2003-2004 - The University of Scranton

2003-2004 - The University of Scranton

2003-2004 - The University of Scranton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ACC 363 3 cr.<br />

Federal Taxes<br />

(Prerequisites: junior standing, ACC 252 or<br />

254) An introductory course covering pertinent<br />

phases <strong>of</strong> federal income taxation. Emphasis on<br />

business transactions, preparation <strong>of</strong> individual<br />

returns, and finding the answers to federal tax<br />

questions.<br />

ACC 364 3 cr.<br />

Auditing <strong>The</strong>ory<br />

(Prerequisite: ACC 361) Regulatory, legal, ethical,<br />

and technical issues related to the independ-<br />

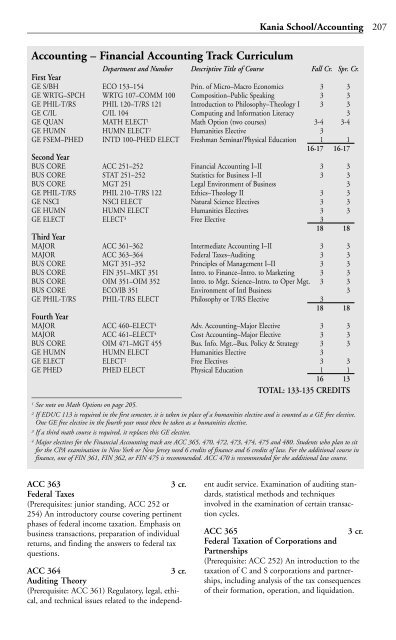

Kania School/Accounting 207<br />

Accounting – Financial Accounting Track Curriculum<br />

Department and Number Descriptive Title <strong>of</strong> Course Fall Cr. Spr. Cr.<br />

First Year<br />

GE S/BH ECO 153–154 Prin. <strong>of</strong> Micro–Macro Economics 3 3<br />

GE WRTG–SPCH WRTG 107–COMM 100 Composition–Public Speaking 3 3<br />

GE PHIL-T/RS PHIL 120–T/RS 121 Introduction to Philosophy–<strong>The</strong>ology I 3 3<br />

GE C/IL C/IL 104 Computing and Information Literacy 3<br />

GE QUAN MATH ELECT 1 Math Option (two courses) 3-4 3-4<br />

GE HUMN HUMN ELECT 2 Humanities Elective 3<br />

GE FSEM–PHED INTD 100–PHED ELECT Freshman Seminar/Physical Education 1 1<br />

16-17 16-17<br />

Second Year<br />

BUS CORE ACC 251–252 Financial Accounting I–II 3 3<br />

BUS CORE STAT 251–252 Statistics for Business I–II 3 3<br />

BUS CORE MGT 251 Legal Environment <strong>of</strong> Business 3<br />

GE PHIL-T/RS PHIL 210–T/RS 122 Ethics–<strong>The</strong>ology II 3 3<br />

GE NSCI NSCI ELECT Natural Science Electives 3 3<br />

GE HUMN HUMN ELECT Humanities Electives 3 3<br />

GE ELECT ELECT 3 Free Elective 3<br />

18 18<br />

Third Year<br />

MAJOR ACC 361–362 Intermediate Accounting I–II 3 3<br />

MAJOR ACC 363–364 Federal Taxes–Auditing 3 3<br />

BUS CORE MGT 351–352 Principles <strong>of</strong> Management I–II 3 3<br />

BUS CORE FIN 351–MKT 351 Intro. to Finance–Intro. to Marketing 3 3<br />

BUS CORE OIM 351–OIM 352 Intro. to Mgt. Science–Intro. to Oper Mgt. 3 3<br />

BUS CORE ECO/IB 351 Environment <strong>of</strong> Intl Business 3<br />

GE PHIL-T/RS PHIL-T/RS ELECT Philosophy or T/RS Elective 3<br />

18 18<br />

Fourth Year<br />

MAJOR ACC 460–ELECT 4 Adv. Accounting–Major Elective 3 3<br />

MAJOR ACC 461–ELECT 4 Cost Accounting–Major Elective 3 3<br />

BUS CORE OIM 471–MGT 455 Bus. Info. Mgt.–Bus. Policy & Strategy 3 3<br />

GE HUMN HUMN ELECT Humanities Elective 3<br />

GE ELECT ELECT 2 Free Electives 3 3<br />

GE PHED PHED ELECT Physical Education 1 1<br />

16 13<br />

TOTAL: 133-135 CREDITS<br />

1 See note on Math Options on page 205.<br />

2 If EDUC 113 is required in the first semester, it is taken in place <strong>of</strong> a humanities elective and is counted as a GE free elective.<br />

One GE free elective in the fourth year must then be taken as a humanities elective.<br />

3 If a third math course is required, it replaces this GE elective.<br />

4 Major electives for the Financial Accounting track are ACC 365, 470, 472, 473, 474, 475 and 480. Students who plan to sit<br />

for the CPA examination in New York or New Jersey need 6 credits <strong>of</strong> finance and 6 credits <strong>of</strong> law. For the additional course in<br />

finance, one <strong>of</strong> FIN 361, FIN 362, or FIN 475 is recommended. ACC 470 is recommended for the additional law course.<br />

ent audit service. Examination <strong>of</strong> auditing standards,<br />

statistical methods and techniques<br />

involved in the examination <strong>of</strong> certain transaction<br />

cycles.<br />

ACC 365 3 cr.<br />

Federal Taxation <strong>of</strong> Corporations and<br />

Partnerships<br />

(Prerequisite: ACC 252) An introduction to the<br />

taxation <strong>of</strong> C and S corporations and partnerships,<br />

including analysis <strong>of</strong> the tax consequences<br />

<strong>of</strong> their formation, operation, and liquidation.