Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

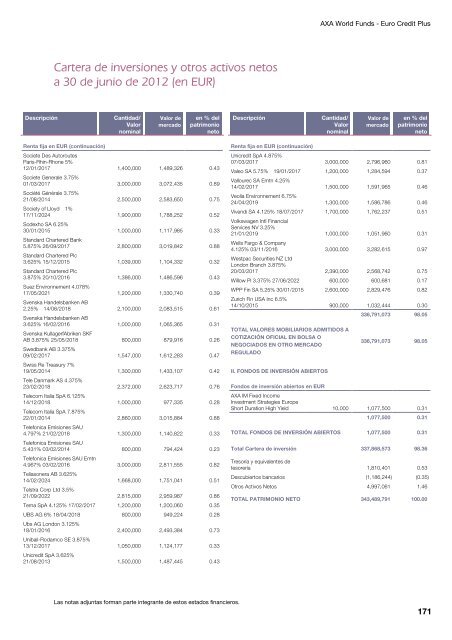

AXA World Funds - Euro Credit PlusCartera de inversiones y otros activos netosa 30 de junio de 2012 (en EUR)DescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoDescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoRenta fija en EUR (continuación)Societe Des AutoroutesParis-Rhin-Rhone 5%12/01/2017 1,400,000 1,489,326 0.43Societe Generale 3.75%01/03/2017 3,000,000 3,072,435 0.89Société Générale 3.75%21/08/2014 2,500,000 2,583,650 0.75Society of Lloyd 1%17/11/2024 1,900,000 1,788,252 0.52Sodexho SA 6.25%30/01/2015 1,000,000 1,117,985 0.33Standard Chartered Bank5.875% 26/09/2017 2,800,000 3,019,842 0.88Standard Chartered Plc3.625% 15/12/2015 1,039,000 1,104,332 0.32Standard Chartered Plc3.875% 20/10/2016 1,386,000 1,486,596 0.43Suez Environnement 4.078%17/05/2021 1,200,000 1,330,740 0.39Svenska Handelsbanken AB2.25% 14/06/2018 2,100,000 2,083,515 0.61Svenska Handelsbanken AB3.625% 16/02/2016 1,000,000 1,065,365 0.31Svenska KullagerfAbriken SKFAB 3.875% 25/05/2018 800,000 879,916 0.26Swedbank AB 3.375%09/02/2017 1,547,000 1,612,283 0.47Swiss Re Treasury 7%19/05/2014 1,300,000 1,433,107 0.42Tele Danmark AS 4.375%23/02/2018 2,372,000 2,623,717 0.76Telecom Italia SpA 6.125%14/12/2018 1,000,000 977,335 0.28Telecom Italia SpA 7.875%22/01/2014 2,860,000 3,015,884 0.88Telefonica Emisiones SAU4.797% 21/02/2018 1,300,000 1,140,822 0.33Telefonica Emisiones SAU5.431% 03/02/2014 800,000 794,424 0.23Telefonica Emisiones SAU Emtn4.967% 03/02/2016 3,000,000 2,811,555 0.82Teliasonera AB 3.625%14/02/2024 1,668,000 1,751,041 0.51Telstra Corp Ltd 3.5%21/09/2022 2,815,000 2,959,987 0.86Terna SpA 4.125% 17/02/2017 1,200,000 1,200,060 0.35UBS AG 6% 18/04/2018 800,000 949,224 0.28Ubs AG London 3.125%18/01/2016 2,400,000 2,493,384 0.73Unibail-Rodamco SE 3.875%13/12/2017 1,050,000 1,124,177 0.33Unicredit SpA 3.625%21/08/2013 1,500,000 1,487,445 0.43Renta fija en EUR (continuación)Unicredit SpA 4.875%07/03/2017 3,000,000 2,796,960 0.81Valeo SA 5.75% 19/01/2017 1,200,000 1,284,594 0.37Vallourec SA Emtn 4.25%14/02/2017 1,500,000 1,591,965 0.46Veolia Environnement 6.75%24/04/2019 1,300,000 1,586,786 0.46Vivendi SA 4.125% 18/07/2017 1,700,000 1,762,237 0.51Volkswagen Intl FinancialServices NV 3.25%21/01/2019 1,000,000 1,051,960 0.31Wells Fargo & Company4.125% 03/11/2016 3,000,000 3,282,615 0.97Westpac Securities NZ LtdLondon Branch 3.875%20/03/2017 2,390,000 2,568,742 0.75Willow Pl 3.375% 27/06/2022 600,000 600,681 0.17WPP Fin SA 5.25% 30/01/2015 2,600,000 2,829,476 0.82Zurich Fin USA Inc 6.5%14/10/2015 900,000 1,032,444 0.30336,791,073 98.05TOTAL VALORES MOBILIARIOS ADMITIDOS ACOTIZACIÓN OFICIAL EN BOLSA ONEGOCIADOS EN OTRO MERCADOREGULADOII. FONDOS DE INVERSIÓN ABIERTOS336,791,073 98.05Fondos de inversión abiertos en EURAXA IM Fixed IncomeInvestment Strategies EuropeShort Duration High Yield 10,000 1,077,500 0.311,077,500 0.31TOTAL FONDOS DE INVERSIÓN ABIERTOS 1,077,500 0.31Total Cartera de inversión 337,868,573 98.36Tresoría y equivalentes detesorería 1,810,401 0.53Descubiertos bancarios (1,186,244) (0.35)Otros Activos Netos 4,997,061 1.46TOTAL PATRIMONIO NETO 343,489,791 100.00Las notas adjuntas forman parte integrante de estos estados financieros.171