A comparative analysis of the US and EU retail banking markets - Wsbi

A comparative analysis of the US and EU retail banking markets - Wsbi

A comparative analysis of the US and EU retail banking markets - Wsbi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

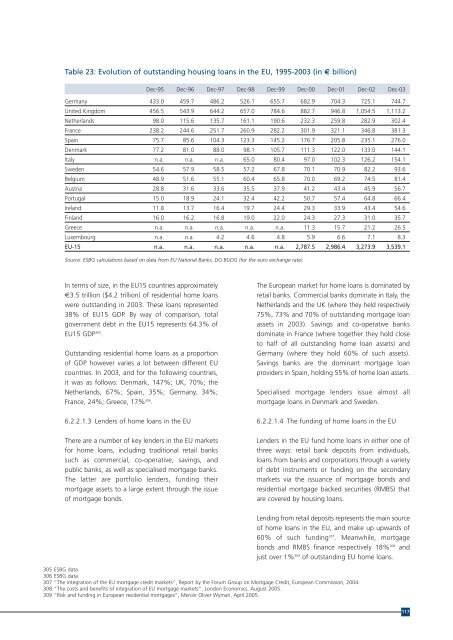

Table 23: Evolution <strong>of</strong> outst<strong>and</strong>ing housing loans in <strong>the</strong> <strong>EU</strong>, 1995-2003 (in € billion)<br />

Dec-95 Dec-96 Dec-97 Dec-98 Dec-99 Dec-00 Dec-01 Dec-02 Dec-03<br />

Germany 433.0 459.7 486.2 526.1 655.7 682.9 704.3 725.1 744.7<br />

United Kingdom 456.5 543.9 644.2 657.0 784.6 882.7 946.8 1,054.5 1,113.2<br />

Ne<strong>the</strong>rl<strong>and</strong>s 98.0 115.6 135.7 161.1 190.6 232.3 259.8 282.9 302.4<br />

France 238.2 244.6 251.7 260.9 282.2 301.9 321.1 346.8 381.3<br />

Spain 75.7 85.6 104.3 123.3 145.2 176.7 205.8 235.1 276.0<br />

Denmark 77.2 81.0 88.0 98.1 105.7 111.3 122.0 133.0 144.1<br />

Italy n.a. n.a. n.a. 65.0 80.4 97.0 102.3 126.2 154.1<br />

Sweden 54.6 57.9 58.5 57.2 67.8 70.1 70.9 82.2 93.6<br />

Belgium 48.9 51.6 55.1 60.4 65.8 70.0 69.2 74.5 81.4<br />

Austria 28.8 31.6 33.6 35.5 37.9 41.2 43.4 45.9 56.7<br />

Portugal 15.0 18.9 24.1 32.4 42.2 50.7 57.4 64.8 66.4<br />

Irel<strong>and</strong> 11.8 13.7 16.4 19.7 24.4 29.3 33.9 43.4 54.6<br />

Finl<strong>and</strong> 16.0 16.2 16.8 19.0 22.0 24.3 27.3 31.0 35.7<br />

Greece n.a. n.a. n.a. n.a. n.a. 11.3 15.7 21.2 26.5<br />

Luxembourg n.a. n.a. 4.2 4.6 4.8 5.9 6.6 7.1 8.3<br />

<strong>EU</strong>-15 n.a. n.a. n.a. n.a. n.a. 2,787.5 2,986.4 3,273.9 3,539.1<br />

Source: ESBG calculations based on data from <strong>EU</strong> National Banks, DG BUDG (for <strong>the</strong> euro exchange rate).<br />

In terms <strong>of</strong> size, in <strong>the</strong> <strong>EU</strong>15 countries approximately<br />

€3.5 trillion ($4.2 trillion) <strong>of</strong> residential home loans<br />

were outst<strong>and</strong>ing in 2003. These loans represented<br />

38% <strong>of</strong> <strong>EU</strong>15 GDP. By way <strong>of</strong> comparison, total<br />

government debt in <strong>the</strong> <strong>EU</strong>15 represents 64.3% <strong>of</strong><br />

<strong>EU</strong>15 GDP 305 .<br />

Outst<strong>and</strong>ing residential home loans as a proportion<br />

<strong>of</strong> GDP however varies a lot between different <strong>EU</strong><br />

countries. In 2003, <strong>and</strong> for <strong>the</strong> following countries,<br />

it was as follows: Denmark, 147%; UK, 70%; <strong>the</strong><br />

Ne<strong>the</strong>rl<strong>and</strong>s, 67%; Spain, 35%; Germany, 34%;<br />

France, 24%; Greece, 17% 306 .<br />

6.2.2.1.3 Lenders <strong>of</strong> home loans in <strong>the</strong> <strong>EU</strong><br />

There are a number <strong>of</strong> key lenders in <strong>the</strong> <strong>EU</strong> <strong>markets</strong><br />

for home loans, including traditional <strong>retail</strong> banks<br />

such as commercial, co-operative, savings, <strong>and</strong><br />

public banks, as well as specialised mortgage banks.<br />

The latter are portfolio lenders, funding <strong>the</strong>ir<br />

mortgage assets to a large extent through <strong>the</strong> issue<br />

<strong>of</strong> mortgage bonds.<br />

The European market for home loans is dominated by<br />

<strong>retail</strong> banks. Commercial banks dominate in Italy, <strong>the</strong><br />

Ne<strong>the</strong>rl<strong>and</strong>s <strong>and</strong> <strong>the</strong> UK (where <strong>the</strong>y held respectively<br />

75%, 73% <strong>and</strong> 70% <strong>of</strong> outst<strong>and</strong>ing mortgage loan<br />

assets in 2003). Savings <strong>and</strong> co-operative banks<br />

dominate in France (where toge<strong>the</strong>r <strong>the</strong>y hold close<br />

to half <strong>of</strong> all outst<strong>and</strong>ing home loan assets) <strong>and</strong><br />

Germany (where <strong>the</strong>y hold 60% <strong>of</strong> such assets).<br />

Savings banks are <strong>the</strong> dominant mortgage loan<br />

providers in Spain, holding 55% <strong>of</strong> home loan assets.<br />

Specialised mortgage lenders issue almost all<br />

mortgage loans in Denmark <strong>and</strong> Sweden.<br />

6.2.2.1.4 The funding <strong>of</strong> home loans in <strong>the</strong> <strong>EU</strong><br />

Lenders in <strong>the</strong> <strong>EU</strong> fund home loans in ei<strong>the</strong>r one <strong>of</strong><br />

three ways: <strong>retail</strong> bank deposits from individuals,<br />

loans from banks <strong>and</strong> corporations through a variety<br />

<strong>of</strong> debt instruments or funding on <strong>the</strong> secondary<br />

<strong>markets</strong> via <strong>the</strong> issuance <strong>of</strong> mortgage bonds <strong>and</strong><br />

residential mortgage backed securities (RMBS) that<br />

are covered by housing loans.<br />

Lending from <strong>retail</strong> deposits represents <strong>the</strong> main source<br />

<strong>of</strong> home loans in <strong>the</strong> <strong>EU</strong>, <strong>and</strong> make up upwards <strong>of</strong><br />

60% <strong>of</strong> such funding 307 . Meanwhile, mortgage<br />

bonds <strong>and</strong> RMBS finance respectively 18% 308 <strong>and</strong><br />

just over 1% 309 <strong>of</strong> outst<strong>and</strong>ing <strong>EU</strong> home loans.<br />

305 ESBG data.<br />

306 ESBG data.<br />

307 “The integration <strong>of</strong> <strong>the</strong> <strong>EU</strong> mortgage credit <strong>markets</strong>”, Report by <strong>the</strong> Forum Group on Mortgage Credit, European Commission, 2004.<br />

308 “The costs <strong>and</strong> benefits <strong>of</strong> integration <strong>of</strong> <strong>EU</strong> mortgage <strong>markets</strong>”, London Economics, August 2005.<br />

309 “Risk <strong>and</strong> funding in European residential mortgages”, Mercer Oliver Wyman, April 2005.<br />

117