AXA World Funds - US High Yield BondsCartera de inversiones y otros activos netosa 30 de junio de 2012 (en USD)DescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoDescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoRenta fija en USD (continuación)Range Resources Corp 7.50%01/10/2017 10,000,000 10,475,000 0.29Regal Entertainment Group9.125% 15/08/2018 12,295,000 13,616,712 0.38Regions Financing Trust II6.625% 01/05/2077 12,920,000 12,209,400 0.34Res Care Inc 10.75%15/01/2019 7,755,000 8,627,438 0.24Reynolds Group 8.75%15/10/2016 9,550,000 10,123,000 0.28Reynolds Group Issuer Inc9.875% 15/08/2019 13,220,000 13,600,075 0.38Reynolds Group IssuerInc/Reynold 9.88% 15/08/2019 11,925,000 12,267,844 0.34Roofing Supply Group 10%01/06/2020 12,184,000 12,762,740 0.36Rouse Company Llc 6.75%09/11/2015 7,305,000 7,679,381 0.21Royal Caribbean Cruises Ltd11.875% 15/07/2015 19,240,000 23,424,700 0.66Ruby Tuesday Inc 7.63%15/05/2020 18,749,000 16,827,228 0.47Rural Metro Corp 10.125%15/07/2019 5,486,000 5,293,990 0.15Ryerson Inc 1% 01/11/2014 6,175,000 5,928,000 0.17Ryerson Inc 12% 01/11/2015 7,660,000 7,755,750 0.22Sally Holdings 6.88%15/11/2019 7,080,000 7,708,350 0.22Samson Investment Company9.75% 15/02/2020 7,835,000 7,766,444 0.22Sandridge Energy Inc 9.875%15/05/2016 14,392,000 15,795,220 0.44Sappi Papier Holding GmbH7.75% 15/07/2017 5,239,000 5,284,841 0.15Sappi Papier Holding GmbH8.38% 15/06/2019 17,920,000 17,987,200 0.50Schaeffler Finance BV 7.75%15/02/2017 3,430,000 3,584,350 0.10Schaeffler Finance BV 8.50%15/02/2019 3,923,000 4,187,802 0.12Scientific Games Intl Inc 9.25%15/06/2019 13,225,000 14,547,500 0.41Seagate Hdd Cayman 7%01/11/2021 9,210,000 9,969,825 0.28Select Medical Corp 7.625%01/02/2015 12,770,000 12,801,925 0.36Sequa Corp 11.75%01/12/2015 21,535,000 22,827,100 0.64Sequa Corp 13.5% 01/12/2015 19,676,385 20,955,350 0.59Servicemaster Co 10.75%15/07/2015 9,059,057 9,376,215 0.26Renta fija en USD (continuación)Servicemaster Co 8%15/02/2020 10,820,000 11,739,700 0.33Sesi Llc 7.125% 15/12/2021 5,275,000 5,749,750 0.16Severstal Columbus Llc10.25% 15/02/2018 23,056,000 23,200,100 0.65SGS Intl Inc 12% 15/12/2013 8,359,000 8,400,795 0.24Sheridan Group Inc 12.5%15/04/2014 7,912,297 6,685,891 0.19Sinclair Television Group 9.25%01/11/2017 6,600,000 7,317,750 0.20Sitel Llc/Sitel Fin Corp 11.50%01/04/2018 34,467,000 24,730,072 0.69Sm Energy Co 6.50%01/01/2023 12,311,000 12,372,555 0.35Sophia Lp/Fin Inc 9.75%15/01/2019 6,876,000 7,322,940 0.20Southern States Coop Inc11.25% 15/05/2015 8,380,000 8,799,000 0.25Speedy Cash IntermediateHldgs Corp 10.75%15/05/2018 10,898,000 11,279,430 0.32Spirit Aerosystems Inc 6.75%15/12/2020 7,410,000 8,076,900 0.23Sprint Cap Corp 8.75%15/03/2032 5,530,000 4,963,175 0.14Sra International Inc 11%01/10/2019 8,055,000 8,135,550 0.23Standard Pacific Corp 10.75%15/09/2016 6,325,000 7,495,125 0.21Steinway Musical InstrumentsInc 7% 01/03/2014 2,525,000 2,534,494 0.07Stewart Enterprises 6.5%15/04/2019 8,145,000 8,409,712 0.24Stoneridge Inc 9.5%15/10/2017 11,435,000 11,792,344 0.33Summit Materials Llc/Fin10.50% 31/01/2020 11,740,000 12,473,750 0.35Sungard Data Systems Inc10.25% 15/08/2015 32,993,000 34,024,032 0.95Sunstate Equipment Co Inc12% 15/06/2016 16,955,000 17,378,875 0.49Supervalu Inc 7.5%15/11/2014 7,000,000 7,122,500 0.20Swift Energy Co 7.13%01/06/2017 4,554,000 4,610,925 0.13Swift Energy Co 7.88%01/03/2022 7,840,000 7,879,200 0.22Symbion Inc 8% 15/06/2016 3,480,000 3,462,600 0.10Symetra Financial Corp 8.3%15/10/2067 9,255,000 9,069,900 0.25Syncreon Global Fin US Inc9.5% 01/05/2018 8,990,000 8,990,000 0.25Synovus Financial Corp 7.88%15/02/2019 5,445,000 5,744,475 0.16218Las notas adjuntas forman parte integrante de estos estados financieros.

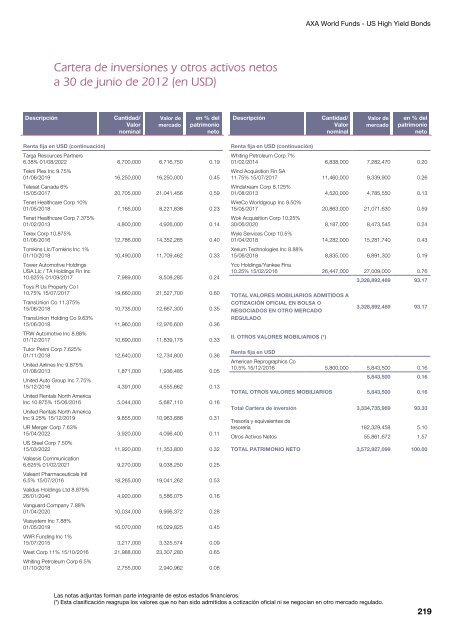

AXA World Funds - US High Yield BondsCartera de inversiones y otros activos netosa 30 de junio de 2012 (en USD)DescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoDescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoRenta fija en USD (continuación)Targa Resources Partners6.38% 01/08/2022 6,700,000 6,716,750 0.19Tekni Plex Inc 9.75%01/06/2019 16,250,000 16,250,000 0.45Telesat Canada 6%15/05/2017 20,705,000 21,041,456 0.59Tenet Healthcare Corp 10%01/05/2018 7,165,000 8,221,838 0.23Tenet Healthcare Corp 7.375%01/02/2013 4,800,000 4,926,000 0.14Terex Corp 10.875%01/06/2016 12,786,000 14,352,285 0.40Tomkins Llc/Tomkins Inc 1%01/10/2018 10,490,000 11,709,462 0.33Tower Automotive HoldingsUSA Llc / TA Holdings Fin Inc10.625% 01/09/2017 7,989,000 8,508,285 0.24Toys R Us Property Co I10.75% 15/07/2017 19,660,000 21,527,700 0.60TransUnion Co 11.375%15/06/2018 10,735,000 12,667,300 0.35TransUnion Holding Co 9.63%15/06/2018 11,960,000 12,976,600 0.36TRW Automotive Inc 8.88%01/12/2017 10,690,000 11,839,175 0.33Tutor Perini Corp 7.625%01/11/2018 12,640,000 12,734,800 0.36United Airlines Inc 9.875%01/08/2013 1,871,000 1,936,485 0.05United Auto Group Inc 7.75%15/12/2016 4,391,000 4,555,662 0.13United Rentals North AmericaInc 10.875% 15/06/2016 5,044,000 5,687,110 0.16United Rentals North AmericaInc 9.25% 15/12/2019 9,855,000 10,963,688 0.31UR Merger Corp 7.63%15/04/2022 3,920,000 4,096,400 0.11US Steel Corp 7.50%15/03/2022 11,920,000 11,353,800 0.32Valassis Communication6.625% 01/02/2021 9,270,000 9,038,250 0.25Valeant Pharmaceuticals Intl6.5% 15/07/2016 18,265,000 19,041,262 0.53Validus Holdings Ltd 8.875%26/01/2040 4,920,000 5,586,075 0.16Vanguard Company 7.88%01/04/2020 10,034,000 9,996,372 0.28Viasystem Inc 7.88%01/05/2019 16,070,000 16,029,825 0.45VWR Funding Inc 1%15/07/2015 3,217,000 3,325,574 0.09West Corp 11% 15/10/2016 21,988,000 23,307,280 0.65Whiting Petroleum Corp 6.5%01/10/2018 2,755,000 2,940,962 0.08Renta fija en USD (continuación)Whiting Petroleum Corp 7%01/02/2014 6,838,000 7,282,470 0.20Wind Acquisition Fin SA11.75% 15/07/2017 11,460,000 9,339,900 0.26Windstream Corp 8.125%01/08/2013 4,520,000 4,785,550 0.13WireCo Worldgroup Inc 9.50%15/05/2017 20,863,000 21,071,630 0.59Wok Acquisition Corp 10.25%30/06/2020 8,187,000 8,473,545 0.24Wyle Services Corp 10.5%01/04/2018 14,282,000 15,281,740 0.43Xerium Technologies Inc 8.88%15/06/2018 8,835,000 6,891,300 0.19Ycc Holdings/Yankee Fina10.25% 15/02/2016 26,447,000 27,009,000 0.763,328,892,469 93.17TOTAL VALORES MOBILIARIOS ADMITIDOS ACOTIZACIÓN OFICIAL EN BOLSA ONEGOCIADOS EN OTRO MERCADOREGULADOII. OTROS VALORES MOBILIARIOS (*)3,328,892,469 93.17Renta fija en USDAmerican Reprographics Co10.5% 15/12/2016 5,800,000 5,843,500 0.165,843,500 0.16TOTAL OTROS VALORES MOBILIARIOS 5,843,500 0.16Total Cartera de inversión 3,334,735,969 93.33Tresoría y equivalentes detesorería 182,329,458 5.10Otros Activos Netos 55,861,672 1.57TOTAL PATRIMONIO NETO 3,572,927,099 100.00Las notas adjuntas forman parte integrante de estos estados financieros.(*) Esta clasificación reagrupa los valores que no han sido admitidos a cotización oficial ni se negocian en otro mercado regulado.219