pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : OThER NOTES<br />

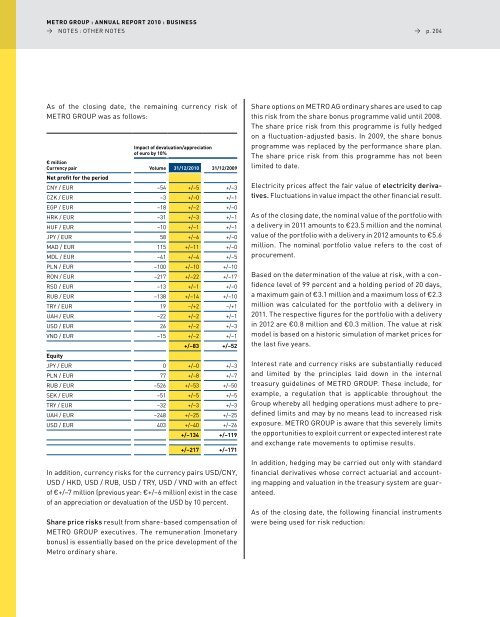

As of the closing date, the remaining currency risk of<br />

<strong>METRO</strong> GROuP was as follows:<br />

Impact of devaluation/appreciation<br />

of euro by 10%<br />

€ million<br />

Currency pair<br />

Net profit for the period<br />

Volume 31/12/2010 31/12/2009<br />

CNy / EuR –54 +/–5 +/–3<br />

CZK / EuR –3 +/–0 +/–1<br />

EGP / EuR –18 +/–2 +/–0<br />

hRK / EuR –31 +/–3 +/–1<br />

huf / EuR –10 +/–1 +/–1<br />

JPy / EuR 58 +/–6 +/–0<br />

MAd / EuR 115 +/–11 +/–0<br />

Mdl / EuR –41 +/–4 +/–5<br />

PlN / EuR –100 +/–10 +/–10<br />

RON / EuR –217 +/–22 +/–17<br />

RSd / EuR –13 +/–1 +/–0<br />

RuB / EuR –138 +/–14 +/–10<br />

TRy / EuR 19 –/+2 –/+1<br />

uAh / EuR –22 +/–2 +/–1<br />

uSd / EuR 26 +/–2 +/–3<br />

VNd / EuR –15 +/–2 +/–1<br />

Equity<br />

+/–83 +/–52<br />

JPy / EuR 0 +/–0 +/–3<br />

PlN / EuR 77 +/–8 +/–7<br />

RuB / EuR –526 +/–53 +/–50<br />

SEK / EuR –51 +/–5 +/–5<br />

TRy / EuR –32 +/–3 +/–3<br />

uAh / EuR –248 +/–25 +/–25<br />

uSd / EuR 403 +/–40 +/–26<br />

+/–134 +/–119<br />

+/–217 +/–171<br />

In addition, currency risks for the currency pairs uSd/CNy,<br />

uSd / hKd, uSd / RuB, uSd / TRy, uSd / VNd with an effect<br />

of €+/–7 million (previous year: €+/–6 million) exist in the case<br />

of an appreciation or devaluation of the uSd by 10 percent.<br />

Share price risks result from share-based compensation of<br />

<strong>METRO</strong> GROuP executives. The remuneration (monetary<br />

bonus) is essentially based on the price development of the<br />

Metro ordinary share.<br />

→ p. 204<br />

Share options on <strong>METRO</strong> AG ordinary shares are used to cap<br />

this risk from the share bonus programme valid until 2008.<br />

The share price risk from this programme is fully hedged<br />

on a fluctuation-adjusted basis. In 2009, the share bonus<br />

programme was replaced by the performance share plan.<br />

The share price risk from this programme has not been<br />

limited to date.<br />

Electricity prices affect the fair value of electricity derivatives.<br />

fluctuations in value impact the other financial result.<br />

As of the closing date, the nominal value of the portfolio with<br />

a delivery in 2011 amounts to €23.5 million and the nominal<br />

value of the portfolio with a delivery in 2012 amounts to €5.6<br />

million. The nominal portfolio value refers to the cost of<br />

procurement.<br />

Based on the determination of the value at risk, with a confidence<br />

level of 99 percent and a holding period of 20 days,<br />

a maximum gain of €3.1 million and a maximum loss of €2.3<br />

million was calculated for the portfolio with a delivery in<br />

2011. The respective figures for the portfolio with a delivery<br />

in 2012 are €0.8 million and €0.3 million. The value at risk<br />

model is based on a historic simulation of market prices for<br />

the last five years.<br />

Interest rate and currency risks are substantially reduced<br />

and limited by the principles laid down in the internal<br />

treasury guidelines of <strong>METRO</strong> GROuP. These include, for<br />

example, a regulation that is applicable throughout the<br />

<strong>Group</strong> whereby all hedging operations must adhere to predefined<br />

limits and may by no means lead to increased risk<br />

exposure. <strong>METRO</strong> GROuP is aware that this severely limits<br />

the opportunities to exploit current or expected interest rate<br />

and exchange rate movements to optimise results.<br />

In addition, hedging may be carried out only with standard<br />

financial derivatives whose correct actuarial and accounting<br />

mapping and valuation in the treasury system are guaranteed.<br />

As of the closing date, the following financial instruments<br />

were being used for risk reduction: