br />

€ million<br />

Finance leases 31/12/2009<br />

1 year 5 years 5 years<br />

future lease payments due (nominal) 4 14 10<br />

discount 0 –2 –6<br />

Present value<br />

Operating leases 31/12/2009<br />

4 12 4<br />

future lease payments due (nominal) 49 123 125<br />

from the perspective of the lessor, the non-guaranteed<br />

residual value must be added to the nominal minimum lease<br />

payments of €21 million (previous year: €28 million) in<br />

existing finance leases. The non-guaranteed residual value<br />

amounts to €3 million (previous year: €5 million) for the<br />

financial year. The resulting gross investment amount is<br />

€24 million (previous year: €33 million). In addition, there<br />

is an unrealised amount from finance leases of €7 million<br />

(previous year: €8 million).<br />

21. Investment properties<br />

Investment properties are recognised at amortised cost. As<br />

of 31 december 2010, this amounted to €238 million (previous<br />

year: €129 million). The increase of €109 million essentially<br />

results from the abandonment of the self-utilisation of<br />

real estate properties and the resulting reclassification to<br />

investment properties. The fair value of these properties is<br />

determined by means of internationally recognised measurement<br />

methods, in particular the comparative value<br />

method and the discounted cash flow method. It totals<br />

€322 million (previous year: €203 million). Rental income<br />

from these properties amounts to €24 million (previous<br />

→ p. 178<br />

year: €15 million). The related expenses amount to €13 million<br />

(previous year: €10 million). Expenses of €0 million<br />

(previous year: €1 million) resulted from properties without<br />

rental income.<br />

limitations to the disposal of assets in the form of liens and<br />

encumbrances amounted to €53 million (previous year:<br />

€61 million). Purchasing obligations for investment properties<br />

in the amount of €5 million (previous year: €2 million) were<br />

made.<br />

22. Financial assets (non-current)<br />

€ million<br />

Acquisition and production costs<br />

Loans<br />

Investments<br />

Securities Total<br />

At 1/1/2009 130 39 1 170<br />

Currency translation 1 0 0 1<br />

Additions 33 0 0 33<br />

disposals –32 –15 0 –47<br />

Transfers –32 –1 0 –33<br />

At 31/12/2009 / 1/1/2010 100 23 1 124<br />

Currency translation 1 0 0 1<br />

Additions 78 3 115 196<br />

disposals –49 –13 0 –62<br />

Transfers 0 0 0 0<br />

At 31/12/2010<br />

Depreciation/amortisation<br />

130 13 116 259<br />

At 1/1/2009 10 16 0 26<br />

Currency translations 0 0 0 0<br />

Additions, non-scheduled 1 0 0 1<br />

disposals 0 –15 0 –15<br />

Write-backs 0 0 0 0<br />

Transfers 0 –1 0 –1<br />

At 31/12/2009 / 1/1/2010 11 0 0 11<br />

Additions, non-scheduled 0 0 0 0<br />

disposals 0 0 0 0<br />

Write-backs 0 0 0 0<br />

Transfers 0 0 0 0<br />

At 31/12/2010 11 0 0 11<br />

Book value at 1/1/2009 120 23 1 144<br />

Book value at 31/12/2009 89 23 1 113<br />

Book value at 31/12/2010 119 13 116 248