pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

pdf (2.5 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2010 : BUSINESS<br />

→ NOTES : NOTES TO ThE BAl ANCE ShEET<br />

The current financial year includes disposals of real estate<br />

assets in the amount of €197 million (previous year: €235<br />

million).<br />

Non-scheduled write-downs mainly concern business and<br />

office equipment related to the disposal of the french consumer<br />

electronics stores and non-scheduled write-downs<br />

of real estate properties.<br />

18. Goodwill<br />

In the financial year 2010, goodwill amounted to €4,064 million<br />

(previous year: €3,992 million).<br />

In 2010, the recognition of shareholder interests with stock<br />

tender rights raised goodwill of Media Markt and Saturn by<br />

€26 million (previous year: reduction by €14 million).<br />

In 2009, the non-controlling shareholders of Metro<br />

Cash & Carry Romania were granted stock tender rights<br />

by <strong>METRO</strong> GROuP. The subsequent measurement of<br />

these stock tender rights resulted in €47 million (previous<br />

year: €27 million) higher goodwill.<br />

With the divestment of Metro Cash & Carry Morocco, goodwill<br />

of €10 million has been disposed of.<br />

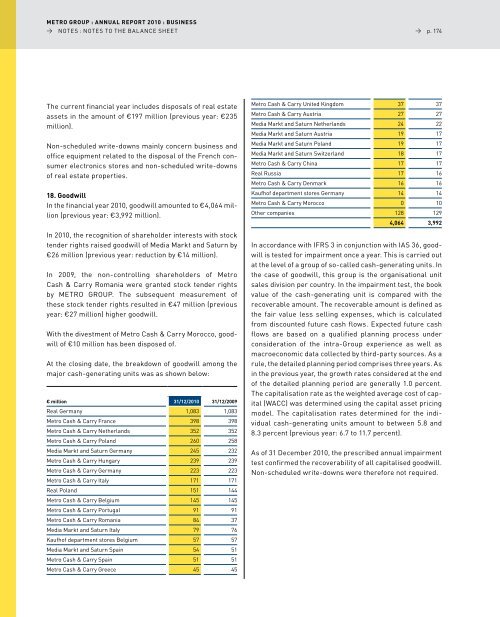

At the closing date, the breakdown of goodwill among the<br />

major cash-generating units was as shown below:<br />

€ million 31/12/2010 31/12/2009<br />

Real Germany 1,083 1,083<br />

Metro Cash & Carry france 398 398<br />

Metro Cash & Carry Netherlands 352 352<br />

Metro Cash & Carry Poland 260 258<br />

Media Markt and Saturn Germany 245 232<br />

Metro Cash & Carry hungary 239 239<br />

Metro Cash & Carry Germany 223 223<br />

Metro Cash & Carry Italy 171 171<br />

Real Poland 151 144<br />

Metro Cash & Carry Belgium 145 145<br />

Metro Cash & Carry Portugal 91 91<br />

Metro Cash & Carry Romania 84 37<br />

Media Markt and Saturn Italy 79 76<br />

Kaufhof department stores Belgium 57 57<br />

Media Markt and Saturn Spain 54 51<br />

Metro Cash & Carry Spain 51 51<br />

Metro Cash & Carry Greece 45 45<br />

→ p. 174<br />

Metro Cash & Carry united Kingdom 37 37<br />

Metro Cash & Carry Austria 27 27<br />

Media Markt and Saturn Netherlands 24 22<br />

Media Markt and Saturn Austria 19 17<br />

Media Markt and Saturn Poland 19 17<br />

Media Markt and Saturn Switzerland 18 17<br />

Metro Cash & Carry China 17 17<br />

Real Russia 17 16<br />

Metro Cash & Carry denmark 16 16<br />

Kaufhof department stores Germany 14 14<br />

Metro Cash & Carry Morocco 0 10<br />

Other companies 128 129<br />

4,064 3,992<br />

In accordance with IfRS 3 in conjunction with IAS 36, goodwill<br />

is tested for impairment once a year. This is carried out<br />

at the level of a group of so-called cash-generating units. In<br />

the case of goodwill, this group is the organisational unit<br />

sales division per country. In the impairment test, the book<br />

value of the cash-generating unit is compared with the<br />

recoverable amount. The recoverable amount is defined as<br />

the fair value less selling expenses, which is calculated<br />

from discounted future cash flows. Expected future cash<br />

flows are based on a qualified planning process under<br />

consideration of the intra-<strong>Group</strong> experience as well as<br />

macroeconomic data collected by third-party sources. As a<br />

rule, the detailed planning period comprises three years. As<br />

in the previous year, the growth rates considered at the end<br />

of the detailed planning period are generally 1.0 percent.<br />

The capitalisation rate as the weighted average cost of capital<br />

(WACC) was determined using the capital asset pricing<br />

model. The capitalisation rates determined for the individual<br />

cash-generating units amount to between 5.8 and<br />

8.3 percent (previous year: 6.7 to 11.7 percent).<br />

As of 31 december 2010, the prescribed annual impairment<br />

test confirmed the recoverability of all capitalised goodwill.<br />

Non-scheduled write-downs were therefore not required.