Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

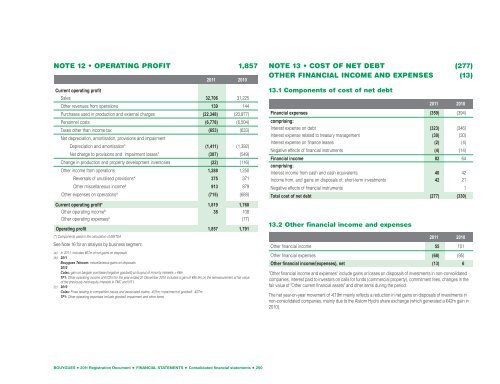

NOTE 12 • OPERATING PROFIT 1,857<br />

Current operating profit<br />

2011 2010<br />

Sales 32,706 31,225<br />

Other revenues from operations 139 144<br />

Purchases used in production and external charges (22,348) (20,977)<br />

Personnel costs (6,778) (6,504)<br />

Taxes other than income tax (653) (633)<br />

Net depreciation, amortisation, provisions and impairment<br />

Depreciation and amortisation* (1,411) (1,392)<br />

Net charge to provisions and impairment losses* (387) (549)<br />

Change in production and property development inventories (22) (116)<br />

Other income from operations 1,288 1,250<br />

Reversals of unutilised provisions* 375 371<br />

Other miscellaneous income a 913 879<br />

Other expenses on operations a (715) (688)<br />

Current operating profit* 1,819 1,760<br />

Other operating income b 38 108<br />

Other operating expenses c (77)<br />

Operating profit 1,857 1,791<br />

(*) Components used in the calculation of EBITDA<br />

See Note 16 for an analysis by business segment.<br />

(a) In 2011; includes €67m of net gains on disposals<br />

(b) 2011<br />

Bouygues Telecom: miscellaneous gains on disposals<br />

2010<br />

Colas: gain on bargain purchase (negative goodwill) on buyout of minority interests = €6m<br />

TF1: Other operating income of €102m for the year ended 31 December 2010 includes a gain of €95.9m on the remeasurement at fair value<br />

of the previously-held equity interests in TMC and NT1.<br />

(c) 2010<br />

Colas: Fines relating to competition issues and associated claims: -€31m; impairment of goodwill: -€27m<br />

TF1: Other operating expenses include goodwill impairment and other items<br />

NOTE 13 • COST OF NET DEBT (277)<br />

OTHER FINANCIAL INCOME AND EXPENSES (13)<br />

13.1 Components of cost of net debt<br />

2011 2010<br />

Financial expenses (359) (394)<br />

comprising:<br />

Interest expense on debt (323) (346)<br />

Interest expense related to treasury management (30) (30)<br />

Interest expense on finance leases (2) (4)<br />

Negative effects of financial instruments (4) (14)<br />

Financial income 82 64<br />

comprising:<br />

Interest income from cash and cash equivalents 40 42<br />

Income from, and gains on disposals of, short-term investments 42 21<br />

Negative effects of financial instruments 1<br />

Total cost of net debt (277) (330)<br />

13.2 Other financial income and expenses<br />

2011 2010<br />

Other financial income 55 101<br />

Other financial expenses (68) (95)<br />

Other financial income/(expenses), net (13) 6<br />

"Other financial income and expenses" include gains or losses on disposals of investments in non-consolidated<br />

companies, interest paid to investors on calls for funds (commercial property), commitment fees, changes in the<br />

fair value of "Other current financial assets" and other items during the period.<br />

The net year-on-year movement of -€19m mainly reflects a reduction in net gains on disposals of investments in<br />

non-consolidated companies, mainly due to the Alstom Hydro share exchange (which generated a €42m gain in<br />

2010).<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • FINANCIAL STATEMENTS • Consolidated financial statements • 250