Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

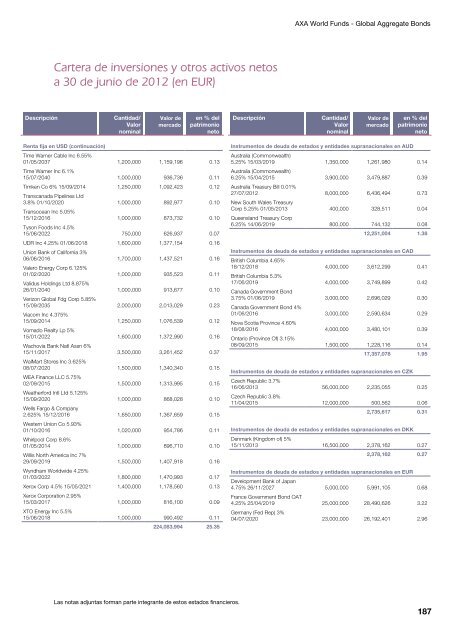

AXA World Funds - Global Aggregate BondsCartera de inversiones y otros activos netosa 30 de junio de 2012 (en EUR)DescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoDescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoRenta fija en USD (continuación)Time Warner Cable Inc 6.55%01/05/2037 1,200,000 1,159,196 0.13Time Warner Inc 6.1%15/07/2040 1,000,000 936,736 0.11Timken Co 6% 15/09/2014 1,250,000 1,092,423 0.12Transcanada Pipelines Ltd3.8% 01/10/2020 1,000,000 892,977 0.10Transocean Inc 5.05%15/12/2016 1,000,000 873,732 0.10Tyson Foods Inc 4.5%15/06/2022 750,000 626,937 0.07UDR Inc 4.25% 01/06/2018 1,600,000 1,377,154 0.16Union Bank of California 3%06/06/2016 1,700,000 1,437,521 0.16Valero Energy Corp 6.125%01/02/2020 1,000,000 935,523 0.11Validus Holdings Ltd 8.875%26/01/2040 1,000,000 913,677 0.10Verizon Global Fdg Corp 5.85%15/09/2035 2,000,000 2,013,029 0.23Viacom Inc 4.375%15/09/2014 1,250,000 1,076,539 0.12Vornado Realty Lp 5%15/01/2022 1,600,000 1,372,990 0.16Wachovia Bank Natl Assn 6%15/11/2017 3,500,000 3,261,452 0.37WalMart Stores Inc 3.625%08/07/2020 1,500,000 1,340,340 0.15WEA Finance LLC 5.75%02/09/2015 1,500,000 1,313,995 0.15Weatherford Intl Ltd 5.125%15/09/2020 1,000,000 868,028 0.10Wells Fargo & Company2.625% 15/12/2016 1,650,000 1,367,659 0.15Western Union Co 5.93%01/10/2016 1,020,000 954,786 0.11Whirlpool Corp 8.6%01/05/2014 1,000,000 896,710 0.10Willis North America Inc 7%29/09/2019 1,500,000 1,407,918 0.16Wyndham Worldwide 4.25%01/03/2022 1,800,000 1,470,993 0.17Xerox Corp 4.5% 15/05/2021 1,400,000 1,178,560 0.13Xerox Corporation 2.95%15/03/2017 1,000,000 816,100 0.09XTO Energy Inc 5.5%15/06/2018 1,000,000 990,492 0.11224,083,994 25.35Instrumentos de deuda de estados y entidades supranacionales en AUDAustralia (Commonwealth)5.25% 15/03/2019 1,350,000 1,261,980 0.14Australia (Commonwealth)6.25% 15/04/2015 3,900,000 3,479,887 0.39Australia Treasury Bill 0.01%27/07/2012 8,000,000 6,436,494 0.73New South Wales TreasuryCorp 5.25% 01/05/2013 400,000 328,511 0.04Queensland Treasury Corp6.25% 14/06/2019 800,000 744,132 0.0812,251,004 1.38Instrumentos de deuda de estados y entidades supranacionales en CADBritish Columbia 4.65%18/12/2018 4,000,000 3,612,299 0.41British Columbia 5.3%17/06/2019 4,000,000 3,749,899 0.42Canada Government Bond3.75% 01/06/2019 3,000,000 2,696,029 0.30Canada Government Bond 4%01/06/2016 3,000,000 2,590,634 0.29Nova Scotia Province 4.60%18/08/2016 4,000,000 3,480,101 0.39Ontario (Province Of) 3.15%08/09/2015 1,500,000 1,228,116 0.1417,357,078 1.95Instrumentos de deuda de estados y entidades supranacionales en CZKCzech Republic 3.7%16/06/2013 56,000,000 2,235,055 0.25Czech Republic 3.8%11/04/2015 12,000,000 500,562 0.062,735,617 0.31Instrumentos de deuda de estados y entidades supranacionales en DKKDenmark (Kingdom of) 5%15/11/2013 16,500,000 2,378,162 0.272,378,162 0.27Instrumentos de deuda de estados y entidades supranacionales en EURDevelopment Bank of Japan4.75% 26/11/2027 5,000,000 5,991,105 0.68France Government Bond OAT4.25% 25/04/2019 25,000,000 28,490,626 3.22Germany (Fed Rep) 3%04/07/2020 23,000,000 26,192,401 2.96Las notas adjuntas forman parte integrante de estos estados financieros.187