Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

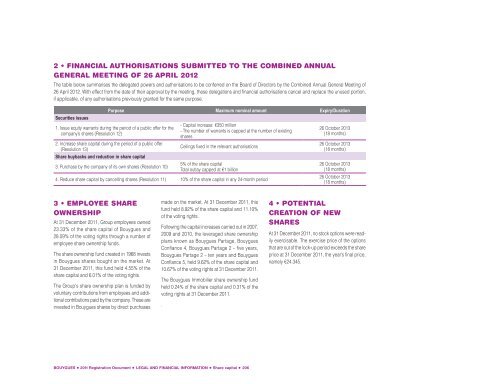

2 • FINANCIAL AUTHORISATIONS SUBMITTED TO THE COMBINED ANNUAL<br />

GENERAL MEETING OF 26 APRIL 2012<br />

The table below summarises the delegated powers and authorisations to be conferred on the Board of Directors by the Combined Annual General Meeting of<br />

26 April 2012. With effect from the date of their approval by the meeting, these delegations and financial authorisations cancel and replace the unused portion,<br />

if applicable, of any authorisations previously granted for the same purpose.<br />

Securities issues<br />

Purpose Maximum nominal amount Expiry/Duration<br />

1. Issue equity warrants during the period of a public offer for the<br />

company’s shares (Resolution 12)<br />

2. Increase share capital during the period of a public offer<br />

(Resolution 13)<br />

Share buybacks and reduction in share capital<br />

3. Purchase by the company of its own shares (Resolution 10)<br />

- Capital increase: €350 million<br />

- The number of warrants is capped at the number of existing<br />

shares<br />

Ceilings fixed in the relevant authorisations<br />

5% of the share capital<br />

Total outlay capped at €1 billion<br />

4. Reduce share capital by cancelling shares (Resolution 11) 10% of the share capital in any 24-month period<br />

26 October 2013<br />

(18 months)<br />

26 October 2013<br />

(18 months)<br />

26 October 2013<br />

(18 months)<br />

26 October 2013<br />

(18 months)<br />

3 • EMPLOYEE SHARE<br />

OWNERSHIP<br />

At 31 December 2011, Group employees owned<br />

23.33% of the share capital of Bouygues and<br />

28.09% of the voting rights through a number of<br />

employee share ownership funds.<br />

The share ownership fund created in 1968 invests<br />

in Bouygues shares bought on the market. At<br />

31 December 2011, this fund held 4.55% of the<br />

share capital and 6.01% of the voting rights.<br />

The Group's share ownership plan is funded by<br />

voluntary contributions from employees and additional<br />

contributions paid by the company. These are<br />

invested in Bouygues shares by direct purchases<br />

made on the market. At 31 December 2011, this<br />

fund held 8.92% of the share capital and 11.10%<br />

of the voting rights.<br />

Following the capital increases carried out in 2007,<br />

2009 and 2010, the leveraged share ownership<br />

plans known as Bouygues Partage, Bouygues<br />

Confiance 4, Bouygues Partage 2 – five years,<br />

Bouygues Partage 2 – ten years and Bouygues<br />

Confiance 5, held 9.62% of the share capital and<br />

10.67% of the voting rights at 31 December 2011.<br />

The Bouygues Immobilier share ownership fund<br />

held 0.24% of the share capital and 0.31% of the<br />

voting rights at 31 December 2011.<br />

.<br />

4 • POTENTIAL<br />

CREATION OF NEW<br />

SHARES<br />

At 31 December 2011, no stock options were readily<br />

exercisable. The exercise price of the options<br />

that are out of the lock-up period exceeds the share<br />

price at 31 December 2011, the year’s final price,<br />

namely €24.345.<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • LEGAL AND FINANCIAL INFORMATION • Share capital • 206