TDCJ-CJAD Data Manual - Texas Department of Criminal Justice

TDCJ-CJAD Data Manual - Texas Department of Criminal Justice

TDCJ-CJAD Data Manual - Texas Department of Criminal Justice

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

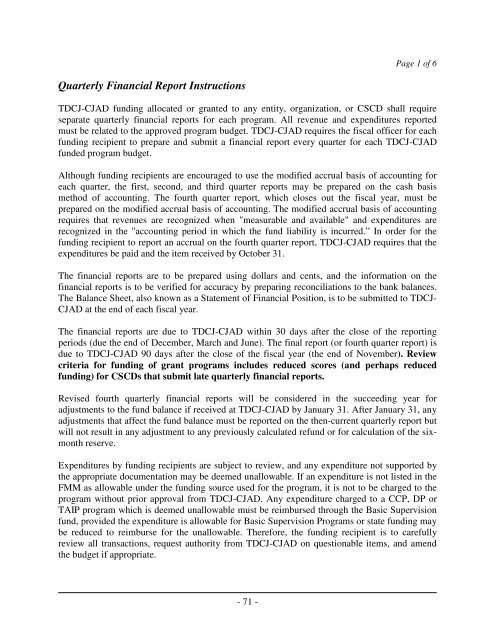

Page 1 <strong>of</strong> 6Quarterly Financial Report Instructions<strong>TDCJ</strong>-<strong>CJAD</strong> funding allocated or granted to any entity, organization, or CSCD shall requireseparate quarterly financial reports for each program. All revenue and expenditures reportedmust be related to the approved program budget. <strong>TDCJ</strong>-<strong>CJAD</strong> requires the fiscal <strong>of</strong>ficer for eachfunding recipient to prepare and submit a financial report every quarter for each <strong>TDCJ</strong>-<strong>CJAD</strong>funded program budget.Although funding recipients are encouraged to use the modified accrual basis <strong>of</strong> accounting foreach quarter, the first, second, and third quarter reports may be prepared on the cash basismethod <strong>of</strong> accounting. The fourth quarter report, which closes out the fiscal year, must beprepared on the modified accrual basis <strong>of</strong> accounting. The modified accrual basis <strong>of</strong> accountingrequires that revenues are recognized when "measurable and available" and expenditures arerecognized in the "accounting period in which the fund liability is incurred.” In order for thefunding recipient to report an accrual on the fourth quarter report, <strong>TDCJ</strong>-<strong>CJAD</strong> requires that theexpenditures be paid and the item received by October 31.The financial reports are to be prepared using dollars and cents, and the information on thefinancial reports is to be verified for accuracy by preparing reconciliations to the bank balances.The Balance Sheet, also known as a Statement <strong>of</strong> Financial Position, is to be submitted to <strong>TDCJ</strong><strong>CJAD</strong> at the end <strong>of</strong> each fiscal year.The financial reports are due to <strong>TDCJ</strong>-<strong>CJAD</strong> within 30 days after the close <strong>of</strong> the reportingperiods (due the end <strong>of</strong> December, March and June). The final report (or fourth quarter report) isdue to <strong>TDCJ</strong>-<strong>CJAD</strong> 90 days after the close <strong>of</strong> the fiscal year (the end <strong>of</strong> November). Reviewcriteria for funding <strong>of</strong> grant programs includes reduced scores (and perhaps reducedfunding) for CSCDs that submit late quarterly financial reports.Revised fourth quarterly financial reports will be considered in the succeeding year foradjustments to the fund balance if received at <strong>TDCJ</strong>-<strong>CJAD</strong> by January 31. After January 31, anyadjustments that affect the fund balance must be reported on the then-current quarterly report butwill not result in any adjustment to any previously calculated refund or for calculation <strong>of</strong> the sixmonthreserve.Expenditures by funding recipients are subject to review, and any expenditure not supported bythe appropriate documentation may be deemed unallowable. If an expenditure is not listed in theFMM as allowable under the funding source used for the program, it is not to be charged to theprogram without prior approval from <strong>TDCJ</strong>-<strong>CJAD</strong>. Any expenditure charged to a CCP, DP orTAIP program which is deemed unallowable must be reimbursed through the Basic Supervisionfund, provided the expenditure is allowable for Basic Supervision Programs or state funding maybe reduced to reimburse for the unallowable. Therefore, the funding recipient is to carefullyreview all transactions, request authority from <strong>TDCJ</strong>-<strong>CJAD</strong> on questionable items, and amendthe budget if appropriate.- 71