pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : OThER NOTES<br />

46. Other legal issues<br />

Status of appraisal processes<br />

The share exchange ratio set for the incorporation of Asko<br />

deutsche Kaufhaus AG and deutsche SB-Kauf AG into<br />

<strong>METRO</strong> AG in 1996 is undergoing judicial review in appraisal<br />

processes initiated by former shareholders. The petitioners<br />

maintain that the exchange ratio was set too low, putting<br />

them at a disadvantage.<br />

These two legal challenges are pending in district courts<br />

located in Saarbrücken and frankfurt am Main.<br />

Investigations by the Federal Cartel Office<br />

On 14 January 2010, the federal Cartel Office searched<br />

former business premises of MGB <strong>METRO</strong> <strong>Group</strong> Buying<br />

Gmbh. The federal Cartel Office’s investigations are ongoing;<br />

to date, the authority has raised no concrete and individualised<br />

allegations against MGB <strong>METRO</strong> <strong>Group</strong> Buying<br />

Gmbh or any other <strong>METRO</strong> GROuP company. As a result, the<br />

Company is unable to comment on the possible impact of<br />

these investigations on the consolidated financial statements<br />

of <strong>METRO</strong> AG at this point in time.<br />

47. Events after the closing date<br />

No events that are of material importance to an assessment<br />

of the earnings, financial and asset position of <strong>METRO</strong> AG<br />

and <strong>METRO</strong> GROuP occurred between the closing date<br />

(31 december 2010) and the date of presentation of the<br />

accounts (28 february 2011).<br />

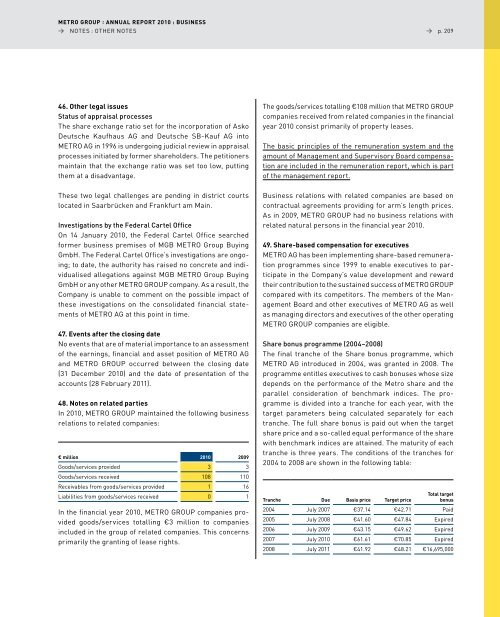

48. Notes on related parties<br />

In 2010, <strong>METRO</strong> GROuP maintained the following business<br />

relations to related companies:<br />

€ million 2010 2009<br />

Goods/services provided 3 3<br />

Goods/services received 108 110<br />

Receivables from goods/services provided 1 16<br />

liabilities from goods/services received 0 1<br />

In the financial year 2010, <strong>METRO</strong> GROuP companies provided<br />

goods/services totalling €3 million to companies<br />

included in the group of related companies. This concerns<br />

primarily the granting of lease rights.<br />

→ p. 209<br />

The goods/services totalling €108 million that <strong>METRO</strong> GROuP<br />

companies received from related companies in the financial<br />

year 2010 consist primarily of property leases.<br />

The basic principles of the remuneration system and the<br />

amount of Management and Supervisory Board compensation<br />

are included in the remuneration report, which is part<br />

of the management report.<br />

Business relations with related companies are based on<br />

contractual agreements providing for arm’s length prices.<br />

As in 2009, <strong>METRO</strong> GROuP had no business relations with<br />

related natural persons in the financial year 2010.<br />

49. Share-based compensation for executives<br />

<strong>METRO</strong> AG has been implementing share-based remuneration<br />

programmes since 1999 to enable executives to participate<br />

in the Company’s value development and reward<br />

their contribution to the sustained success of <strong>METRO</strong> GROuP<br />

compared with its competitors. The members of the Management<br />

Board and other executives of <strong>METRO</strong> AG as well<br />

as managing directors and executives of the other operating<br />

<strong>METRO</strong> GROuP companies are eligible.<br />

Share bonus programme (2004–2008)<br />

The final tranche of the Share bonus programme, which<br />

<strong>METRO</strong> AG introduced in 2004, was granted in 2008. The<br />

programme entitles executives to cash bonuses whose size<br />

depends on the performance of the Metro share and the<br />

parallel consideration of benchmark indices. The programme<br />

is divided into a tranche for each year, with the<br />

target parameters being calculated separately for each<br />

tranche. The full share bonus is paid out when the target<br />

share price and a so-called equal performance of the share<br />

with benchmark indices are attained. The maturity of each<br />

tranche is three years. The conditions of the tranches for<br />

2004 to 2008 are shown in the following table:<br />

Tranche Due Basis price Target price<br />

Total target<br />

bonus<br />

2004 July 2007 €37.14 €42.71 Paid<br />

2005 July 2008 €41.60 €47.84 Expired<br />

2006 July 2009 €43.15 €49.62 Expired<br />

2007 July 2010 €61.61 €70.85 Expired<br />

2008 July 2011 €41.92 €48.21 €16,695,000