Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

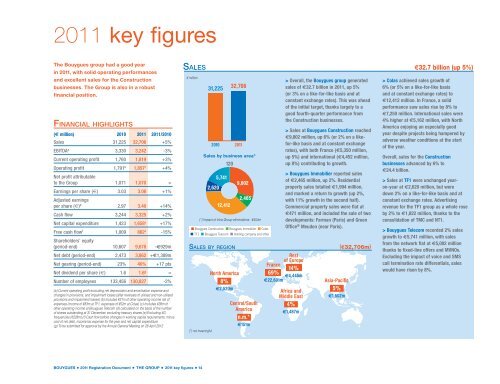

2011 key figures<br />

The Bouygues group had a good year<br />

in 2011, with solid operating performances<br />

and excellent sales for the Construction<br />

businesses. The Group is also in a robust<br />

financial position.<br />

financial hiGhliGhtS<br />

(€ million) 2010 2011 2011/2010<br />

Sales 31,225 32,706 +5%<br />

EBITDA a 3,330 3,242 -3%<br />

Current operating profit 1,760 1,819 +3%<br />

Operating profit 1,791 b 1,857 c +4%<br />

Net profit attributable<br />

to the Group 1,071 1,070 =<br />

Earnings per share (€) 3.03 3.06 +1%<br />

Adjusted earnings<br />

per share (€) d 2.97 3.40 +14%<br />

Cash flow 3,244 3,325 +2%<br />

Net capital expenditure 1,423 1,658 e +17%<br />

Free cash flow f 1,009 862 e -15%<br />

Shareholders’ equity<br />

(period-end) 10,607 9,678 -€929m<br />

Net debt (period-end) 2,473 3,862 +€1,389m<br />

Net gearing (period-end) 23% 40% +17 pts<br />

Net dividend per share (€) 1.6 1.6 g =<br />

Number of employees 133,456 130,827 -2%<br />

(a) Current operating profit excluding net depreciation and amortisation expense and<br />

changes in provisions, and impairment losses (after reversals of utilised and non-utilised<br />

provisions and impairment losses) (b) Includes €31m of other operating income net of<br />

expenses (income of €83m at TF1, expenses of €52m at Colas) (c) Includes €38m of<br />

other operating income at Bouygues Telecom (d) calculated on the basis of the number<br />

of shares outstanding at 31 December, excluding treasury shares (e) Excluding 4G<br />

frequencies (€228m) (f) Cash flow before changes in working capital requirements, minus<br />

cost of net debt, income tax expense for the year and net capital expenditure<br />

(g) To be submitted for approval by the Annual General Meeting on 26 April 2012<br />

SaleS e32.7 billion (up 5%)<br />

€ million<br />

(*) not meaningful<br />

31,225<br />

2010<br />

32,706<br />

2011<br />

Sales by business area*<br />

120<br />

2,620<br />

5,741<br />

12,412<br />

North America<br />

8%<br />

e2,520m<br />

9,802<br />

2,465<br />

(*) Impact of intra-Group eliminations: -€454m<br />

n Bouygues Construction n Bouygues Immobilier n Colas<br />

n TF1 n Bouygues Telecom n Holding company and other<br />

SaleS by reGion<br />

Central/South<br />

America<br />

n.m.*<br />

e151m<br />

Rest<br />

of Europe<br />

France<br />

14%<br />

69%<br />

e4,445m<br />

e22,601m<br />

> Overall, the Bouygues group generated<br />

sales of €32.7 billion in 2011, up 5%<br />

(or 3% on a like-for-like basis and at<br />

constant exchange rates). This was ahead<br />

of the initial target, thanks largely to a<br />

good fourth-quarter performance from<br />

the Construction businesses.<br />

> Sales at Bouygues Construction reached<br />

€9,802 million, up 6% (or 2% on a likefor-like<br />

basis and at constant exchange<br />

rates), with both France (€5,350 million,<br />

up 5%) and international (€4,452 million,<br />

up 8%) contributing to growth.<br />

> Bouygues Immobilier reported sales<br />

of €2,465 million, up 2%. Residential<br />

property sales totalled €1,994 million,<br />

and marked a return to growth (up 2%,<br />

with 11% growth in the second half).<br />

Commercial property sales were flat at<br />

€471 million, and included the sale of two<br />

developments: Farman (Paris) and Green<br />

Office ® Meudon (near Paris).<br />

Africa and<br />

Middle East<br />

4%<br />

e1,487m<br />

Asia-Pacific<br />

5%<br />

e1,502m<br />

(e32,706m)<br />

> Colas achieved sales growth of<br />

6% (or 5% on a like-for-like basis<br />

and at constant exchange rates) to<br />

€12,412 million. In France, a solid<br />

performance saw sales rise by 8% to<br />

€7,250 million. International sales were<br />

4% higher at €5,162 million, with North<br />

America enjoying an especially good<br />

year despite projects being hampered by<br />

adverse weather conditions at the start<br />

of the year.<br />

Overall, sales for the Construction<br />

businesses advanced by 6% to<br />

€24.4 billion.<br />

> Sales at TF1 were unchanged yearon-year<br />

at €2,620 million, but were<br />

down 2% on a like-for-like basis and at<br />

constant exchange rates. Advertising<br />

revenue for the TF1 group as a whole rose<br />

by 2% to €1,822 million, thanks to the<br />

consolidation of TMC and NT1.<br />

> Bouygues Telecom recorded 2% sales<br />

growth to €5,741 million, with sales<br />

from the network flat at €5,082 million<br />

thanks to fixed-line offers and MVNOs.<br />

Excluding the impact of voice and SMS<br />

call termination rate differentials, sales<br />

would have risen by 8%.<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • THE GROUP • 2011 key figures • 14