Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

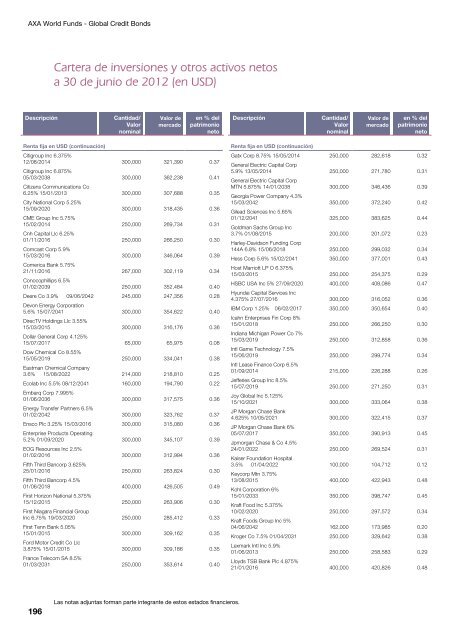

AXA World Funds - Global Credit BondsCartera de inversiones y otros activos netosa 30 de junio de 2012 (en USD)DescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoDescripciónCantidad/ValornominalValor demercadoen % delpatrimonionetoRenta fija en USD (continuación)Citigroup Inc 6.375%12/08/2014 300,000 321,390 0.37Citigroup Inc 6.875%05/03/2038 300,000 362,238 0.41Citizens Communications Co6.25% 15/01/2013 300,000 307,688 0.35City National Corp 5.25%15/09/2020 300,000 318,435 0.36CME Group Inc 5.75%15/02/2014 250,000 269,734 0.31Cnh Capital Llc 6.25%01/11/2016 250,000 266,250 0.30Comcast Corp 5.9%15/03/2016 300,000 346,064 0.39Comerica Bank 5.75%21/11/2016 267,000 302,119 0.34Conocophillips 6.5%01/02/2039 250,000 352,484 0.40Deere Co 3.9% 09/06/2042 245,000 247,356 0.28Devon Energy Corporation5.6% 15/07/2041 300,000 354,622 0.40DirecTV Holdings Llc 3.55%15/03/2015 300,000 316,176 0.36Dollar General Corp 4.125%15/07/2017 65,000 65,975 0.08Dow Chemical Co 8.55%15/05/2019 250,000 334,041 0.38Eastman Chemical Company3.6% 15/08/2022 214,000 218,810 0.25Ecolab Inc 5.5% 08/12/2041 160,000 194,790 0.22Embarq Corp 7.995%01/06/2036 300,000 317,575 0.36Energy Transfer Partners 6.5%01/02/2042 300,000 323,762 0.37Ensco Plc 3.25% 15/03/2016 300,000 315,080 0.36Enterprise Products Operating5.2% 01/09/2020 300,000 345,107 0.39EOG Resources Inc 2.5%01/02/2016 300,000 312,994 0.36Fifth Third Bancorp 3.625%25/01/2016 250,000 263,824 0.30Fifth Third Bancorp 4.5%01/06/2018 400,000 426,505 0.49First Horizon National 5.375%15/12/2015 250,000 263,906 0.30First Niagara Financial GroupInc 6.75% 19/03/2020 250,000 285,412 0.33First Tenn Bank 5.05%15/01/2015 300,000 309,162 0.35Ford Motor Credit Co Llc3.875% 15/01/2015 300,000 309,186 0.35France Telecom SA 8.5%01/03/2031 250,000 353,614 0.40Renta fija en USD (continuación)Gatx Corp 8.75% 15/05/2014 250,000 282,618 0.32General Electric Capital Corp5.9% 13/05/2014 250,000 271,780 0.31General Electric Capital CorpMTN 5.875% 14/01/2038 300,000 346,436 0.39Georgia Power Company 4.3%15/03/2042 350,000 372,240 0.42Gilead Sciences Inc 5.65%01/12/2041 325,000 383,625 0.44Goldman Sachs Group Inc3.7% 01/08/2015 200,000 201,072 0.23Harley-Davidson Funding Corp144A 6.8% 15/06/2018 250,000 299,032 0.34Hess Corp 5.6% 15/02/2041 350,000 377,001 0.43Host Marriott LP O 6.375%15/03/2015 250,000 254,375 0.29HSBC USA Inc 5% 27/09/2020 400,000 408,086 0.47Hyundai Capital Services Inc4.375% 27/07/2016 300,000 316,052 0.36IBM Corp 1.25% 06/02/2017 350,000 350,654 0.40Icahn Enterprises Fin Corp 8%15/01/2018 250,000 266,250 0.30Indiana Michigan Power Co 7%15/03/2019 250,000 312,858 0.36Intl Game Technology 7.5%15/06/2019 250,000 299,774 0.34Intl Lease Finance Corp 6.5%01/09/2014 215,000 226,288 0.26Jefferies Group Inc 8.5%15/07/2019 250,000 271,250 0.31Joy Global Inc 5.125%15/10/2021 300,000 333,064 0.38JP Morgan Chase Bank4.625% 10/05/2021 300,000 322,415 0.37JP Morgan Chase Bank 6%05/07/2017 350,000 390,913 0.45Jpmorgan Chase & Co 4.5%24/01/2022 250,000 269,524 0.31Kaiser Foundation Hospital3.5% 01/04/2022 100,000 104,712 0.12Keycorp Mtn 3.75%13/08/2015 400,000 422,943 0.48Kohl Corporation 6%15/01/2033 350,000 398,747 0.45Kraft Food Inc 5.375%10/02/2020 250,000 297,572 0.34Kraft Foods Group Inc 5%04/06/2042 162,000 173,985 0.20Kroger Co 7.5% 01/04/2031 250,000 329,642 0.38Lexmark Intl Inc 5.9%01/06/2013 250,000 258,583 0.29Lloyds TSB Bank Plc 4.875%21/01/2016 400,000 420,826 0.48196Las notas adjuntas forman parte integrante de estos estados financieros.