Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5<br />

Financial statements<br />

Consolidated financial statements<br />

2.7 Non-current assets<br />

2.7.1 Property, plant and equipment<br />

Property, plant and equipment is measured at acquisition cost net of accumulated depreciation and<br />

impairment. Depreciation is recognised on a straight line basis over the estimated useful life of the asset.<br />

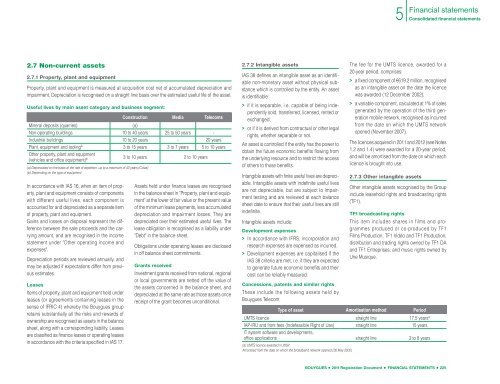

Useful lives by main asset category and business segment:<br />

Construction Media Telecoms<br />

Mineral deposits (quarries)<br />

(a)<br />

Non-operating buildings 10 to 40 years 25 to 50 years -<br />

Industrial buildings 10 to 20 years - 20 years<br />

Plant, equipment and tooling b 3 to 15 years 3 to 7 years 5 to 10 years<br />

Other property, plant and equipment<br />

(vehicles and office equipment) b 3 to 10 years 2 to 10 years<br />

(a) Depreciated on the basis of the rate of depletion, up to a maximum of 40 years (Colas)<br />

(b) Depending on the type of equipment<br />

In accordance with IAS 16, when an item of property,<br />

plant and equipment consists of components<br />

with different useful lives, each component is<br />

accounted for and depreciated as a separate item<br />

of property, plant and equipment.<br />

Gains and losses on disposal represent the difference<br />

between the sale proceeds and the carrying<br />

amount, and are recognised in the income<br />

statement under "Other operating income and<br />

expenses".<br />

Depreciation periods are reviewed annually, and<br />

may be adjusted if expectations differ from previous<br />

estimates.<br />

Leases<br />

Items of property, plant and equipment held under<br />

leases (or agreements containing leases in the<br />

sense of IFRIC 4) whereby the Bouygues group<br />

retains substantially all the risks and rewards of<br />

ownership are recognised as assets in the balance<br />

sheet, along with a corresponding liability. Leases<br />

are classified as finance leases or operating leases<br />

in accordance with the criteria specified in IAS 17.<br />

Assets held under finance leases are recognised<br />

in the balance sheet in "Property, plant and equipment"<br />

at the lower of fair value or the present value<br />

of the minimum lease payments, less accumulated<br />

depreciation and impairment losses. They are<br />

depreciated over their estimated useful lives. The<br />

lease obligation is recognised as a liability under<br />

"Debt" in the balance sheet.<br />

Obligations under operating leases are disclosed<br />

in off balance sheet commitments.<br />

Grants received<br />

Investment grants received from national, regional<br />

or local governments are netted off the value of<br />

the assets concerned in the balance sheet, and<br />

depreciated at the same rate as those assets once<br />

receipt of the grant becomes unconditional.<br />

2.7.2 Intangible assets<br />

IAS 38 defines an intangible asset as an identifiable<br />

non-monetary asset without physical substance<br />

which is controlled by the entity. An asset<br />

is identifiable:<br />

> if it is separable, i.e. capable of being independently<br />

sold, transferred, licensed, rented or<br />

exchanged;<br />

> or if it is derived from contractual or other legal<br />

rights, whether separable or not.<br />

An asset is controlled if the entity has the power to<br />

obtain the future economic benefits flowing from<br />

the underlying resource and to restrict the access<br />

of others to those benefits.<br />

Intangible assets with finite useful lives are depreciable.<br />

Intangible assets with indefinite useful lives<br />

are not depreciable, but are subject to impairment<br />

testing and are reviewed at each balance<br />

sheet date to ensure that their useful lives are still<br />

indefinite.<br />

Intangible assets include:<br />

Development expenses<br />

> In accordance with IFRS, incorporation and<br />

research expenses are expensed as incurred.<br />

> Development expenses are capitalised if the<br />

IAS 38 criteria are met, i.e. if they are expected<br />

to generate future economic benefits and their<br />

cost can be reliably measured.<br />

Concessions, patents and similar rights<br />

These include the following assets held by<br />

Bouygues Telecom:<br />

The fee for the UMTS licence, awarded for a<br />

20-year period, comprises:<br />

> a fixed component of €619.2 million, recognised<br />

as an intangible asset on the date the licence<br />

was awarded (12 December 2002);<br />

> a variable component, calculated at 1% of sales<br />

generated by the operation of the third generation<br />

mobile network, recognised as incurred<br />

from the date on which the UMTS network<br />

opened (November 2007).<br />

The licences acquired in 2011 and 2012 (see Notes<br />

1.2 and 1.4) were awarded for a 20-year period,<br />

and will be amortised from the date on which each<br />

licence is brought into use.<br />

2.7.3 Other intangible assets<br />

Other intangible assets recognised by the Group<br />

include leasehold rights and broadcasting rights<br />

(TF1).<br />

TF1 broadcasting rights<br />

This item includes shares in films and programmes<br />

produced or co-produced by TF1<br />

Films Production, TF1 Vidéo and TF1 Production;<br />

distribution and trading rights owned by TF1 DA<br />

and TF1 Entreprises; and music rights owned by<br />

Une Musique.<br />

Type of asset Amortisation method Period<br />

UMTS licence straight line 17.5 years a<br />

IAP-IRU and front fees (Indefeasible Right of Use) straight line 15 years<br />

IT system software and developments,<br />

office applications straight line 3 to 8 years<br />

(a) UMTS licence awarded in 2002:<br />

Amortised from the date on which the broadband network opened (26 May 2005)<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • FINANCIAL STATEMENTS • 225