Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

International<br />

France<br />

11.7<br />

5.0<br />

6.7<br />

2010<br />

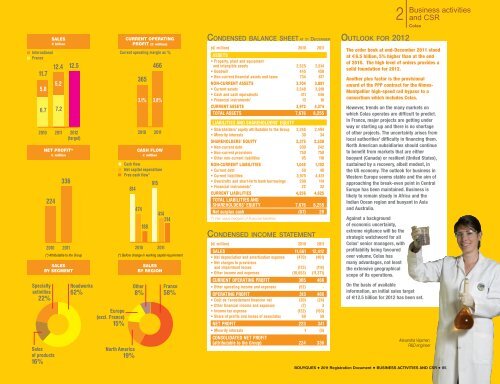

SALES<br />

€ billion<br />

12.4<br />

5.2<br />

7.2<br />

2011<br />

NET PROFIT*<br />

€ million<br />

224<br />

2010<br />

Specialty<br />

activities<br />

22%<br />

336<br />

2011<br />

12.5<br />

2012<br />

(target)<br />

(*) Attributable to the Group<br />

SALES<br />

BY SEGMENT<br />

Sales<br />

of products<br />

16%<br />

Roadworks<br />

62%<br />

Europe<br />

(excl. France)<br />

15%<br />

CURRENT OPERATING<br />

PROFIT (€ million)<br />

Current operating margin as %<br />

814<br />

365<br />

2010<br />

466<br />

3.1% 3.8%<br />

2011<br />

CASH FLOW<br />

€ million<br />

Cash flow<br />

Net capital expenditure<br />

Free cash flow*<br />

474<br />

188<br />

915<br />

2010 2011<br />

(*) Before change in working capital requirement<br />

North America<br />

19%<br />

SALES<br />

BY REGION<br />

Other<br />

8%<br />

414<br />

314<br />

France<br />

58%<br />

Condensed inCome sTaTemenT<br />

2<br />

Condensed balanCe sHeeT aT 31 deCember ouTlooK for 2012<br />

(e million) 2010 2011<br />

ASSETS<br />

• Property, plant and equipment<br />

and intangible assets 2,525 2,614<br />

• Goodwill 445 450<br />

• Non-current financial assets and taxes 734 817<br />

NON-CURRENT ASSETS 3,704 3,881<br />

• Current assets 3,548 3,910<br />

• Cash and cash equivalents 411 446<br />

• Financial instruments* 13 18<br />

CURRENT ASSETS 3,972 4,374<br />

TOTAL ASSETS 7,676 8,255<br />

LIABILITIES AND SHAREHOLDERS' EQUITY<br />

• Shareholders' equity attributable to the Group 2,345 2,494<br />

• Minority interests 30 34<br />

SHAREHOLDERS' EQUITY 2,375 2,528<br />

• Non-current debt 200 242<br />

• Non-current provisions 750 750<br />

• Other non-current liabilities 95 110<br />

NON-CURRENT LIABILITIES 1,045 1,102<br />

• Current debt 50 48<br />

• Current liabilities 3,975 4,431<br />

• Overdrafts and short-term bank borrowings 209 114<br />

• Financial instruments* 22 32<br />

CURRENT LIABILITIES 4,256 4,625<br />

TOTAL LIABILITIES AND<br />

SHAREHOLDERS' EQUITY 7,676 8,255<br />

Net surplus cash (57) 28<br />

(*) Fair value hedges of financial liabilities<br />

(e million) 2010 2011<br />

SALES 11,661 12,412<br />

• Net depreciation and amortisation expense (470) (461)<br />

• Net charges to provisions<br />

and impairment losses (173) (114)<br />

• Other income and expenses (10,653) (11,371)<br />

CURRENT OPERATING PROFIT 365 466<br />

• Other operating income and expenses (52) -<br />

OPERATING PROFIT 313 466<br />

• Coût de l'endettement financier net (30) (24)<br />

• Other financial income and expenses (7) 3<br />

• Income tax expense (122) (163)<br />

• Share of profits and losses of associates 69 59<br />

NET PROFIT 223 341<br />

• Minority interests 1 (5)<br />

CONSOLIDATED NET PROFIT<br />

(attributable to the Group) 224 336<br />

Business activities<br />

and CSR<br />

Colas<br />

The order book at end-December 2011 stood<br />

at €6.5 billion, 5% higher than at the end<br />

of 2010. The high level of orders provides a<br />

solid foundation for 2012.<br />

Another plus factor is the provisional<br />

award of the PPP contract for the Nimes-<br />

Montpellier high-speed rail bypass to a<br />

consortium which includes Colas.<br />

However, trends on the many markets on<br />

which Colas operates are difficult to predict.<br />

In France, major projects are getting under<br />

way or starting up and there is no shortage<br />

of other projects. The uncertainty arises from<br />

local authorities' difficulty in financing them.<br />

North American subsidiaries should continue<br />

to benefit from markets that are either<br />

buoyant (Canada) or resilient (United States),<br />

sustained by a recovery, albeit modest, in<br />

the US economy. The outlook for business in<br />

Western Europe seems stable and the aim of<br />

approaching the break-even point in Central<br />

Europe has been maintained. Business is<br />

likely to remain steady in Africa and the<br />

Indian Ocean region and buoyant in Asia<br />

and Australia.<br />

Against a background<br />

of economic uncertainty,<br />

extreme vigilance will be the<br />

strategic watchword for all<br />

Colas' senior managers, with<br />

profitability being favoured<br />

over volume. Colas has<br />

many advantages, not least<br />

the extensive geographical<br />

scope of its operations.<br />

On the basis of available<br />

information, an initial sales target<br />

of €12.5 billion for 2012 has been set.<br />

Alexandra Vajsman,<br />

R&D engineer<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • BUSINESS ACTIVITIES AND CSR • 85