Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Remuneration of corporate officers<br />

and stock options granted to corporate officers and Group employees<br />

1 • REMUNERATION<br />

Report required by Articles L. 225-102-1 and<br />

L. 225-37 paragraph 9 of the Commercial Code.<br />

This chapter contains the reports required under<br />

the French Commercial Code. It also includes<br />

the tables required by the Afep/Medef Corporate<br />

Governance Code of December 2008 and by the<br />

AMF Recommendation of 22 December 2008 (as<br />

updated on 10 December 2009) on the information<br />

to be provided in registration documents concerning<br />

the remuneration of corporate officers.<br />

1.1 Principles and rules<br />

for determining the<br />

remuneration of executive<br />

directors<br />

In 2007, the Board took into account the Afep/<br />

Medef recommendations published in January<br />

2007 relating to the remuneration of executive<br />

directors of listed companies. Afep and Medef<br />

published a new set of recommendations on<br />

6 October 2008. The Board noted that virtually all<br />

these recommendations had already been implemented<br />

and adopted the remaining provisions in<br />

early 2009.<br />

1.1.1 Fixed remuneration and benefits<br />

in kind in FY2011<br />

The rules for determining fixed remuneration were<br />

decided in 1999 and have been applied consistently<br />

since then.<br />

Fixed remuneration takes account of the level and<br />

difficulty of the individual’s responsibilities, job<br />

experience, and length of service in the Group<br />

and also the wage policy of groups or companies<br />

in similar sectors.<br />

Benefits in kind involve use of a company car<br />

and, in the case of Martin Bouygues and Olivier<br />

Bouygues, the part-time assignment of an assistant<br />

and a chauffeur/security guard for their personal<br />

requirements.<br />

1.1.2 Variable remuneration in FY2011<br />

The rules for determining the variable portion<br />

of remuneration were also decided in 1999 and<br />

remained unchanged until February 2007, when<br />

the Board adjusted the calculation in light of the<br />

Afep/Medef recommendations. It then modified<br />

them again in 2010.<br />

Variable remuneration is awarded on an individual<br />

basis. The Board decides the criteria for<br />

the variable portion of each executive director’s<br />

remuneration and limits it to a percentage of the<br />

fixed remuneration. The percentage limit relative<br />

to the fixed remuneration also depends on the<br />

individual executive director.<br />

Variable remuneration is based on the performance<br />

of the Group, with performance being determined<br />

by reference to the following key economic indicators:<br />

> increase in current operating profit;<br />

> change in consolidated net profit (attributable<br />

to the Group) relative to the plan;<br />

> change in the consolidated net profit (attributable<br />

to the Group) compared with the preceding<br />

year;<br />

> free cash flow of Bouygues (before changes in<br />

working capital).<br />

These quantitative objectives have been calculated<br />

precisely but are not publicly disclosed for confidentiality<br />

reasons.<br />

Each criterion is used to determine part of the<br />

variable remuneration.<br />

In exceptional cases, upon the advice of the<br />

Remuneration Committee, the Board may award<br />

special bonuses.<br />

The existence of a capped additional retirement<br />

provision is taken into account when setting the<br />

overall remuneration of executive directors, as<br />

is the fact that they have received no severance<br />

compensation.<br />

1.1.3 Other information regarding<br />

remuneration<br />

Remuneration accruing to Martin Bouygues and<br />

Olivier Bouygues is paid by SCDM, which then<br />

invoices Bouygues pursuant to the agreement<br />

governing relations between Bouygues and<br />

SCDM, approved under the regulated agreements<br />

procedure.<br />

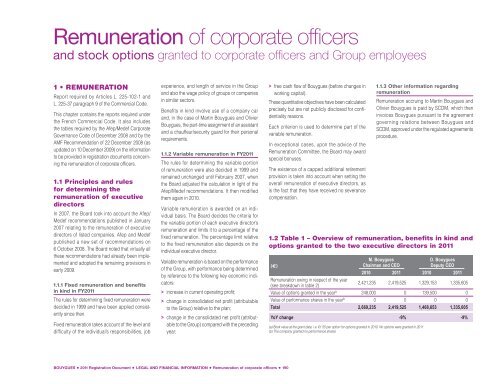

1.2 Table 1 – Overview of remuneration, benefits in kind and<br />

options granted to the two executive directors in 2011<br />

(e)<br />

M. Bouygues<br />

Chairman and CEO<br />

O. Bouygues<br />

Deputy CEO<br />

2010 2011 2010 2011<br />

Remuneration owing in respect of the year<br />

(see breakdown in table 2)<br />

2,421,235 2,419,525 1,329,153 1,335,605<br />

Value of options granted in the year a 248,000 0 139,500 0<br />

Value of performance shares in the year b 0 0 0 0<br />

Total 2,669,235 2,419,525 1,468,653 1,335,605<br />

YoY change -9% -9%<br />

(a) Book value at the grant date, i.e. €1.55 per option for options granted in 2010. No options were granted in 2011<br />

(b) The company granted no performance shares<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • LEGAL AND FINANCIAL INFORMATION • Remuneration of corporate officers • 190