Health Systems in Transition - Hungary - World Health Organization ...

Health Systems in Transition - Hungary - World Health Organization ...

Health Systems in Transition - Hungary - World Health Organization ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Health</strong> systems <strong>in</strong> transition <strong>Hungary</strong> 75<br />

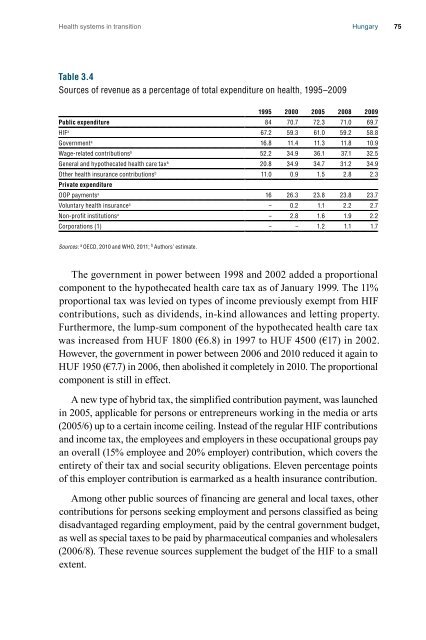

Table 3.4<br />

Sources of revenue as a percentage of total expenditure on health, 1995–2009<br />

1995 2000 2005 2008 2009<br />

Public expenditure 84 70.7 72.3 71.0 69.7<br />

HIF a 67.2 59.3 61.0 59.2 58.8<br />

Government a 16.8 11.4 11.3 11.8 10.9<br />

Wage-related contributions b 52.2 34.9 36.1 37.1 32.5<br />

General and hypothecated health care tax b 20.8 34.9 34.7 31.2 34.9<br />

Other health <strong>in</strong>surance contributions b 11.0 0.9 1.5 2.8 2.3<br />

Private expenditure<br />

OOP payments a 16 26.3 23.8 23.8 23.7<br />

Voluntary health <strong>in</strong>surance a – 0.2 1.1 2.2 2.7<br />

Non-profit <strong>in</strong>stitutions a – 2.8 1.6 1.9 2.2<br />

Corporations (1) – – 1.2 1.1 1.7<br />

Sources: a OECD, 2010 and WHO, 2011; b Authors’ estimate.<br />

The government <strong>in</strong> power between 1998 and 2002 added a proportional<br />

component to the hypothecated health care tax as of January 1999. The 11%<br />

proportional tax was levied on types of <strong>in</strong>come previously exempt from HIF<br />

contributions, such as dividends, <strong>in</strong>-k<strong>in</strong>d allowances and lett<strong>in</strong>g property.<br />

Furthermore, the lump-sum component of the hypothecated health care tax<br />

was <strong>in</strong>creased from HUF 1800 (€6.8) <strong>in</strong> 1997 to HUF 4500 (€17) <strong>in</strong> 2002.<br />

However, the government <strong>in</strong> power between 2006 and 2010 reduced it aga<strong>in</strong> to<br />

HUF 1950 (€7.7) <strong>in</strong> 2006, then abolished it completely <strong>in</strong> 2010. The proportional<br />

component is still <strong>in</strong> effect.<br />

A new type of hybrid tax, the simplified contribution payment, was launched<br />

<strong>in</strong> 2005, applicable for persons or entrepreneurs work<strong>in</strong>g <strong>in</strong> the media or arts<br />

(2005/6) up to a certa<strong>in</strong> <strong>in</strong>come ceil<strong>in</strong>g. Instead of the regular HIF contributions<br />

and <strong>in</strong>come tax, the employees and employers <strong>in</strong> these occupational groups pay<br />

an overall (15% employee and 20% employer) contribution, which covers the<br />

entirety of their tax and social security obligations. Eleven percentage po<strong>in</strong>ts<br />

of this employer contribution is earmarked as a health <strong>in</strong>surance contribution.<br />

Among other public sources of f<strong>in</strong>anc<strong>in</strong>g are general and local taxes, other<br />

contributions for persons seek<strong>in</strong>g employment and persons classified as be<strong>in</strong>g<br />

disadvantaged regard<strong>in</strong>g employment, paid by the central government budget,<br />

as well as special taxes to be paid by pharmaceutical companies and wholesalers<br />

(2006/8). These revenue sources supplement the budget of the HIF to a small<br />

extent.