pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

The fixed interest rate for short- and medium-term financial<br />

liabilities and the repricing dates of all fixed-interest liabilities<br />

essentially correspond to the displayed remaining<br />

terms. The repricing dates for variable interest rates are<br />

less than one year.<br />

The effects that changes in interest rates concerning the<br />

variable portion of financial liabilities have on the net profit<br />

for the period and the equity of <strong>METRO</strong> GROuP are described<br />

in detail in no. 43 “Management of financial risks”.<br />

€ million Total<br />

→ p. 195<br />

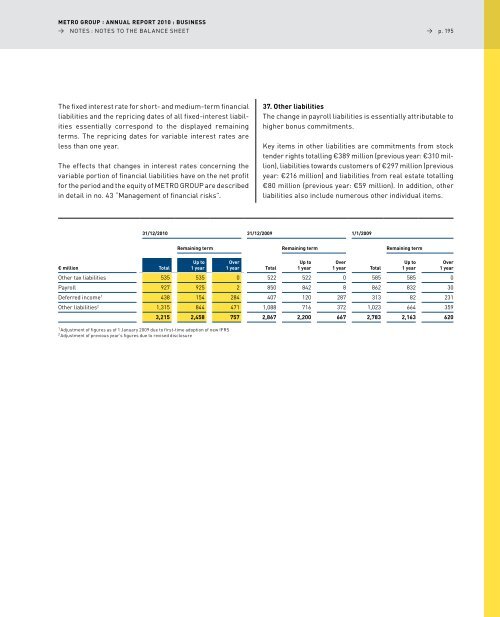

37. Other liabilities<br />

The change in payroll liabilities is essentially attributable to<br />

higher bonus commitments.<br />

Key items in other liabilities are commitments from stock<br />

tender rights totalling €389 million (previous year: €310 million),<br />

liabilities towards customers of €297 million (previous<br />

year: €216 million) and liabilities from real estate totalling<br />

€80 million (previous year: €59 million). In addition, other<br />

liabilities also include numerous other individual items.<br />

31/12/2010 31/12/2009 1/1/2009<br />

Remaining term Remaining term Remaining term<br />

Up to<br />

1 year<br />

Over<br />

1 year Total<br />

Up to<br />

1 year<br />

Over<br />

1 year Total<br />

Other tax liabilities 535 535 0 522 522 0 585 585 0<br />

Payroll 927 925 2 850 842 8 862 832 30<br />

deferred income 1 438 154 284 407 120 287 313 82 231<br />

Other liabilities 2 1,315 844 471 1,088 716 372 1,023 664 359<br />

1 Adjustment of figures as of 1 January 2009 due to first-time adoption of new IfRS<br />

2 Adjustment of previous year’s figures due to revised disclosure<br />

Up to<br />

1 year<br />

Over<br />

1 year<br />

3,215 2,458 757 2,867 2,200 667 2,783 2,163 620