Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

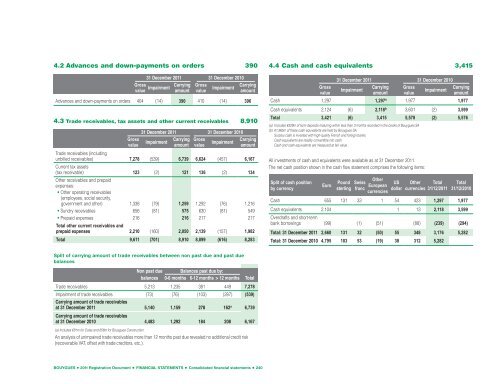

4.2 Advances and down-payments on orders 390<br />

31 December 2011 31 December 2010<br />

Gross<br />

value Impairment<br />

Carrying<br />

amount<br />

Gross<br />

value<br />

Impairment<br />

Carrying<br />

amount<br />

Advances and down-payments on orders 404 (14) 390 410 (14) 396<br />

4.3 Trade receivables, tax assets and other current receivables 8,910<br />

Gross<br />

value<br />

31 December 2011 31 December 2010<br />

Impairment<br />

Carrying<br />

amount<br />

Gross<br />

value<br />

Impairment<br />

Carrying<br />

amount<br />

Trade receivables (including<br />

unbilled receivables) 7,278 (539) 6,739 6,624 (457) 6,167<br />

Current tax assets<br />

(tax receivable) 123 (2) 121 136 (2) 134<br />

Other receivables and prepaid<br />

expenses:<br />

• Other operating receivables<br />

(employees, social security,<br />

government and other) 1,338 (79) 1,259 1,292 (76) 1,216<br />

• Sundry receivables 656 (81) 575 630 (81) 549<br />

• Prepaid expenses 216 216 217 217<br />

Total other current receivables and<br />

prepaid expenses 2,210 (160) 2,050 2,139 (157) 1,982<br />

Total 9,611 (701) 8,910 8,899 (616) 8,283<br />

4.4 Cash and cash equivalents 3,415<br />

Gross<br />

value<br />

31 December 2011 31 December 2010<br />

Impairment<br />

Carrying<br />

amount<br />

Gross<br />

value<br />

Impairment<br />

Carrying<br />

amount<br />

Cash 1,297 1,297 a 1,977 1,977<br />

Cash equivalents 2,124 (6) 2,118 b 3,601 (2) 3,599<br />

Total 3,421 (6) 3,415 5,578 (2) 5,576<br />

(a) Includes €329m of term deposits maturing within less than 3 months recorded in the books of Bouygues SA<br />

(b) €1,965m of these cash equivalents are held by Bouygues SA.<br />

Surplus cash is invested with high-quality French and foreign banks.<br />

Cash equivalents are readily convertible into cash.<br />

Cash and cash equivalents are measured at fair value.<br />

All investments of cash and equivalents were available as at 31 December 2011.<br />

The net cash position shown in the cash flow statement comprises the following items:<br />

Split of cash position<br />

by currency<br />

Euro<br />

Pound<br />

sterling<br />

Swiss<br />

franc<br />

Other<br />

European<br />

currencies<br />

US<br />

dollar<br />

Other<br />

currencies<br />

Total<br />

31/12/2011<br />

Total<br />

31/12/2010<br />

Cash 655 131 33 1 54 423 1,297 1,977<br />

Cash equivalents 2,104 1 13 2,118 3,599<br />

Overdrafts and short-term<br />

bank borrowings (99) (1) (51) (88) (239) (294)<br />

Total: 31 December 2011 2,660 131 32 (50) 55 348 3,176 5,282<br />

Total: 31 December 2010 4,795 103 53 (19) 38 312 5,282<br />

Split of carrying amount of trade receivables between non past due and past due<br />

balances<br />

Non past due Balances past due by:<br />

balances 0-6 months 6-12 months > 12 months Total<br />

Trade receivables 5,213 1,235 381 449 7,278<br />

Impairment of trade receivables (73) (76) (103) (287) (539)<br />

Carrying amount of trade receivables<br />

at 31 December 2011 5,140 1,159 278 162 a 6,739<br />

Carrying amount of trade receivables<br />

at 31 December 2010 4,483 1,292 184 208 6,167<br />

(a) Includes €81m for Colas and €56m for Bouygues Construction<br />

An analysis of unimpaired trade receivables more than 12 months past due revealed no additional credit risk<br />

(recoverable VAT, offset with trade creditors, etc.).<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • FINANCIAL STATEMENTS • Consolidated financial statements • 240