Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1<br />

The Group<br />

2011 key figures<br />

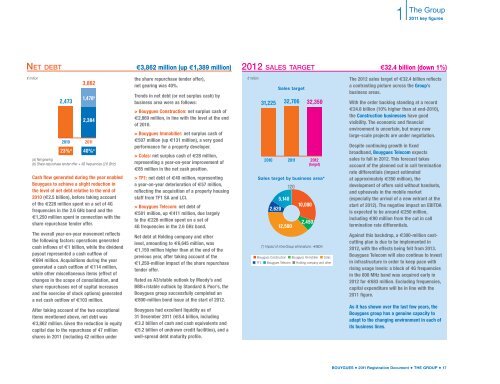

net debt<br />

€ million the share repurchase tender offer),<br />

€ million<br />

3,862<br />

net gearing was 40%.<br />

2,473<br />

1,478 b<br />

2,384<br />

2010 2011<br />

23% a 40% a<br />

(a) Net gearing<br />

(b) Share repurchase tender offer + 4G frequencies (2.6 GHz)<br />

Cash flow generated during the year enabled<br />

Bouygues to achieve a slight reduction in<br />

the level of net debt relative to the end of<br />

2010 (€2.5 billion), before taking account<br />

of the €228 million spent on a set of 4G<br />

frequencies in the 2.6 GHz band and the<br />

€1,250 million spent in connection with the<br />

share repurchase tender offer.<br />

The overall year-on-year movement reflects<br />

the following factors: operations generated<br />

cash inflows of €1 billion, while the dividend<br />

payout represented a cash outflow of<br />

€694 million. Acquisitions during the year<br />

generated a cash outflow of €114 million,<br />

while other miscellaneous items (effect of<br />

changes in the scope of consolidation, and<br />

share repurchases net of capital increases<br />

and the exercise of stock options) generated<br />

a net cash outflow of €103 million.<br />

After taking account of the two exceptional<br />

items mentioned above, net debt was<br />

€3,862 million. Given the reduction in equity<br />

capital due to the repurchase of 47 million<br />

shares in 2011 (including 42 million under<br />

e3,862 million (up e1,389 million)<br />

Trends in net debt (or net surplus cash) by<br />

business area were as follows:<br />

> Bouygues Construction: net surplus cash of<br />

€2,869 million, in line with the level at the end<br />

of 2010.<br />

> Bouygues Immobilier: net surplus cash of<br />

€507 million (up €131 million), a very good<br />

performance for a property developer.<br />

> Colas: net surplus cash of €28 million,<br />

representing a year-on-year improvement of<br />

€85 million in the net cash position.<br />

> TF1: net debt of €40 million, representing<br />

a year-on-year deterioration of €57 million,<br />

reflecting the acquisition of a property housing<br />

staff from TF1 SA and LCI.<br />

> Bouygues Telecom: net debt of<br />

€581 million, up €411 million, due largely<br />

to the €228 million spent on a set of<br />

4G frequencies in the 2.6 GHz band.<br />

Net debt at Holding company and other<br />

level, amounting to €6,645 million, was<br />

€1,150 million higher than at the end of the<br />

previous year, after taking account of the<br />

€1,250-million impact of the share repurchase<br />

tender offer.<br />

Rated as A3/stable outlook by Moody’s and<br />

BBB+/stable outlook by Standard & Poor’s, the<br />

Bouygues group successfully completed an<br />

€800-million bond issue at the start of 2012.<br />

Bouygues had excellent liquidity as of<br />

31 December 2011 (€8.4 billion, including<br />

€3.2 billion of cash and cash equivalents and<br />

€5.2 billion of undrawn credit facilities), and a<br />

well-spread debt maturity profile.<br />

2012 SaleS tarGet e32.4 billion (down 1%)<br />

31,225<br />

2010<br />

Sales target<br />

Sales target by business area*<br />

120<br />

2,620<br />

32,706<br />

5,140<br />

2011<br />

12,500<br />

10,000<br />

32,350<br />

2,450<br />

2012<br />

(target)<br />

(*) Impact of intra-Group eliminations: -€480m<br />

n Bouygues Construction n Bouygues Immobilier n Colas<br />

n TF1 n Bouygues Telecom n Holding company and other<br />

The 2012 sales target of €32.4 billion reflects<br />

a contrasting picture across the Group’s<br />

business areas.<br />

With the order backlog standing at a record<br />

€24.8 billion (10% higher than at end-2010),<br />

the Construction businesses have good<br />

visibility. The economic and financial<br />

environment is uncertain, but many new<br />

large-scale projects are under negotiation.<br />

Despite continuing growth in fixed<br />

broadband, Bouygues Telecom expects<br />

sales to fall in 2012. This forecast takes<br />

account of the planned cut in call termination<br />

rate differentials (impact estimated<br />

at approximately €350 million), the<br />

development of offers sold without handsets,<br />

and upheavals in the mobile market<br />

(especially the arrival of a new entrant at the<br />

start of 2012). The negative impact on EBITDA<br />

is expected to be around €250 million,<br />

including €90 million from the cut in call<br />

termination rate differentials.<br />

Against this backdrop, a €300-million costcutting<br />

plan is due to be implemented in<br />

2012, with the effects being felt from 2013.<br />

Bouygues Telecom will also continue to invest<br />

in infrastructure in order to keep pace with<br />

rising usage levels: a block of 4G frequencies<br />

in the 800 MHz band was acquired early in<br />

2012 for €683 million. Excluding frequencies,<br />

capital expenditure will be in line with the<br />

2011 figure.<br />

As it has shown over the last few years, the<br />

Bouygues group has a genuine capacity to<br />

adapt to the changing environment in each of<br />

its business lines.<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • THE GROUP • 17