Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

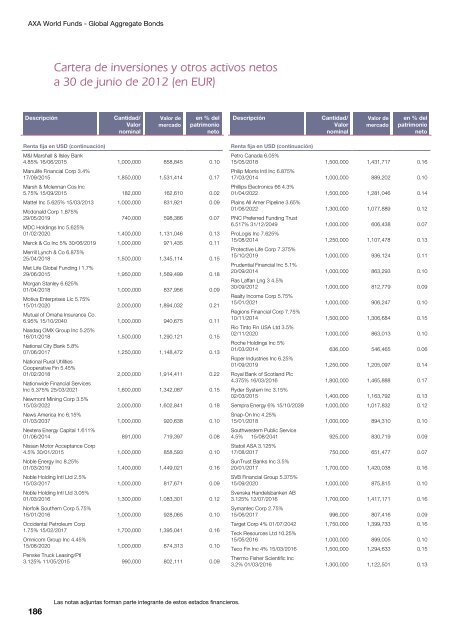

AXA World Funds - Global Aggregate BondsCartera de inversiones y otros activos netosa 30 de junio de 2012 (en EUR)DescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoDescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoRenta fija en USD (continuación)M&I Marshall & Ilsley Bank4.85% 16/06/2015 1,000,000 858,845 0.10Manulife Financial Corp 3.4%17/09/2015 1,850,000 1,531,414 0.17Marsh & Mclennan Cos Inc5.75% 15/09/2015 182,000 162,610 0.02Mattel Inc 5.625% 15/03/2013 1,000,000 831,921 0.09Mcdonald Corp 1.875%29/05/2019 740,000 598,386 0.07MDC Holdings Inc 5.625%01/02/2020 1,400,000 1,131,046 0.13Merck & Co Inc 5% 30/06/2019 1,000,000 971,435 0.11Merrill Lynch & Co 6.875%25/04/2018 1,500,000 1,345,114 0.15Met Life Global Funding I 1.7%29/06/2015 1,950,000 1,569,499 0.18Morgan Stanley 6.625%01/04/2018 1,000,000 837,956 0.09Motiva Enterprises Llc 5.75%15/01/2020 2,000,000 1,894,032 0.21Mutual of Omaha Insurance Co.6.95% 15/10/2040 1,000,000 940,675 0.11Nasdaq OMX Group Inc 5.25%16/01/2018 1,500,000 1,290,121 0.15National City Bank 5.8%07/06/2017 1,250,000 1,148,472 0.13National Rural UtilitiesCooperative Fin 5.45%01/02/2018 2,000,000 1,914,411 0.22Nationwide Financial ServicesInc 5.375% 25/03/2021 1,600,000 1,342,087 0.15Newmont Mining Corp 3.5%15/03/2022 2,000,000 1,602,841 0.18News America Inc 6.15%01/03/2037 1,000,000 920,638 0.10Nextera Energy Capital 1.611%01/06/2014 891,000 719,397 0.08Nissan Motor Acceptance Corp4.5% 30/01/2015 1,000,000 858,593 0.10Noble Energy Inc 8.25%01/03/2019 1,400,000 1,449,021 0.16Noble Holding Intl Ltd 2.5%15/03/2017 1,000,000 817,671 0.09Noble Holding Intl Ltd 3.05%01/03/2016 1,300,000 1,083,301 0.12Norfolk Southern Corp 5.75%15/01/2016 1,000,000 928,065 0.10Occidental Petroleum Corp1.75% 15/02/2017 1,700,000 1,395,041 0.16Omnicom Group Inc 4.45%15/08/2020 1,000,000 874,313 0.10Penske Truck Leasing/Ptl3.125% 11/05/2015 990,000 802,111 0.09Renta fija en USD (continuación)Petro Canada 6.05%15/05/2018 1,500,000 1,431,717 0.16Philip Morris Intl Inc 6.875%17/03/2014 1,000,000 889,202 0.10Phillips Electronics 66 4.3%01/04/2022 1,500,000 1,281,046 0.14Plains All Amer Pipeline 3.65%01/06/2022 1,300,000 1,077,889 0.12PNC Preferred Funding Trust6.517% 31/12/2049 1,000,000 606,438 0.07ProLogis Inc 7.625%15/08/2014 1,250,000 1,107,478 0.13Protective Life Corp 7.375%15/10/2019 1,000,000 936,124 0.11Prudential Financial Inc 5.1%20/09/2014 1,000,000 863,293 0.10Ras Laffan Lng 3 4.5%30/09/2012 1,000,000 812,779 0.09Realty Income Corp 5.75%15/01/2021 1,000,000 906,247 0.10Regions Financial Corp 7.75%10/11/2014 1,500,000 1,306,684 0.15Rio Tinto Fin USA Ltd 3.5%02/11/2020 1,000,000 863,013 0.10Roche Holdings Inc 5%01/03/2014 636,000 546,465 0.06Roper Industries Inc 6.25%01/09/2019 1,250,000 1,205,097 0.14Royal Bank of Scotland Plc4.375% 16/03/2016 1,800,000 1,465,888 0.17Ryder System Inc 3.15%02/03/2015 1,400,000 1,163,792 0.13Sempra Energy 6% 15/10/2039 1,000,000 1,017,832 0.12Snap-On Inc 4.25%15/01/2018 1,000,000 894,310 0.10Southwestern Public Service4.5% 15/08/2041 925,000 830,719 0.09Statoil ASA 3.125%17/08/2017 750,000 651,477 0.07SunTrust Banks Inc 3.5%20/01/2017 1,700,000 1,420,038 0.16SVB Financial Group 5.375%15/09/2020 1,000,000 875,815 0.10Svenska Handelsbanken AB3.125% 12/07/2016 1,700,000 1,417,171 0.16Symantec Corp 2.75%15/06/2017 996,000 807,416 0.09Target Corp 4% 01/07/2042 1,750,000 1,399,733 0.16Teck Resources Ltd 10.25%15/05/2016 1,000,000 899,005 0.10Teco Fin Inc 4% 15/03/2016 1,500,000 1,294,633 0.15Thermo Fisher Scientific Inc3.2% 01/03/2016 1,300,000 1,122,501 0.13186Las notas adjuntas forman parte integrante de estos estados financieros.