A comparative analysis of the US and EU retail banking markets - Wsbi

A comparative analysis of the US and EU retail banking markets - Wsbi

A comparative analysis of the US and EU retail banking markets - Wsbi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

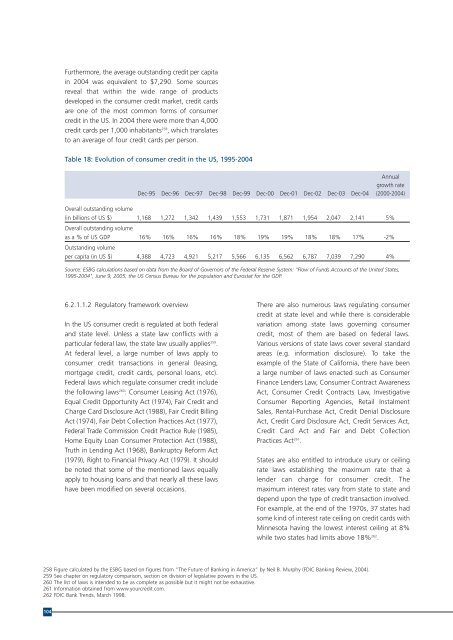

Fur<strong>the</strong>rmore, <strong>the</strong> average outst<strong>and</strong>ing credit per capita<br />

in 2004 was equivalent to $7,290. Some sources<br />

reveal that within <strong>the</strong> wide range <strong>of</strong> products<br />

developed in <strong>the</strong> consumer credit market, credit cards<br />

are one <strong>of</strong> <strong>the</strong> most common forms <strong>of</strong> consumer<br />

credit in <strong>the</strong> <strong>US</strong>. In 2004 <strong>the</strong>re were more than 4,000<br />

credit cards per 1,000 inhabitants 258 , which translates<br />

to an average <strong>of</strong> four credit cards per person.<br />

Table 18: Evolution <strong>of</strong> consumer credit in <strong>the</strong> <strong>US</strong>, 1995-2004<br />

Annual<br />

growth rate<br />

Dec-95 Dec-96 Dec-97 Dec-98 Dec-99 Dec-00 Dec-01 Dec-02 Dec-03 Dec-04 (2000-2004)<br />

Overall outst<strong>and</strong>ing volume<br />

(in billions <strong>of</strong> <strong>US</strong> $) 1,168 1,272 1,342 1,439 1,553 1,731 1,871 1,954 2,047 2,141 5%<br />

Overall outst<strong>and</strong>ing volume<br />

as a % <strong>of</strong> <strong>US</strong> GDP 16% 16% 16% 16% 18% 19% 19% 18% 18% 17% -2%<br />

Outst<strong>and</strong>ing volume<br />

per capita (in <strong>US</strong> $) 4,388 4,723 4,921 5,217 5,566 6,135 6,562 6,787 7,039 7,290 4%<br />

Source: ESBG calculations based on data from <strong>the</strong> Board <strong>of</strong> Governors <strong>of</strong> <strong>the</strong> Federal Reserve System: "Flow <strong>of</strong> Funds Accounts <strong>of</strong> <strong>the</strong> United States,<br />

1995-2004", June 9, 2005, <strong>the</strong> <strong>US</strong> Census Bureau for <strong>the</strong> population <strong>and</strong> Eurostat for <strong>the</strong> GDP.<br />

6.2.1.1.2 Regulatory framework overview<br />

In <strong>the</strong> <strong>US</strong> consumer credit is regulated at both federal<br />

<strong>and</strong> state level. Unless a state law conflicts with a<br />

particular federal law, <strong>the</strong> state law usually applies 259 .<br />

At federal level, a large number <strong>of</strong> laws apply to<br />

consumer credit transactions in general (leasing,<br />

mortgage credit, credit cards, personal loans, etc).<br />

Federal laws which regulate consumer credit include<br />

<strong>the</strong> following laws 260 : Consumer Leasing Act (1976),<br />

Equal Credit Opportunity Act (1974), Fair Credit <strong>and</strong><br />

Charge Card Disclosure Act (1988), Fair Credit Billing<br />

Act (1974), Fair Debt Collection Practices Act (1977),<br />

Federal Trade Commission Credit Practice Rule (1985),<br />

Home Equity Loan Consumer Protection Act (1988),<br />

Truth in Lending Act (1968), Bankruptcy Reform Act<br />

(1979), Right to Financial Privacy Act (1979). It should<br />

be noted that some <strong>of</strong> <strong>the</strong> mentioned laws equally<br />

apply to housing loans <strong>and</strong> that nearly all <strong>the</strong>se laws<br />

have been modified on several occasions.<br />

There are also numerous laws regulating consumer<br />

credit at state level <strong>and</strong> while <strong>the</strong>re is considerable<br />

variation among state laws governing consumer<br />

credit, most <strong>of</strong> <strong>the</strong>m are based on federal laws.<br />

Various versions <strong>of</strong> state laws cover several st<strong>and</strong>ard<br />

areas (e.g. information disclosure). To take <strong>the</strong><br />

example <strong>of</strong> <strong>the</strong> State <strong>of</strong> California, <strong>the</strong>re have been<br />

a large number <strong>of</strong> laws enacted such as Consumer<br />

Finance Lenders Law, Consumer Contract Awareness<br />

Act, Consumer Credit Contracts Law, Investigative<br />

Consumer Reporting Agencies, Retail Instalment<br />

Sales, Rental-Purchase Act, Credit Denial Disclosure<br />

Act, Credit Card Disclosure Act, Credit Services Act,<br />

Credit Card Act <strong>and</strong> Fair <strong>and</strong> Debt Collection<br />

Practices Act 261 .<br />

States are also entitled to introduce usury or ceiling<br />

rate laws establishing <strong>the</strong> maximum rate that a<br />

lender can charge for consumer credit. The<br />

maximum interest rates vary from state to state <strong>and</strong><br />

depend upon <strong>the</strong> type <strong>of</strong> credit transaction involved.<br />

For example, at <strong>the</strong> end <strong>of</strong> <strong>the</strong> 1970s, 37 states had<br />

some kind <strong>of</strong> interest rate ceiling on credit cards with<br />

Minnesota having <strong>the</strong> lowest interest ceiling at 8%<br />

while two states had limits above 18% 262 .<br />

258 Figure calculated by <strong>the</strong> ESBG based on figures from “The Future <strong>of</strong> Banking in America” by Neil B. Murphy (FDIC Banking Review, 2004).<br />

259 See chapter on regulatory comparison, section on division <strong>of</strong> legislative powers in <strong>the</strong> <strong>US</strong>.<br />

260 The list <strong>of</strong> laws is intended to be as complete as possible but it might not be exhaustive.<br />

261 Information obtained from www.yourcredit.com.<br />

262 FDIC Bank Trends, March 1998.<br />

104