A comparative analysis of the US and EU retail banking markets - Wsbi

A comparative analysis of the US and EU retail banking markets - Wsbi

A comparative analysis of the US and EU retail banking markets - Wsbi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5.3.1.1.2 Bank assets<br />

Looking at graph 9, it can be seen that loans <strong>and</strong><br />

leases have consistently represented more than half<br />

<strong>of</strong> <strong>the</strong> assets <strong>of</strong> FDIC-insured credit institutions over<br />

<strong>the</strong> years, <strong>and</strong> this proportion has remained steady<br />

throughout. Apart from ‘o<strong>the</strong>r assets’, no significant<br />

change in proportion <strong>of</strong> total assets can be observed<br />

for any <strong>of</strong> <strong>the</strong> different asset classes (figures for<br />

graph 9 can be found in table J <strong>of</strong> <strong>the</strong> table annex).<br />

In terms <strong>of</strong> bank loans to <strong>the</strong> private sector as a<br />

proportion <strong>of</strong> GDP, it can be seen in Table 11 that<br />

in 1980, <strong>the</strong>se represented 35% <strong>of</strong> GDP, while <strong>the</strong><br />

equivalent proportion in 2000 was <strong>of</strong> <strong>the</strong> order <strong>of</strong> 49%.<br />

5.3.1.1.3 Loan composition<br />

As can be seen in graph 10 opposite, lending to<br />

households in 2004 represented more than<br />

two/thirds <strong>of</strong> all lending to <strong>the</strong> private sector, while<br />

<strong>the</strong> remainder <strong>of</strong> lending to <strong>the</strong> private sector was<br />

loans to business. Of lending to households, 88%<br />

was home lending (representing 62% <strong>of</strong> total<br />

lending to <strong>the</strong> private sector), <strong>and</strong> 9% was consumer<br />

lending (representing 6% <strong>of</strong> total lending to <strong>the</strong><br />

private sector). Note that <strong>the</strong>se figures include all<br />

private sector lending, <strong>and</strong> <strong>the</strong>refore not just lending<br />

by credit institutions (figures relating to graph 10 can<br />

be found in <strong>the</strong> table annex in table K).<br />

100%<br />

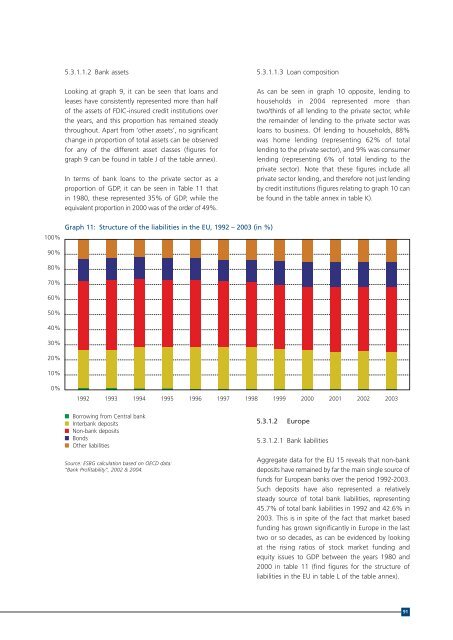

Graph 11: Structure <strong>of</strong> <strong>the</strong> liabilities in <strong>the</strong> <strong>EU</strong>, 1992 – 2003 (in %)<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003<br />

■ Borrowing from Central bank<br />

■ Interbank deposits<br />

■ Non-bank deposits<br />

■ Bonds<br />

■ O<strong>the</strong>r liabilities<br />

Source: ESBG calculation based on OECD data:<br />

“Bank Pr<strong>of</strong>itability”, 2002 & 2004.<br />

5.3.1.2 Europe<br />

5.3.1.2.1 Bank liabilities<br />

Aggregate data for <strong>the</strong> <strong>EU</strong> 15 reveals that non-bank<br />

deposits have remained by far <strong>the</strong> main single source <strong>of</strong><br />

funds for European banks over <strong>the</strong> period 1992-2003.<br />

Such deposits have also represented a relatively<br />

steady source <strong>of</strong> total bank liabilities, representing<br />

45.7% <strong>of</strong> total bank liabilities in 1992 <strong>and</strong> 42.6% in<br />

2003. This is in spite <strong>of</strong> <strong>the</strong> fact that market based<br />

funding has grown significantly in Europe in <strong>the</strong> last<br />

two or so decades, as can be evidenced by looking<br />

at <strong>the</strong> rising ratios <strong>of</strong> stock market funding <strong>and</strong><br />

equity issues to GDP between <strong>the</strong> years 1980 <strong>and</strong><br />

2000 in table 11 (find figures for <strong>the</strong> structure <strong>of</strong><br />

liabilities in <strong>the</strong> <strong>EU</strong> in table L <strong>of</strong> <strong>the</strong> table annex).<br />

91