pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 4. FINANCIAL ANd ASSET POSITION<br />

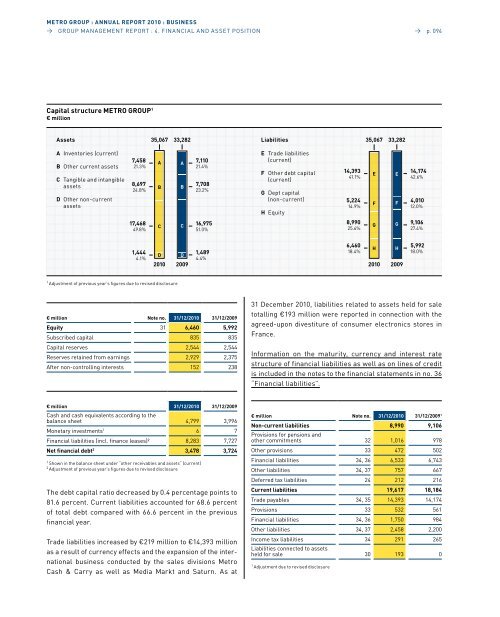

Capital structure <strong>METRO</strong> GROUP 1<br />

€ million<br />

Assets<br />

A Inventories (current)<br />

B Other current assets<br />

C Tangible and intangible<br />

assets<br />

D Other non-current<br />

assets<br />

7,458<br />

21.3%<br />

8,697<br />

24.8%<br />

17,468<br />

49.8%<br />

1,444<br />

4.1%<br />

35,067<br />

D<br />

2010<br />

1 Adjustment of previous year’s figures due to revised disclosure<br />

€ million Note no. 31/12/2010 31/12/2009<br />

Equity 31 6,460 5,992<br />

Subscribed capital 835 835<br />

Capital reserves 2,544 2,544<br />

Reserves retained from earnings 2,929 2,375<br />

After non-controlling interests 152 238<br />

€ million 31/12/2010 31/12/2009<br />

Cash and cash equivalents according to the<br />

balance sheet 4,799 3,996<br />

Monetary investments1 6 7<br />

Financial liabilities (incl. finance leases)² 8,283 7,727<br />

Net financial debt2 3,478 3,724<br />

1 Shown in the balance sheet under “other receivables and assets“ (current)<br />

2 Adjustment of previous year’s figures due to revised disclosure<br />

The debt capital ratio decreased by 0.4 percentage points to<br />

81.6 percent. Current liabilities accounted for 68.6 percent<br />

of total debt compared with 66.6 percent in the previous<br />

financial year.<br />

Trade liabilities increased by €219 million to €14,393 million<br />

as a result of currency effects and the expansion of the international<br />

business conducted by the sales divisions Metro<br />

Cash & Carry as well as Media Markt and Saturn. As at<br />

A<br />

B<br />

C<br />

33,282<br />

A<br />

B<br />

C<br />

D<br />

2009<br />

7,110<br />

21.4%<br />

7,708<br />

23.2%<br />

16,975<br />

51.0%<br />

1,489<br />

4.4%<br />

Liabilities<br />

E Trade liabilities<br />

(current)<br />

F Other debt capital<br />

(current)<br />

G dept capital<br />

(non-current)<br />

H Equity<br />

→ p. 094<br />

31 december 2010, liabilities related to assets held for sale<br />

totalling €193 million were reported in connection with the<br />

agreed-upon divestiture of consumer electronics stores in<br />

France.<br />

Information on the maturity, currency and interest rate<br />

structure of financial liabilities as well as on lines of credit<br />

is included in the notes to the financial statements in no. 36<br />

“Financial liabilities”.<br />

€ million Note no. 31/12/2010 31/12/20091 Non-current liabilities<br />

Provisions for pensions and<br />

8,990 9,106<br />

other commitments 32 1,016 978<br />

Other provisions 33 472 502<br />

Financial liabilities 34, 36 6,533 6,743<br />

Other liabilities 34, 37 757 667<br />

deferred tax liabilities 24 212 216<br />

Current liabilities 19,617 18,184<br />

Trade payables 34, 35 14,393 14,174<br />

Provisions 33 532 561<br />

Financial liabilities 34, 36 1,750 984<br />

Other liabilities 34, 37 2,458 2,200<br />

Income tax liabilities<br />

Liabilities connected to assets<br />

34 291 265<br />

held for sale 30 193 0<br />

1 Adjustment due to revised disclosure<br />

14,393<br />

41.1%<br />

5,224<br />

14.9%<br />

8,990<br />

25.6%<br />

6,460<br />

18.4%<br />

35,067<br />

E<br />

F<br />

G<br />

H<br />

2010<br />

33,282<br />

E<br />

F<br />

G<br />

H<br />

2009<br />

14,174<br />

42.6%<br />

4,010<br />

12.0%<br />

9,106<br />

27.4%<br />

5,992<br />

18.0%