Untitled - Ministry of Power

Untitled - Ministry of Power

Untitled - Ministry of Power

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

84<br />

<strong>Power</strong> inance Corporation Ltd.<br />

The <strong>Power</strong> Finance Corporation Limited (PFC) was<br />

incorporated in 1986 under the Companies<br />

Act,1956. The mission <strong>of</strong> PFC is to function as the<br />

prime Development Financial Institution dedicated<br />

to the growth and overall development <strong>of</strong> the <strong>Power</strong><br />

Sector. The borrower-portfolio <strong>of</strong> PFC comprises <strong>of</strong><br />

State Electricity Boards (SEBs), State Generation<br />

Transmission & Distribution Companies,<br />

Municipality-run power utilities and also central,<br />

private, joint sector and co-operative sector power<br />

utilities. The funds provided by the Corporation are<br />

in the nature <strong>of</strong> additionality to Central Plan<br />

Allocation (in respect <strong>of</strong> SEBs, etc.) and based on<br />

the merits <strong>of</strong> the individual projects. The <strong>Power</strong><br />

Finance Corporation is a schedule ‘A’ organisation.<br />

PERFORMANCE HIGHLIGHTS<br />

As on 31.03.2004, PFC sanctioned loans <strong>of</strong> the<br />

order <strong>of</strong> Rs. 16,472 crores (during 2003-04) for a<br />

wide range <strong>of</strong> power projects in various parts <strong>of</strong> the<br />

country and disbursements are to the tune <strong>of</strong> Rs.<br />

8975 crores. As on 31st March, 2004 the Authorised<br />

Capital and the Paid-up (equity) capital <strong>of</strong> the<br />

Corporation stood at Rs. 2000 crores and Rs. 1030<br />

crores, respectively. The Pr<strong>of</strong>it Before Tax<br />

(provisional), for the year ended 31.03.2004 was<br />

about Rs.2127 crores. In addition to the above, PFC<br />

had paid an interim dividend <strong>of</strong> Rs. 147 crores for<br />

the year 2003-04 to the Govt. <strong>of</strong> India which owns<br />

all its equity. Besides being a consistently pr<strong>of</strong>itmaking<br />

Corporation, PFC was placed in the highest<br />

category <strong>of</strong> ‘Excellent’ for the tenth consecutive<br />

year, by Govt. <strong>of</strong> India on the basis <strong>of</strong> its overall<br />

performance during the year 2002-03. PFC has<br />

figured in the top 10 PSUs list for the outstanding<br />

performance shown against Memorandum <strong>of</strong><br />

Understanding (MoU) targets for which it has<br />

recently received ‘MoU Excellence Award’ from<br />

Hon’ble President <strong>of</strong> India.<br />

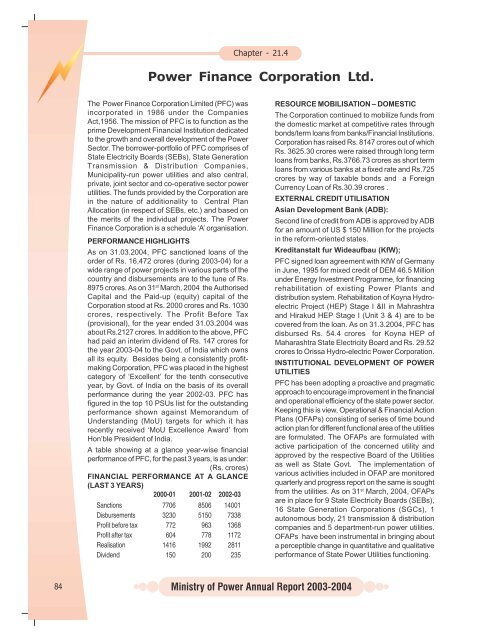

A table showing at a glance year-wise financial<br />

performance <strong>of</strong> PFC, for the past 3 years, is as under:<br />

(Rs. crores)<br />

FINANCIAL PERFORMANCE AT A GLANCE<br />

(LAST 3 YEARS)<br />

2000-01 2001-02 2002-03<br />

Sanctions 7706 8506 14001<br />

Disbursements 3230 5150 7338<br />

Pr<strong>of</strong>it before tax 772 963 1368<br />

Pr<strong>of</strong>it after tax 604 778 1172<br />

Realisation 1416 1992 2811<br />

Dividend 150 200 235<br />

Chapter - 21.4<br />

RESOURCE MOBILISATION – DOMESTIC<br />

The Corporation continued to mobilize funds from<br />

the domestic market at competitive rates through<br />

bonds/term loans from banks/Financial Institutions.<br />

Corporation has raised Rs. 8147 crores out <strong>of</strong> which<br />

Rs. 3625.30 crores were raised through long term<br />

loans from banks, Rs.3766.73 crores as short term<br />

loans from various banks at a fixed rate and Rs.725<br />

crores by way <strong>of</strong> taxable bonds and a Foreign<br />

Currency Loan <strong>of</strong> Rs.30.39 crores .<br />

EXTERNAL CREDIT UTILISATION<br />

Asian Development Bank (ADB):<br />

Second line <strong>of</strong> credit from ADB is approved by ADB<br />

for an amount <strong>of</strong> US $ 150 Million for the projects<br />

in the reform-oriented states.<br />

Kreditanstalt fur Wideaufbau (KfW);<br />

PFC signed loan agreement with KfW <strong>of</strong> Germany<br />

in June, 1995 for mixed credit <strong>of</strong> DEM 46.5 Million<br />

under Energy Investment Programme, for financing<br />

rehabilitation <strong>of</strong> existing <strong>Power</strong> Plants and<br />

distribution system. Rehabilitation <strong>of</strong> Koyna Hydroelectric<br />

Project (HEP) Stage I &II in Mahrashtra<br />

and Hirakud HEP Stage I (Unit 3 & 4) are to be<br />

covered from the loan. As on 31.3.2004, PFC has<br />

disbursed Rs. 54.4 crores for Koyna HEP <strong>of</strong><br />

Maharashtra State Electricity Board and Rs. 29.52<br />

crores to Orissa Hydro-electric <strong>Power</strong> Corporation.<br />

INSTITUTIONAL DEVELOPMENT OF POWER<br />

UTILITIES<br />

PFC has been adopting a proactive and pragmatic<br />

approach to encourage improvement in the financial<br />

and operational efficiency <strong>of</strong> the state power sector.<br />

Keeping this is view, Operational & Financial Action<br />

Plans (OFAPs) consisting <strong>of</strong> series <strong>of</strong> time bound<br />

action plan for different functional area <strong>of</strong> the utilities<br />

are formulated. The OFAPs are formulated with<br />

active participation <strong>of</strong> the concerned utility and<br />

approved by the respective Board <strong>of</strong> the Utilities<br />

as well as State Govt. The implementation <strong>of</strong><br />

various activities included in OFAP are monitored<br />

quarterly and progress report on the same is sought<br />

from the utilities. As on 31st March, 2004, OFAPs<br />

are in place for 9 State Electricity Boards (SEBs),<br />

16 State Generation Corporations (SGCs), 1<br />

autonomous body, 21 transmission & distribution<br />

companies and 5 department-run power utilities.<br />

OFAPs have been instrumental in bringing about<br />

a perceptible change in quantitative and qualitative<br />

performance <strong>of</strong> State <strong>Power</strong> Utilities functioning.