pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

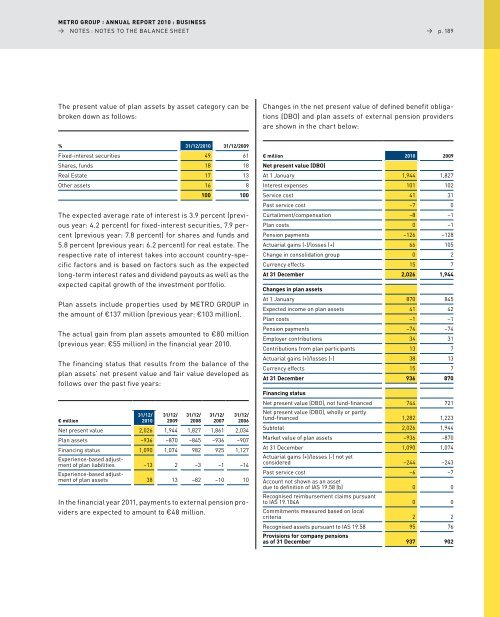

The present value of plan assets by asset category can be<br />

broken down as follows:<br />

% 31/12/2010 31/12/2009<br />

fixed-interest securities 49 61<br />

Shares, funds 18 18<br />

Real Estate 17 13<br />

Other assets 16 8<br />

100 100<br />

The expected average rate of interest is 3.9 percent (previous<br />

year: 4.2 percent) for fixed-interest securities, 7.9 percent<br />

(previous year: 7.8 percent) for shares and funds and<br />

5.8 percent (previous year: 6.2 percent) for real estate. The<br />

respective rate of interest takes into account country-specific<br />

factors and is based on factors such as the expected<br />

long-term interest rates and dividend payouts as well as the<br />

expected capital growth of the investment portfolio.<br />

Plan assets include properties used by <strong>METRO</strong> GROuP in<br />

the amount of €137 million (previous year: €103 million).<br />

The actual gain from plan assets amounted to €80 million<br />

(previous year: €55 million) in the financial year 2010.<br />

The financing status that results from the balance of the<br />

plan assets’ net present value and fair value developed as<br />

follows over the past five years:<br />

€ million<br />

31/12/<br />

2010<br />

31/12/<br />

2009<br />

31/12/<br />

2008<br />

31/12/<br />

2007<br />

31/12/<br />

2006<br />

Net present value 2,026 1,944 1,827 1,861 2,034<br />

Plan assets –936 –870 –845 –936 –907<br />

financing status 1,090 1,074 982 925 1,127<br />

Experience-based adjustment<br />

of plan liabilities<br />

Experience-based adjust-<br />

–13 2 –3 –1 –14<br />

ment of plan assets 38 13 –82 –10 10<br />

In the financial year 2011, payments to external pension providers<br />

are expected to amount to €48 million.<br />

→ p. 189<br />

Changes in the net present value of defined benefit obligations<br />

(dBO) and plan assets of external pension providers<br />

are shown in the chart below:<br />

€ million<br />

Net present value (DBO)<br />

2010 2009<br />

At 1 January 1,944 1,827<br />

Interest expenses 101 102<br />

Service cost 41 31<br />

Past service cost –7 0<br />

Curtailment/compensation –8 –1<br />

Plan costs 0 –1<br />

Pension payments –126 –128<br />

Actuarial gains (-)/losses (+) 66 105<br />

Change in consolidation group 0 2<br />

Currency effects 15 7<br />

At 31 December 2,026 1,944<br />

Changes in plan assets<br />

At 1 January 870 845<br />

Expected income on plan assets 41 42<br />

Plan costs –1 –1<br />

Pension payments –74 –74<br />

Employer contributions 34 31<br />

Contributions from plan participants 13 7<br />

Actuarial gains (+)/losses (-) 38 13<br />

Currency effects 15 7<br />

At 31 December 936 870<br />

Financing status<br />

Net present value (dBO), not fund-financed<br />

Net present value (dBO), wholly or partly<br />

744 721<br />

fund-financed 1,282 1,223<br />

Subtotal 2,026 1,944<br />

Market value of plan assets –936 –870<br />

At 31 december<br />

Actuarial gains (+)/losses (-) not yet<br />

1,090 1,074<br />

considered –244 –243<br />

Past service cost<br />

Account not shown as an asset<br />

–6 –7<br />

due to definition of IAS 19.58 (b)<br />

Recognised reimbursement claims pursuant<br />

0 0<br />

to IAS 19.104A<br />

Commitments measured based on local<br />

0 0<br />

criteria 2 2<br />

Recognised assets pursuant to IAS 19.58<br />

Provisions for company pensions<br />

95 76<br />

as of 31 December 937 902