- Page 1 and 2:

Adopted Budget And ResouRce AllocAt

- Page 3 and 4:

Projects Budget Guide

- Page 5 and 6:

generally relate to the long-term r

- Page 7 and 8:

which are divided into thirteen pro

- Page 9 and 10:

Numerical Project Index

- Page 11 and 12:

City of Sunnyvale Numerical Project

- Page 13 and 14:

City of Sunnyvale Numerical Project

- Page 15 and 16:

City of Sunnyvale Numerical Project

- Page 17 and 18:

City of Sunnyvale Numerical Project

- Page 19 and 20:

City of Sunnyvale Numerical Project

- Page 21 and 22:

This Page Not Used

- Page 23 and 24:

Alphabetical Project Index

- Page 25 and 26:

City of Sunnyvale Alphabetical Proj

- Page 27 and 28:

City of Sunnyvale Alphabetical Proj

- Page 29 and 30:

City of Sunnyvale Alphabetical Proj

- Page 31 and 32:

City of Sunnyvale Alphabetical Proj

- Page 33 and 34:

City of Sunnyvale Alphabetical Proj

- Page 35 and 36:

City of Sunnyvale Alphabetical Proj

- Page 37 and 38:

This Page Not Used

- Page 39 and 40:

Departmental Project Index

- Page 41 and 42:

City of Sunnyvale Departmental Proj

- Page 43 and 44:

City of Sunnyvale Departmental Proj

- Page 45 and 46:

City of Sunnyvale Departmental Proj

- Page 47 and 48:

City of Sunnyvale Departmental Proj

- Page 49 and 50:

City of Sunnyvale Departmental Proj

- Page 51 and 52:

City of Sunnyvale Departmental Proj

- Page 53 and 54:

City of Sunnyvale Departmental Proj

- Page 55 and 56:

City of Sunnyvale Departmental Proj

- Page 57 and 58:

City of Sunnyvale Departmental Proj

- Page 59 and 60:

This Page Not Used

- Page 61 and 62:

Traffic and Transportation

- Page 63 and 64:

development citywide. The fees are

- Page 65 and 66:

Traffic and Transportation Long Ran

- Page 67 and 68:

Anticipated Project Description Cos

- Page 69 and 70:

The TSP supports land development p

- Page 71 and 72:

Transportation related projects ide

- Page 73 and 74:

Anticipated Project Description Cos

- Page 75 and 76:

(2) Improvements to 216 sidewalk se

- Page 77 and 78:

This Page Not Used

- Page 79 and 80:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 81 and 82:

This Page Not Used

- Page 83 and 84:

Project: 802500 City Share of Devel

- Page 85 and 86:

Project Information Sheet Project:

- Page 87 and 88:

Project: 820120 Repaint Street Ligh

- Page 89 and 90:

Project: 820180 Traffic Signal Cont

- Page 91 and 92:

Project Information Sheet Project:

- Page 93 and 94:

Project: 825070 Bicycle Map Revisio

- Page 95 and 96:

Project: 825340 Street Lights Condu

- Page 97 and 98:

Project: 825530 Computerized Transp

- Page 99 and 100:

Project: 825621 Wolfe Road Caltrain

- Page 101 and 102:

Project: 825740 Battery Backup Syst

- Page 103 and 104:

Project: 826730 Underground Overhea

- Page 105 and 106:

Project: 826850 Calabazas Creek Bri

- Page 107 and 108:

Project Information Sheet Project:

- Page 109 and 110:

Project: 827680 Mathilda Avenue Cal

- Page 111 and 112:

Project: 828030 Annual Slurry Seal

- Page 113 and 114:

Project: 828180 Homestead Road Pave

- Page 115 and 116:

Project: 828540 Hollenbeck/Danforth

- Page 117 and 118:

Project: 828580 Tasman Light Rail T

- Page 119 and 120:

Project: 828600 Borregas Avenue Bic

- Page 121 and 122:

Project: 828620 Light Emitting Diod

- Page 123 and 124: This Page Not Used

- Page 125 and 126: Project: 825600 Caribbean Drive Bri

- Page 127 and 128: Project: 827580 In-Pavement Crosswa

- Page 129 and 130: Project: 900141 Future Traffic Calm

- Page 131 and 132: Project: 900454 Stevens Creek Trail

- Page 133 and 134: Project: 900469 El Camino Real Gate

- Page 135 and 136: Project: 900692 Calabazas Creek Tra

- Page 137 and 138: Downtown

- Page 139 and 140: delay in construction schedule, add

- Page 141 and 142: CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 143 and 144: Project: 824450 Downtown Developmen

- Page 145 and 146: Project: 826620 Town Center Constru

- Page 147 and 148: Project: 826700 Town Center Site In

- Page 149 and 150: Project: 826790 Sunnyvale Avenue Me

- Page 151 and 152: Project: 826810 Downtown Murphy Ave

- Page 153 and 154: Project Information Sheet Project:

- Page 155 and 156: Project: 827570 Downtown Parking Di

- Page 157 and 158: Project: 828670 Downtown Streetscap

- Page 159 and 160: Project: 900210 Downtown Parking Ma

- Page 161 and 162: Project Information Sheet Project:

- Page 163 and 164: This Page Not Used

- Page 165 and 166: Housing

- Page 167 and 168: This Page Not Used

- Page 169 and 170: Project: 823750 BMR Compliance Enfo

- Page 171 and 172: Project: 826530 County-wide Homeles

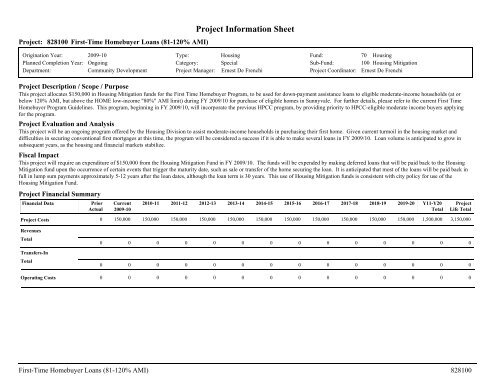

- Page 173: Project Information Sheet Project:

- Page 177 and 178: Project: 828130 Homelessness Preven

- Page 179 and 180: Project: 828700 Momentum for Mental

- Page 181 and 182: Project: 828820 Infill Infrastructu

- Page 183 and 184: Water

- Page 185 and 186: Water Sunnyvale provides water serv

- Page 187 and 188: CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 189 and 190: CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 191 and 192: Project: 806303 Water Pipes, Manhol

- Page 193 and 194: Project Information Sheet Project:

- Page 195 and 196: Project: 819771 Utility Maintenance

- Page 197 and 198: Project: 824291 Water Cost of Servi

- Page 199 and 200: Project: 824801 Roof Replacement of

- Page 201 and 202: Project: 825231 Cleaning of Water T

- Page 203 and 204: Project: 825251 Mary/Carson Water P

- Page 205 and 206: Project: 825271 Well House Emergenc

- Page 207 and 208: Project: 825391 Wolfe/Evelyn Plant

- Page 209 and 210: Project: 825431 Well Connections to

- Page 211 and 212: Project: 825461 Interior Coating of

- Page 213 and 214: Project: 825491 Exterior Painting o

- Page 215 and 216: Project: 826910 H Street Water Line

- Page 217 and 218: Project Information Sheet Project:

- Page 219 and 220: Project: 826960 Water Utility Maste

- Page 221 and 222: Project: 828490 Electronic Utility

- Page 223 and 224: Project Information Sheet Project:

- Page 225 and 226:

Project: 900276 Maude Avenue Recycl

- Page 227 and 228:

Solid Waste

- Page 229 and 230:

Solid Waste Sunnyvale provides Soli

- Page 231 and 232:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 233 and 234:

Project Information Sheet Project:

- Page 235 and 236:

Project: 821170 SMaRT Station Opera

- Page 237 and 238:

Project: 822331 Trim Landfill Scree

- Page 239 and 240:

Project: 824261 Solid Waste Cost of

- Page 241 and 242:

Project: 825121 SMaRT Station Offic

- Page 243 and 244:

Project Information Sheet Project:

- Page 245 and 246:

Project Information Sheet Project:

- Page 247 and 248:

Wastewater

- Page 249 and 250:

Wastewater Sunnyvale provides waste

- Page 251 and 252:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 253 and 254:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 255 and 256:

Project: 801101 WPCP Air Conditioni

- Page 257 and 258:

Project Information Sheet Project:

- Page 259 and 260:

Project: 822752 Storm Pump Station

- Page 261 and 262:

Project: 822802 Storm Sewer Extensi

- Page 263 and 264:

Project: 822822 Storm Sewer Extensi

- Page 265 and 266:

Project: 824341 Wastewater Cost of

- Page 267 and 268:

Project: 825111 Tertiary Plant Tank

- Page 269 and 270:

Project: 825321 Replacement/Rehabil

- Page 271 and 272:

Project: 825351 Replacement/Rehabil

- Page 273 and 274:

Project: 825371 Video Inspection an

- Page 275 and 276:

Project: 825521 Pond Sediment Remov

- Page 277 and 278:

Project: 825961 SCVURPPP Contractin

- Page 279 and 280:

Project: 826980 Crossman/Java Drive

- Page 281 and 282:

Project: 827000 Mathilda/First Stre

- Page 283 and 284:

Project: 827020 Emergency Bypass Pu

- Page 285 and 286:

Project: 827040 WPCP Asset Conditio

- Page 287 and 288:

Project: 827060 Sulfur Dioxide (SO2

- Page 289 and 290:

Project: 827090 Construction of a N

- Page 291 and 292:

Project: 828060 Gray Water Filterin

- Page 293 and 294:

Project: 828220 Storm Drain Marking

- Page 295 and 296:

Project: 828240 Replacement of Temp

- Page 297 and 298:

Public Safety

- Page 299 and 300:

Public Safety A quick response to e

- Page 301 and 302:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 303 and 304:

Project: 818100 Public Safety Build

- Page 305 and 306:

Project: 819840 Police Services Equ

- Page 307 and 308:

Project Information Sheet Project:

- Page 309 and 310:

Project Information Sheet Project:

- Page 311 and 312:

Project Information Sheet Project:

- Page 313 and 314:

Project Information Sheet Project:

- Page 315 and 316:

Project Information Sheet Project:

- Page 317 and 318:

Project: 827400 Implement CalEPA Ab

- Page 319 and 320:

Project: 828000 "Avoid the 13" DUI

- Page 321 and 322:

Project: 828150 Police Services Equ

- Page 323 and 324:

Project Information Sheet Project:

- Page 325 and 326:

Project Information Sheet Project:

- Page 327 and 328:

Project Information Sheet Project:

- Page 329 and 330:

Project: 818150 Public Safety Build

- Page 331 and 332:

Project: 900426 Sunnyvale Public Sa

- Page 333 and 334:

CDBG

- Page 335 and 336:

Community Development Block Grant (

- Page 337 and 338:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 339 and 340:

Project: 800851 Support Network for

- Page 341 and 342:

Project: 803601 Sunnyvale Community

- Page 343 and 344:

Project Information Sheet Project:

- Page 345 and 346:

Project: 820631 ADA Curb Retrofit O

- Page 347 and 348:

Project: 824370 Friends for Youth -

- Page 349 and 350:

Project: 825920 Bill Wilson Center

- Page 351 and 352:

Project: 827211 EHC Life Builders -

- Page 353 and 354:

Project: 827550 Outside Group Fundi

- Page 355 and 356:

Project: 828140 CDBG Sidewalk Repla

- Page 357 and 358:

Project: 828510 ADA Curb Retrofit:

- Page 359 and 360:

Project: 828720 Facade Program (CDB

- Page 361 and 362:

Project: 828740 Micro-Enterprise As

- Page 363 and 364:

Outside Group Funding

- Page 365 and 366:

Outside Group Funding The City of S

- Page 367 and 368:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 369 and 370:

Project: 803700 Leadership Sunnyval

- Page 371 and 372:

Project: 823500 Junior Achievement

- Page 373 and 374:

Project: 827230 Second Harvest Food

- Page 375 and 376:

Project: 827770 Senior Housing Solu

- Page 377 and 378:

Project: 828440 Catholic Charities:

- Page 379 and 380:

Project Information Sheet Project:

- Page 381 and 382:

Project Information Sheet Project:

- Page 383 and 384:

Project: 828880 Community Events Gr

- Page 385 and 386:

Parks and Recreation

- Page 387 and 388:

Parks and Recreation The mission of

- Page 389 and 390:

Anticipated Project Year Parks of t

- Page 391 and 392:

Anticipated Project Year Project De

- Page 393 and 394:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 395 and 396:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 397 and 398:

Project: 800451 Sunnyvale Tennis Ce

- Page 399 and 400:

Project: 818450 Community Center Bu

- Page 401 and 402:

Project: 818600 Senior Center Build

- Page 403 and 404:

Project Information Sheet Project:

- Page 405 and 406:

Project: 820240 Park Tennis/Basketb

- Page 407 and 408:

Project: 820280 Park Furniture and

- Page 409 and 410:

Project: 820351 Golf Course Sand Bu

- Page 411 and 412:

Project: 820370 Golf Course Parking

- Page 413 and 414:

Project: 822080 Fair Oaks Park Hard

- Page 415 and 416:

Project: 825650 Needs Assessment fo

- Page 417 and 418:

Project: 825760 Washington Pool Ren

- Page 419 and 420:

Project: 826750 Senior Center Safet

- Page 421 and 422:

Project: 827140 Community Center Th

- Page 423 and 424:

Project: 827160 Tennis Center Court

- Page 425 and 426:

Project: 827970 History Museum Util

- Page 427 and 428:

Project: 828190 Encinal and Fair Oa

- Page 429 and 430:

Project: 828290 Repair/Replace Park

- Page 431 and 432:

Project: 828310 Parks Baseball/Soft

- Page 433 and 434:

Project: 828330 Community Center Fi

- Page 435 and 436:

Project: 828350 Senior Center Fitne

- Page 437 and 438:

Project: 828370 Chemical Storage Wa

- Page 439 and 440:

Project: 828390 Sunken Gardens Golf

- Page 441 and 442:

Project: 828410 Golf Buildings HVAC

- Page 443 and 444:

Project: 828680 Active Start Progra

- Page 445 and 446:

Project: 826720 Sunnyvale Skatepark

- Page 447 and 448:

Library

- Page 449 and 450:

Library The City of Sunnyvale’s L

- Page 451 and 452:

Project: 805150 Library Foundation

- Page 453 and 454:

Project: 827980 Digital Storytellin

- Page 455 and 456:

Project: 828850 Library Programming

- Page 457 and 458:

Project: 900425 Sunnyvale Library F

- Page 459 and 460:

Project: 900664 Library Interior Li

- Page 461 and 462:

Governance and Community Engagement

- Page 463 and 464:

Governance & Community Engagement T

- Page 465 and 466:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 467 and 468:

Project: 804201 City-wide Aerial Ph

- Page 469 and 470:

Project: 814950 Redevelopment Plan

- Page 471 and 472:

Project: 824570 Outside Counsel Ser

- Page 473 and 474:

Project: 825700 Update of Mandated

- Page 475 and 476:

Project: 825900 Information Technol

- Page 477 and 478:

Project: 826552 Onizuka AFS BRAC- E

- Page 479 and 480:

Project: 827500 New Residential Her

- Page 481 and 482:

Project: 828630 Climate Action Plan

- Page 483 and 484:

Project: 828690 Land Use & Transpor

- Page 485 and 486:

Project: 822920 GIS Support for the

- Page 487 and 488:

Project: 900257 Citywide Facade Imp

- Page 489 and 490:

Administrative Facilities

- Page 491 and 492:

Administrative Facilities This sect

- Page 493 and 494:

CITY OF SUNNYVALE FUNDED / UNFUNDED

- Page 495 and 496:

Project: 818700 Corporation Yard Bu

- Page 497 and 498:

Project: 820570 Minor Building Modi

- Page 499 and 500:

Project: 821010 City Owned Properti

- Page 501 and 502:

Project: 824980 Sunnyvale Office Ce

- Page 503 and 504:

Project: 825930 City Owned Properti

- Page 505 and 506:

Project: 828040 Automated Fuel Mana

- Page 507 and 508:

Project: 817950 Civic Center Buildi

- Page 509 and 510:

Project: 818651 Corporation Yard Bu

- Page 511 and 512:

Project: 825560 Security Access Con

- Page 513 and 514:

Project: 900424 City Hall Facility

- Page 515 and 516:

Project: 900595 Demolition of Struc

- Page 517 and 518:

Project: 900667 Building Lock and K

- Page 519 and 520:

Project: 900675 Cooling Tower Reloc