2001-2003 Graduate Catalog - Texas Southern University: ::em.tsu ...

2001-2003 Graduate Catalog - Texas Southern University: ::em.tsu ...

2001-2003 Graduate Catalog - Texas Southern University: ::em.tsu ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

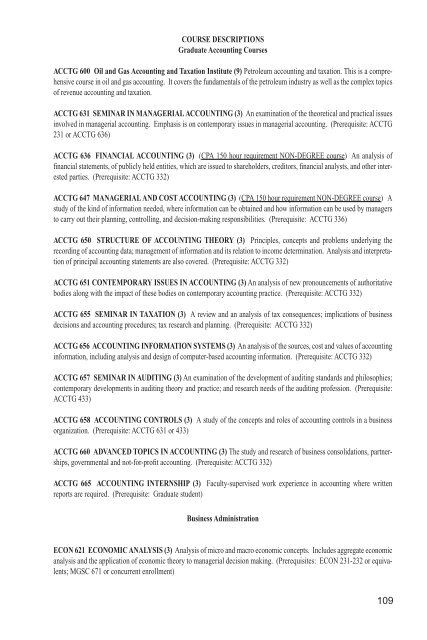

COURSE DESCRIPTIONS<strong>Graduate</strong> Accounting CoursesACCTG 600 Oil and Gas Accounting and Taxation Institute (9) Petroleum accounting and taxation. This is a comprehensivecourse in oil and gas accounting. It covers the fundamentals of the petroleum industry as well as the complex topicsof revenue accounting and taxation.ACCTG 631 SEMINAR IN MANAGERIAL ACCOUNTING (3) An examination of the theoretical and practical issuesinvolved in managerial accounting. Emphasis is on cont<strong>em</strong>porary issues in managerial accounting. (Prerequisite: ACCTG231 or ACCTG 636)ACCTG 636 FINANCIAL ACCOUNTING (3) (CPA 150 hour requir<strong>em</strong>ent NON-DEGREE course) An analysis offinancial stat<strong>em</strong>ents, of publicly held entities, which are issued to shareholders, creditors, financial analysts, and other interestedparties. (Prerequisite: ACCTG 332)ACCTG 647 MANAGERIAL AND COST ACCOUNTING (3) (CPA 150 hour requir<strong>em</strong>ent NON-DEGREE course) Astudy of the kind of information needed, where information can be obtained and how information can be used by managersto carry out their planning, controlling, and decision-making responsibilities. (Prerequisite: ACCTG 336)ACCTG 650 STRUCTURE OF ACCOUNTING THEORY (3) Principles, concepts and probl<strong>em</strong>s underlying therecording of accounting data; manag<strong>em</strong>ent of information and its relation to income determination. Analysis and interpretationof principal accounting stat<strong>em</strong>ents are also covered. (Prerequisite: ACCTG 332)ACCTG 651 CONTEMPORARY ISSUES IN ACCOUNTING (3) An analysis of new pronounc<strong>em</strong>ents of authoritativebodies along with the impact of these bodies on cont<strong>em</strong>porary accounting practice. (Prerequisite: ACCTG 332)ACCTG 655 SEMINAR IN TAXATION (3) A review and an analysis of tax consequences; implications of businessdecisions and accounting procedures; tax research and planning. (Prerequisite: ACCTG 332)ACCTG 656 ACCOUNTING INFORMATION SYSTEMS (3) An analysis of the sources, cost and values of accountinginformation, including analysis and design of computer-based accounting information. (Prerequisite: ACCTG 332)ACCTG 657 SEMINAR IN AUDITING (3) An examination of the development of auditing standards and philosophies;cont<strong>em</strong>porary developments in auditing theory and practice; and research needs of the auditing profession. (Prerequisite:ACCTG 433)ACCTG 658 ACCOUNTING CONTROLS (3) A study of the concepts and roles of accounting controls in a businessorganization. (Prerequisite: ACCTG 631 or 433)ACCTG 660 ADVANCED TOPICS IN ACCOUNTING (3) The study and research of business consolidations, partnerships,governmental and not-for-profit accounting. (Prerequisite: ACCTG 332)ACCTG 665 ACCOUNTING INTERNSHIP (3) Faculty-supervised work experience in accounting where writtenreports are required. (Prerequisite: <strong>Graduate</strong> student)Business AdministrationECON 621 ECONOMIC ANALYSIS (3) Analysis of micro and macro economic concepts. Includes aggregate economicanalysis and the application of economic theory to managerial decision making. (Prerequisites: ECON 231-232 or equivalents;MGSC 671 or concurrent enrollment)109