Registration Document BOUYGUES

Registration Document BOUYGUES

Registration Document BOUYGUES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1 2011<br />

The Group<br />

key figures<br />

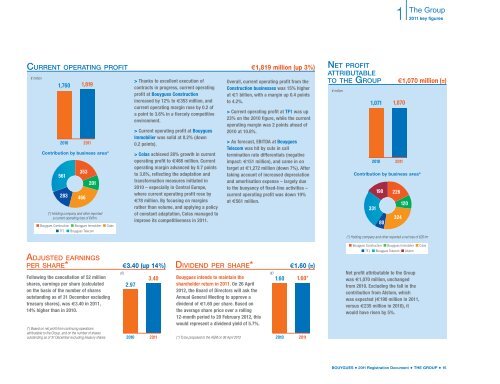

current operatinG profit e1,819 million (up 3%)<br />

€ million<br />

1,760<br />

2010<br />

Contribution by business area*<br />

561<br />

283<br />

353<br />

466<br />

1,819<br />

2011<br />

201<br />

(*) Holding company and other reported<br />

a current operating loss of €45m.<br />

n Bouygues Construction n Bouygues Immobilier n Colas<br />

n TF1 n Bouygues Telecom<br />

> Thanks to excellent execution of<br />

contracts in progress, current operating<br />

profit at Bouygues Construction<br />

increased by 12% to €353 million, and<br />

current operating margin rose by 0.2 of<br />

a point to 3.6% in a fiercely competitive<br />

environment.<br />

> Current operating profit at Bouygues<br />

Immobilier was solid at 8.2% (down<br />

0.2 points).<br />

> Colas achieved 28% growth in current<br />

operating profit to €466 million. Current<br />

operating margin advanced by 0.7 points<br />

to 3.8%, reflecting the adaptation and<br />

transformation measures initiated in<br />

2010 – especially in Central Europe,<br />

where current operating profit rose by<br />

€78 million. By focusing on margins<br />

rather than volume, and applying a policy<br />

of constant adaptation, Colas managed to<br />

improve its competitiveness in 2011.<br />

Overall, current operating profit from the<br />

Construction businesses was 15% higher<br />

at €1 billion, with a margin up 0.4 points<br />

to 4.2%.<br />

> Current operating profit at TF1 was up<br />

23% on the 2010 figure, while the current<br />

operating margin was 2 points ahead of<br />

2010 at 10.8%.<br />

> As forecast, EBITDA at Bouygues<br />

Telecom was hit by cuts in call<br />

termination rate differentials (negative<br />

impact: €151 million), and came in on<br />

target at €1,272 million (down 7%). After<br />

taking account of increased depreciation<br />

and amortisation expense – largely due<br />

to the buoyancy of fixed-line activities –<br />

current operating profit was down 19%<br />

at €561 million.<br />

net profit<br />

attributable<br />

to the Group e1,070 million (=)<br />

€ million<br />

1,071<br />

2010<br />

1,070<br />

2011<br />

Contribution by business area*<br />

331<br />

190<br />

80<br />

226<br />

324<br />

120<br />

(*) Holding company and other reported a net loss of €201m<br />

adjuSted earninGS<br />

per Share*<br />

Following the cancellation of 52 million<br />

shares, earnings per share (calculated<br />

on the basis of the number of shares<br />

outstanding as of 31 December excluding<br />

treasury shares), was €3.40 in 2011,<br />

14% higher than in 2010.<br />

(*) Based on net profit from continuing operations<br />

attributable to the Group, and on the number of shares<br />

outstanding as of 31 December excluding treasury shares<br />

e3.40 (up 14%) dividend per Share*<br />

(€) (€)<br />

3.40 Bouygues intends to maintain the<br />

1.60<br />

2.97<br />

shareholder return in 2011. On 26 April<br />

2012, the Board of Directors will ask the<br />

Annual General Meeting to approve a<br />

dividend of €1.60 per share. Based on<br />

the average share price over a rolling<br />

12-month period to 20 February 2012, this<br />

would represent a dividend yield of 5.7%.<br />

2010<br />

2011<br />

(*) To be proposed to the AGM on 26 April 2012<br />

2010<br />

e1.60 (=)<br />

1.60*<br />

2011<br />

n Bouygues Construction n Bouygues Immobilier n Colas<br />

n TF1 n Bouygues Telecom n Alstom<br />

Net profit attributable to the Group<br />

was €1,070 million, unchanged<br />

from 2010. Excluding the fall in the<br />

contribution from Alstom, which<br />

was expected (€190 million in 2011,<br />

versus €235 million in 2010), it<br />

would have risen by 5%.<br />

<strong>BOUYGUES</strong> • 2011 <strong>Registration</strong> <strong>Document</strong> • THE GROUP • 15