Airport Master Plan 2012 - City of Waterville

Airport Master Plan 2012 - City of Waterville

Airport Master Plan 2012 - City of Waterville

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

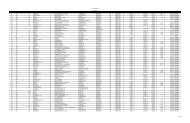

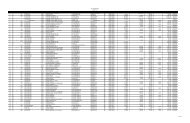

8.7 Summary <strong>of</strong> <strong>Airport</strong> Financial Assessment<br />

The five year financial history <strong>of</strong> the <strong>Airport</strong> reveals that FBO expenses averaged $284,670 while FBO<br />

revenues averaged $285,260. This results in an annual average FBO pr<strong>of</strong>it <strong>of</strong> $590 between 2006 and<br />

2010. For the same five years, maintenance expenses averaged approximately $88,000 per year while<br />

maintenance revenues averaged approximately $8,000 per year. This indicates that maintenance activities<br />

have been operating at an average loss <strong>of</strong> nearly $80,000 annually. Unfortunately FBO revenue has<br />

steadily decreased each year since 2007. Another disturbing trend in the overall pr<strong>of</strong>it and loss shows an<br />

increasing (doubling) deficit over the last three years since 2008. The Strategic Recommendations section<br />

<strong>of</strong> this chapter looks to provide options for the <strong>Airport</strong> to secure long term positive revenues while<br />

reducing current airport expenses.<br />

8.8 Strategic Recommendations<br />

There are various items that can improve an <strong>Airport</strong>’s ability to generate increased revenue such as new<br />

development, new tenants, additional airport services and amenities, and/or a modification to existing<br />

rates and charges. However, just as revenues can change over any given time, expenses can change as<br />

well. Unexpected expenses associated with airfield maintenance, as well as airport owned buildings and<br />

equipment, as well as the departure or failure <strong>of</strong> an existing on-airport business can significantly affect<br />

annual budgets.<br />

It is important to note that an <strong>Airport</strong> <strong>Master</strong> <strong>Plan</strong>, including the study <strong>of</strong> its financials, is based upon<br />

recent history, and current conditions. Therefore, the FAA suggests completing an update to the <strong>Master</strong><br />

<strong>Plan</strong> every 5 to 10 years, or if the characteristics <strong>of</strong> the facility changes. Regularly updating the <strong>Airport</strong>’s<br />

<strong>Master</strong> <strong>Plan</strong> will enable the <strong>City</strong> to develop a successful roadmap into the future while tracking the<br />

<strong>Airport</strong>’s performance <strong>of</strong> the past.<br />

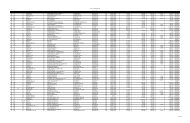

The following strategic recommendations for WVL are based upon the historical financial data provided<br />

by the <strong>City</strong> and are both quantitative and qualitative in nature. They include:<br />

1) Maintenance and Rehabilitation <strong>of</strong> <strong>Airport</strong> Infrastructure. Without improvements to the runway<br />

infrastructure, activity levels will not increase. Further, the <strong>Airport</strong> runs the risk <strong>of</strong> losing based<br />

aircraft as well as the potential additional liability <strong>of</strong> high speed aircraft operating on poorly rated<br />

airfield pavements. Maintenance and reconstruction <strong>of</strong> the runway infrastructure is a key component<br />

to being able to attract an FBO as well as attract additional based aircraft tenants/hangar development<br />

opportunities.<br />

When based aircraft tenants choose to keep their aircraft at an airport, they do this based on the<br />

infrastructure (i.e. runways, services, navaids, etc.) available at the facility and in turn pay the <strong>Airport</strong><br />

a fee to do so through leases and fuel sales. The expectation is that the <strong>Airport</strong> utilizes those fees to<br />

maintain and improve the facility accordingly.<br />

The following is one scenario <strong>of</strong> just one component <strong>of</strong> <strong>Airport</strong> revenues paying back a capital<br />

improvement. While not all encompassing <strong>of</strong> the capital program or airport revenues, the<br />

Reconstruction <strong>of</strong> Runway 14-32 is a good example <strong>of</strong> return on investment. At a total reconstruction<br />

cost <strong>of</strong> $811,000 the <strong>City</strong>’s share at 5% is $40,550. Assuming $5,000 <strong>of</strong> the existing rental/land lease<br />

income annually, the <strong>City</strong>’s share is returned in just 8 years.<br />

Infrastructure improvements are the most prudent investment the <strong>City</strong> can undertake to make the<br />

<strong>Airport</strong> more attractive. And considering that every $0.05 the <strong>City</strong> spends in capital improvements<br />

attracts $0.95 from the federal (FAA) and state (Maine DOT) makes this a wise investment.<br />

The <strong>City</strong> <strong>of</strong> <strong>Waterville</strong> Maine<br />

Implementation and Financial <strong>Plan</strong> – Page 8-16<br />

<strong>Airport</strong> Solutions Group, LLC & The Louis Berger Group, Inc. December 2011