pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : OThER NOTES<br />

Consumer electronics retail<br />

Media Markt and Saturn offers a comprehensive assortment<br />

including the latest brand products. With its two<br />

strong brands, the sales division is now represented in 17<br />

countries.<br />

Department stores<br />

Galeria Kaufhof operates department stores in Germany<br />

and Belgium. In Belgium, the sales division operates under<br />

the name Galeria Inno. Galeria’s department stores offer<br />

high-quality assortments with a focus on textiles.<br />

Real Estate<br />

<strong>METRO</strong> <strong>Group</strong> Asset Management manages <strong>METRO</strong> GROuP’s<br />

real estate assets in 30 countries. Its responsibilities<br />

include, among other things, actively increasing the portfolio<br />

value, developing new stores and branches as well as<br />

managing existing locations.<br />

Additional information on the segments is provided in the<br />

management report.<br />

Aside from the information on the operating segments<br />

listed above, equivalent information is provided on the<br />

Metro regions. here, a distinction is made between the<br />

regions Germany, Western Europe excluding Germany,<br />

Eastern Europe and Asia/Africa.<br />

→ External sales represent sales of the operating segments<br />

to third parties outside the <strong>Group</strong>.<br />

→ Internal sales represent sales between the <strong>Group</strong>’s<br />

operating segments.<br />

→ Segment EBITdAR represents EBITdA before rental<br />

expenses less rental income.<br />

→ Segment EBITdA comprises EBIT before write-downs<br />

and write-ups on tangible and intangible assets.<br />

→ EBIT as the key ratio for segment reporting describes<br />

operating earnings for the period before net financial<br />

income and income taxes. Intra-<strong>Group</strong> rental contracts<br />

are shown as operating leases in the segments. The<br />

properties are leased at market rates. In principle, location<br />

risks and recoverability risks related to non-current<br />

assets are only shown in the segments when they represent<br />

<strong>Group</strong> risks.<br />

→ Segment investments include additions to assets<br />

adjusted for additions due to the reclassification of<br />

→ p. 201<br />

“assets held for sale” as fixed assets. Additions to noncurrent<br />

financial assets represent another exception.<br />

→ Segment assets include non-current and current assets.<br />

They do not include mostly financial assets according to<br />

the balance sheet, income tax items, cash and assets<br />

allocable to discontinued operations.<br />

→ Segment liabilities include non-current and current<br />

liabilities. They do not include, in particular, financial<br />

liabilities according to the balance sheet, income tax<br />

items and liabilities allocable to discontinued operations.<br />

→ In principle, transfers between segments are made<br />

based on the costs incurred from the <strong>Group</strong>’s perspective.<br />

→ discontinued operations in 2009 include the figures<br />

relating to the Adler fashion stores.<br />

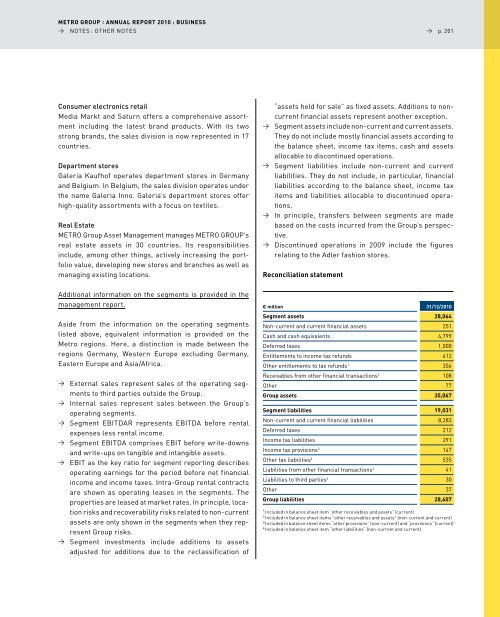

Reconciliation statement<br />

€ million 31/12/2010<br />

Segment assets 28,064<br />

Non-current and current financial assets 251<br />

Cash and cash equivalents 4,799<br />

deferred taxes 1,000<br />

Entitlements to income tax refunds 412<br />

Other entitlements to tax refunds 1 356<br />

Receivables from other financial transactions 2 108<br />

Other 77<br />

<strong>Group</strong> assets 35,067<br />

Segment liabilities 19,031<br />

Non-current and current financial liabilities 8,283<br />

deferred taxes 212<br />

Income tax liabilities 291<br />

Income tax provisions 3 147<br />

Other tax liabilities 4 535<br />

liabilities from other financial transactions 4 41<br />

liabilities to third parties 4 30<br />

Other 37<br />

<strong>Group</strong> liabilities 28,607<br />

1 Included in balance sheet item “other receivables and assets” (current)<br />

2 Included in balance sheet items “other receivables and assets” (non-current and current)<br />

3 Included in balance sheet items “other provisions” (non-current) and “provisions” (current)<br />

4 Included in balance sheet item “other liabilities” (non-current and current)