Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

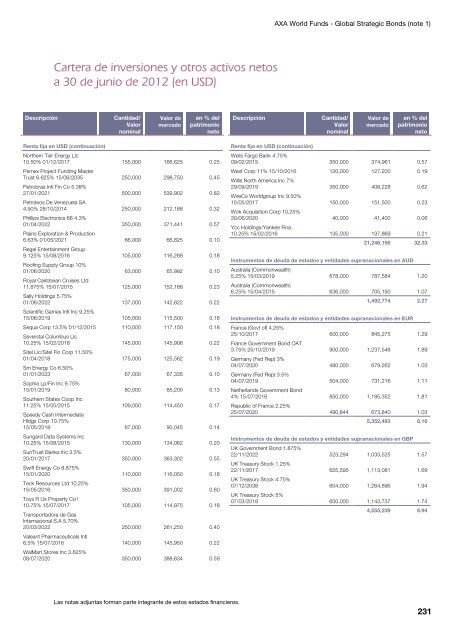

AXA World Funds - Global Strategic Bonds (note 1)Cartera de inversiones y otros activos netosa 30 de junio de 2012 (en USD)DescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoDescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoRenta fija en USD (continuación)Northern Tier Energy Llc10.50% 01/12/2017 155,000 166,625 0.25Pemex Project Funding MasterTrust 6.625% 15/06/2035 250,000 298,750 0.45Petrobras Intl Fin Co 5.38%27/01/2021 500,000 539,902 0.82Petroleos De Venezuela SA4.90% 28/10/2014 250,000 212,188 0.32Phillips Electronics 66 4.3%01/04/2022 350,000 371,441 0.57Plains Exploration & Production6.63% 01/05/2021 66,000 66,825 0.10Regal Entertainment Group9.125% 15/08/2018 105,000 116,288 0.18Roofing Supply Group 10%01/06/2020 63,000 65,992 0.10Royal Caribbean Cruises Ltd11.875% 15/07/2015 125,000 152,188 0.23Sally Holdings 5.75%01/06/2022 137,000 142,822 0.22Scientific Games Intl Inc 9.25%15/06/2019 105,000 115,500 0.18Sequa Corp 13.5% 01/12/2015 110,000 117,150 0.18Severstal Columbus Llc10.25% 15/02/2018 145,000 145,906 0.22Sitel Llc/Sitel Fin Corp 11.50%01/04/2018 175,000 125,562 0.19Sm Energy Co 6.50%01/01/2023 67,000 67,335 0.10Sophia Lp/Fin Inc 9.75%15/01/2019 80,000 85,200 0.13Southern States Coop Inc11.25% 15/05/2015 109,000 114,450 0.17Speedy Cash IntermediateHldgs Corp 10.75%15/05/2018 87,000 90,045 0.14Sungard Data Systems Inc10.25% 15/08/2015 130,000 134,062 0.20SunTrust Banks Inc 3.5%20/01/2017 350,000 363,302 0.55Swift Energy Co 8.875%15/01/2020 110,000 116,050 0.18Teck Resources Ltd 10.25%15/05/2016 350,000 391,002 0.60Toys R Us Property Co I10.75% 15/07/2017 105,000 114,975 0.18Transportadora de GasInternacional S.A 5.70%20/03/2022 250,000 261,250 0.40Valeant Pharmaceuticals Intl6.5% 15/07/2016 140,000 145,950 0.22WalMart Stores Inc 3.625%08/07/2020 350,000 388,634 0.59Renta fija en USD (continuación)Wells Fargo Bank 4.75%09/02/2015 350,000 374,961 0.57West Corp 11% 15/10/2016 120,000 127,200 0.19Willis North America Inc 7%29/09/2019 350,000 408,228 0.62WireCo Worldgroup Inc 9.50%15/05/2017 150,000 151,500 0.23Wok Acquisition Corp 10.25%30/06/2020 40,000 41,400 0.06Ycc Holdings/Yankee Fina10.25% 15/02/2016 135,000 137,869 0.2121,246,196 32.33Instrumentos de deuda de estados y entidades supranacionales en AUDAustralia (Commonwealth)5.25% 15/03/2019 678,000 787,584 1.20Australia (Commonwealth)6.25% 15/04/2015 636,000 705,190 1.071,492,774 2.27Instrumentos de deuda de estados y entidades supranacionales en EURFrance (Govt of) 4.25%25/10/2017 600,000 845,275 1.29France Government Bond OAT3.75% 25/10/2019 900,000 1,237,548 1.89Germany (Fed Rep) 3%04/07/2020 480,000 679,262 1.03Germany (Fed Rep) 3.5%04/07/2019 504,000 731,216 1.11Netherlands Government Bond4% 15/07/2016 850,000 1,185,352 1.81Republic of France 2.25%25/07/2020 490,644 673,840 1.035,352,493 8.16Instrumentos de deuda de estados y entidades supranacionales en GBPUK Government Bond 1.875%22/11/2022 523,294 1,033,525 1.57UK Treasury Stock 1.25%22/11/2017 625,595 1,113,081 1.69UK Treasury Stock 4.75%07/12/2038 604,000 1,264,896 1.94UK Treasury Stock 5%07/03/2018 600,000 1,143,737 1.744,555,239 6.94Las notas adjuntas forman parte integrante de estos estados financieros.231